Modi’s Budget Falls Short as Focus Shifts to RBI Meeting

Indian Prime Minister Narendra Modi’s second budget in seven months disappointed investors.

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

Indian Prime Minister Narendra Modi’s second budget in seven months disappointed investors who were hoping for big-bang stimulus to revive growth in Asia’s third-largest economy.

The fiscal plan -- delivered by Finance Minister Nirmala Sitharaman on Saturday -- proposed tax cuts for individuals and wider deficit targets, but failed to provide specific steps to fix a struggling financial sector, improve infrastructure and create jobs. The benchmark stock index had its biggest budget-day plunge since 2009 and may extend its drop on Monday after futures contracts on the Nifty 50 Index slumped before the markets opening.

Read More: India Nifty Futures Drop as Budget Fails to Allay Growth Worries

“Far from being a game changer, the budget provides little in terms of short-term growth stimulus,” said Priyanka Kishore, head of India and South East Asia economics at Oxford Economics Ltd. in Singapore. “While income tax cuts will provide some relief on the consumption front, the multiplier effect is low and the overall stance of the budget is not expansionary.”

The focus now shifts to the Reserve Bank of India’s interest rate decision on Feb. 6. However, having already cut interest rates five times last year and with inflation exceeding 7%, well above the central bank’s target, there’s limited scope for Governor Shaktikanta Das to ease more.

What Bloomberg’s Economists Say:

The burden of recovery now falls solely on the Reserve Bank of India. With inflation breaching RBI’s target at present, any rate cuts by the central bank are likely to be delayed and contingent upon inflation falling below the upper end of its 2%-6% target range.

-- Abhishek Gupta, India economist

To read more, click here

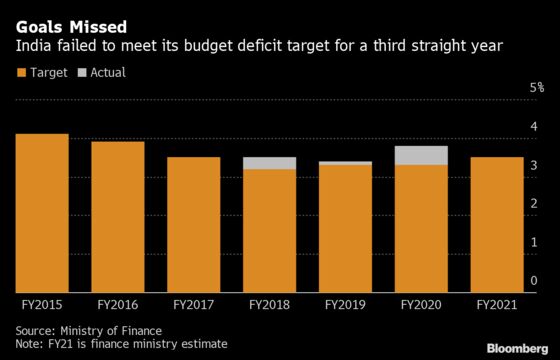

Sitharaman didn’t have much room to deliver a big stimulus in the budget. A revenue shortfall prompted her to invoke a never-used provision in fiscal laws, allowing the government to exceed the budget gap by 0.5 percentage points. As a result, the budget deficit in the year through March will widen to 3.8% of gross domestic product from a planned 3.3%.

While the government has taken a number of steps in recent months to spur growth, they’ve fallen short of boosting demand in the consumption-driven economy. Growth is set to slow to 5% this fiscal year, the weakest performance in more than a decade.

The Economic Survey, published by the Sitharaman’s chief economic adviser last week, estimated growth will rebound to 6%-6.5% in the year starting April.

“It’s an okay budget but not firing on all cylinders that the market was hoping for,” said Andrew Holland, chief executive officer at Avendus Capital Alternate Strategies in Mumbai.

The fiscal gap will narrow to 3.5% next year, with the government budgeting for an increase in gross market borrowing to 7.8 trillion rupees from 7.1 trillion rupees in the current year. It also plans to earn 2.1 trillion rupees by selling state-owned assets in the coming fiscal year to help plug the deficit.

Total spending will increase to 30.4 trillion rupees, a 13% increase from the current year’s budget, according to latest data.

| Key highlights from the budget: |

|---|

|

Analysts didn’t have much confidence the muted spending plan would spur growth and said deficit goals will be difficult to reach.

“It is very doubtful that the increase in expenditure will push demand much,” Chakravarthy Rangarajan, former governor at the Reserve Bank of India told BloombergQuint, adding that achieving next year’s budget deficit goal of 3.5% of GDP was doubtful.

All of the economists in a Bloomberg survey so far predict the RBI will keep its benchmark interest rate unchanged at 5.15% this week. Inflation surged to a five-year high of 7.35% in December, well above the central bank’s 2%-6% target.

Governor Das may instead focus on unconventional policy tools such as the Federal Reserve-style Operation Twist -- buying long-end debt while selling short-tenor bonds -- to keep borrowing costs down.

--With assistance from Ronojoy Mazumdar.

To contact the reporter on this story: Anirban Nag in Mumbai at anag8@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Karthikeyan Sundaram, Jeanette Rodrigues

©2020 Bloomberg L.P.