ADVERTISEMENT

Fed May Tweak Excess Reserves Rate Again Before December Meeting

Fed May Tweak Excess Reserves Rate Again Before December Meeting

30 Nov 2018, 01:51 AM IST

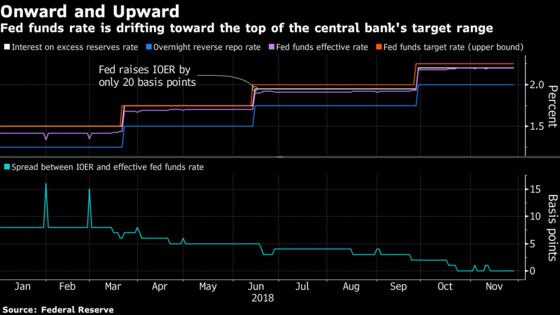

(Bloomberg) -- Federal Reserve Chairman Jerome Powell said it might be appropriate to reprise the kind of adjustment that the central bank made in June to ensure that the effective fed funds rate remains “well within” the central bank’s target range -- and such a move could even come before the December policy meeting if necessary.

- Minutes of the Federal Open Market Committee’s Nov. 8 meeting released Thursday said Powell noted the upward trend in the effective Fed funds rate relative to the IOER rate and suggested that “fairly soon” it might be appropriate to implement another technical adjustment in the rate relative to the top of the target range for the federal funds rate

Key Insights

- Another tweak would follow an on June 13, when the FOMC raised the fed funds target range by 25 basis points, but only raised the IOER rate -- an effective ceiling for fed funds -- by 20 basis points

- That move came after fed funds had threatened to break out of the target rage and the central bank foreshadowed the change in minutes of its May 1-2 meeting; while the rate increase that they implemented in September saw IOER moved by a full 25 basis points, speculation has been growing that policy makers would tweak again, because the effective fed funds rate has bumped up against IOER at 2.20 percent

- Tweaking IOER again calls attention to the effects of the Fed’s balance-sheet runoff policy on money-market rates

- Balance sheet issues, excess reserves and the rate that the Fed chooses to target were also discussed by participants at the FOMC meeting

- Strategists including Bank of America’s Mark Cabana have said the Fed may only be able to adjust IOER two more times (including the next move), assuming the overnight reverse repo facility remains a floor for the fed funds target range and that repo rates remain steady

Market Action

- Markets had anticipated the idea of a tweak and January fed funds futures were already priced for a 2.40 percent rate, implying that the rate would be 20 basis points rather than 25 basis points higher after the December meeting

- That said, the mention in the minutes of a possible move before the December FOMC meeting helped push January fed funds futures -- which reflect pricing for the outcome of the December gathering -- back to their highs of the session, taking the implied yield just below 2.40 percent

Get More

To contact the reporter on this story: Alexandra Harris in New York at aharris48@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Elizabeth Stanton

©2018 Bloomberg L.P.

Get live Stock market updates, Business news, Today’s latest news, Trending stories, and Videos on NDTV Profit.

ADVERTISEMENT