Plans for a Global Minimum Tax Revolution, Explained

Plans for a Bigger Pie of Global Taxes, Sliced Fairly

(Bloomberg) -- Multinational companies have long used creative but legal ways to shrink their tax bills. One is to book profits from customers in places like Boston and Berlin as if they came from, say, Bermuda, which has no corporate income tax. The world’s richest economies have agreed to a revamp of the global tax system that would undercut the effectiveness of such a strategy while also reallocating the taxes paid by huge technology companies.

1. What’s the agreement?

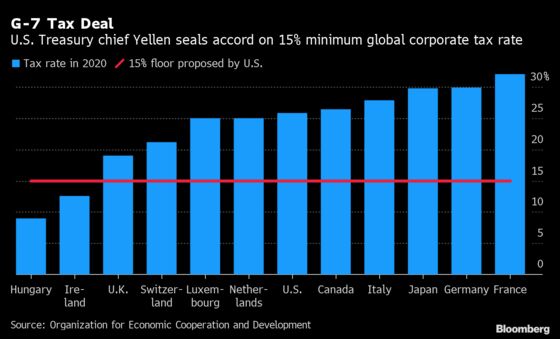

The Group of 20 nations -- which represent about 90% of the global economy -- reached an agreement in July to support the outlines of a new global tax system that will change how much corporations pay, and to whom. A worldwide minimum corporate tax rate of at least 15% would reduce the attractiveness of tax havens. Companies such as Amazon, Facebook and Google, which can sell their digital products in countries without establishing an easily taxed physical presence, may see some of their taxes paid based on where those sales occur. Countries where big firms operate would get the right to tax between 20% to 30% of profits exceeding a 10% margin, according to the G-20 deal. So far, 132 countries have signed on. Holdouts include Ireland and Hungary, which have benefited from having some of the lowest corporate tax rates in Europe.

2. How would a global minimum tax work?

Here’s a scenario sketched out in a paper for the Atlantic Council by Jeff Goldstein, a former special assistant to the chairman of the White House Council of Economic Advisers: A company headquartered in Country A is reporting income in Country B, where the rate is 11%. With a global minimum rate of 15% in effect, Country A would “top up” the tax and collect another 4% of the company’s profit from Country B -- representing the difference between Country B’s rate and the global minimum rate. That undercuts any advantage of shifting to lower-tax places and pressures countries to conform to the global norm.

3. What’s wrong with the current system?

The “legal and not-so-legal” use of tax havens costs governments $500 billion to $600 billion in lost corporate tax revenue each year, according to estimates cited by the International Monetary Fund. The Tax Justice Network, a U.K. advocacy group that says it wants a fairer tax system, names the British Virgin Islands, Cayman Islands, Bermuda, the Netherlands and Switzerland (in that order) as the top five “jurisdictions most complicit in helping multinational corporations underpay corporate income tax.” U.S. Treasury Secretary Janet Yellen said the goal of the proposed global minimum rate is to end a “30-year race to the bottom on corporate tax rates.”

4. Who benefits from the current system?

At least 55 large U.S. companies, including Nike Inc. and FedEx Corp., reported paying no U.S. federal income taxes in 2020 even though they were profitable, according to the Institute on Taxation and Economic Policy. Some nations benefit as well, by attracting businesses with low rates. Ireland, with a corporate tax rate of 12.5% -- among the lowest across industrialized nations -- boasts the European headquarters of companies including Google, Facebook and Apple. Ireland won the most foreign investment projects in Europe on a per capita basis in 2019, according to advisory firm EY. Among the 27 members of the European Union, corporate tax rates range from 9% in Hungary to 31.5% in Portugal, according to the Tax Foundation.

5. Where do digital taxes come in?

Some nations have imposed so-called digital services taxes on local sales of companies such as Facebook, Amazon and Google -- grabbing a bigger share of the pie. France led the way, imposing a 3% levy on revenue such as targeted advertising and the sale of data for companies with at least 750 million euros ($915 million) in global revenue and digital sales of 25 million euros in France. Of about 30 businesses affected, most are American, but the list also includes Chinese, German and British as well as French firms.

6. What happens next?

Focus will now shift to an October meeting of the Group of 20 finance ministers in Italy and long-running talks among about 140 countries spearheaded by the Organization for Economic Cooperation and Development, a club of 37 mostly rich countries, to hash out the details and finalize the agreement. The plan likely won’t be implemented until 2023 at the earliest to give countries time to update their laws to reflect the plan. A big question is whether Yellen, who played a major role in brokering the global deal, can sell the U.S. Congress on legislative changes to the U.S.’s own global minimum tax in line with the new rules. Lawmakers may also have to sign off on the global reallocation plan -- possibly through changes to tax treaties, which go through the Senate. Buy-in from the U.S. will be key to the OECD plan’s success around the world.

The Reference Shelf

- A look at Yellen’s role in the G-7 dealmaking.

- A QuickTake on the rise of digital taxes around the globe.

- The Urban-Brookings Tax Policy Center breaks down how the international tax rules currently work.

- Corporate America found ways to dodge taxes in the current tax system.

- The Tax Foundation ranks countries on the competitiveness of their tax systems.

©2021 Bloomberg L.P.