Fed Traders Pare Bets on Bigger June Hike After Powell Pushback

Fed Traders Pare Bets on Bigger June Hike After Powell Pushback

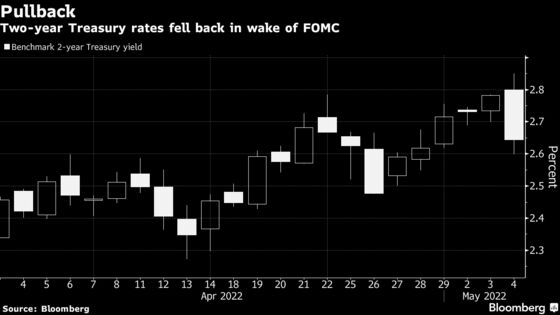

(Bloomberg) -- Traders are paring bets on expected Federal Reserve policy tightening in June in the dovish aftermath of the Wednesday gathering after Chair Jerome Powell appeared to push back on even larger hikes in the near time. Short-end Treasury yields and the dollar dived.

Interest-rate derivative contracts tied to Fed meeting dates briefly priced in even odds of a 75-basis-point rate increase at the next meeting after this week’s half-point rate hike -- but the move subsequently proved short-lived as Powell appeared to sideline the idea of an imminent move of that scale.

“Wow, very clear words from Powell,” said Priya Misra, global head of rates strategy at TD Securities, referring to the Fed chair’s comments that ruled out a 75bp move in the next few meetings. “I think too many hikes were priced in, so the front end should stabilize. Powell is not being all that hawkish relative to market pricing.”

Overnight index swap contracts referencing the June meeting dipped back to around 1.35% -- a low for the day -- after earlier trading as high as 1.464%, up from before Wednesday’s decision was announced at 2 p.m. in Washington. The total amount priced in for the whole year also dropped. The dollar and shorter-term Treasury rates fell, steepening yield curves.

The two-year Treasury rate plunged as much as 18 basis points to just under 2.60%, while three-year rates slid by a similar magnitude. The 10-year inflation breakeven rate surged 7 basis points to 2.89% even as Powell expressed concern about elevated inflation pressure during his remarks.

The moves happened as the monetary chief spoke at a press conference about the policy decision. The U.S. central bank voted unanimously to increase the benchmark rate by a half percentage point. It will begin allowing its holdings of Treasuries and mortgage-backed securities to decline in June at an initial combined monthly pace of $47.5 billion, stepping up over three months to $95 billion.

Powell said “there is a broad sense on the committee that additional 50-basis-point increases should be on the table at the next couple of meetings,” a comment seen by some as taking something bigger off the table. He also said a 75-basis-point bump is not something the committee is “actively” considering.

The Fed chair’s pushback “is a breadcrumb of certainty for the bond market as it implies there is less risk of an intra-meeting or emergency hike,” said Jake Remley, senior portfolio manager at IR&M, a fixed income asset manager.

The rally in policy-sensitive yields spurred a steeper curve, with the gap between two-, and 10-year yields climbing as much as 12 basis points to 0.30 percentage points.

“Long end rates will need to price in all the Treasury supply due to QT,” supporting the curve steepening, said Misra.

©2022 Bloomberg L.P.