Saudi Arabia Joins Egypt’s Gulf-Cash Influx With $15 Billion

Saudi Arabia Makes $5 Billion Deposit in Egypt Central Bank

(Bloomberg) -- Saudi Arabia pledged $15 billion to support Egypt, the latest Gulf state to back an economy that’s under increasing pressure from the war in Ukraine and is seeking International Monetary Fund help.

The kingdom deposited $5 billion in Egypt’s central bank, the state-run Saudi Press Agency reported on Wednesday. Saudi Arabia’s Public Investment Fund is also looking into $10 billion of potential investments in Egypt’s healthcare, education, agriculture and financial sectors, according to an Egyptian cabinet statement.

Egypt will take quick steps to ease the process in order to secure investments expected to come through cooperation between the PIF and Egypt’s sovereign wealth fund, the cabinet statement said.

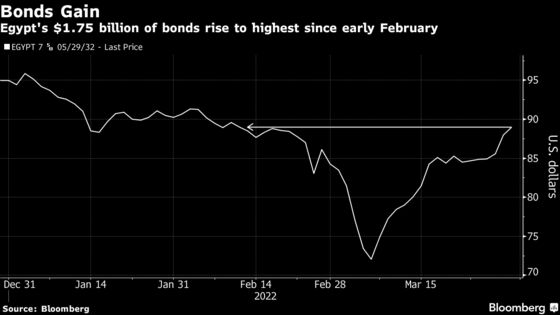

The deposit in the central bank is part of the kingdom’s efforts to help Egypt, according to SPA. The yield on Egypt’s $1.75 billion of bonds maturing in 2032 dropped 18 basis points to 9.41% after that news.

“The transfer helps alleviate short-term funding pressures and should help sealing the IMF program as it covers part of the expected funding gap,” said Mohamed Abu Basha, head of macroeconomic research at Egyptian investment bank EFG Hermes.

Qatar on Tuesday pledged to pump $5 billion into investments in Egypt, while Abu Dhabi wealth fund ADQ earlier this month made a roughly $2 billion deal to buy Egyptian state-owned stakes in publicly listed companies.

A major food importer, Egypt has been hit hard by record grain prices fueled by Russia’s invasion of Ukraine. One of the Middle East’s most indebted nations, it buys most of its wheat from the two countries currently at war, while Russian visitors previously made up a significant portion of its tourism market.

The most populous Arab nation has requested discussions with the International Monetary Fund on new support that may include a loan. The central bank last week allowed the pound -- which had been stable against the dollar for about two years -- to weaken by more than 15%, and raised interest rates for the first time since 2017.

Some of the assistance reflects a political focus as much as an economic one. Oil-rich Saudi Arabia and the United Arab Emirates pumped in billions of dollars in aid, deposits and investments in recent years. That aid bolstered Egypt’s economy in the wake of the 2013 ouster of Mohamed Mursi, who hailed from the Muslim Brotherhood, an Islamist political organization many Gulf nations see as a threat.

©2022 Bloomberg L.P.