Carvana Revamps $3.3 Billion Junk Bond in Effort to Lure Buyers

Carvana Revamps $3.3 Billion Junk Bond in Effort to Lure Buyers

(Bloomberg) -- Used-car retailer Carvana Co. is restructuring a multibillion-dollar junk-bond offering as it struggles to attract investors despite double-digit yields.

The company dropped a $1 billion preferred-equity chunk and increased the debt portion by the same amount to a total of $3.275 billion, according to a person with knowledge of the matter. It also added a bankruptcy make-whole provision, a type of safeguard that pays creditors a fee should the company refinance while in chapter 11.

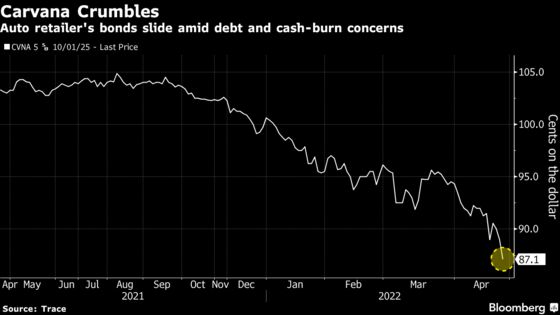

The move is already fueling angst among the firm’s existing creditors, with Carvana’s 5.625% notes due 2025 among the worst performers on the secondary market Wednesday. The new financing package could add more than $225 million of annual interest expense, roughly doubling what it paid over the previous 12 months, according to Bloomberg Intelligence. Carvana’s shares have plunged more than 70% this year amid a deepening cash burn, fueled in part by surging used-vehicle prices and capital spending.

This adds “an additional fixed layer of cash usage into a company that is likely to burn through liquidity in 2022, 2023 and 2024,” said Bloomberg Intelligence’s Joel Levington.

Bankruptcy make-whole provisions have been contentious in the past due to how the language is interpreted. The specifics of Carvana’s new provision could not yet be determined.

The company, famous for allowing consumers to pick up used cars in giant vending-machine style towers, also changed how early the eight-year bonds can be paid back, another concession to investors.

Previously the notes had a three-year “non-call” period. That’s now been increased to five years, said the person, who asked not identified discussing a private transaction. It added a special provision where it can call 10% of the notes in years four and five at 105.125 cents on the dollar.

Following these investor-friendly changes, the yield is now being discussed at 10.25%, lower than earlier discussions in the 10% to 10.5% range. The deal had initially been intended to wrap up on Tuesday, but that extended into Wednesday after some investors asked for a yield of around 11% and the company struggled to fill the order book, Bloomberg reported.

What Bloomberg Intelligence Says

Carvana’s plan to issue a $3.275 billion, eight-year note will make the issue a top 10 bond in the Bloomberg US Corporate High Yield Bond Index, potentially creating additional liquidity and demand for the issue. Carvana’s plan to drop its PIK (payment in kind) preferred adds additional risk into its vulnerable credit profile.

The bond sale is meant to replace debt commitments worth as much as about $3.3 billion that JPMorgan Chase & Co. and Citigroup Inc. agreed to give Carvana to finance its acquisition of Adesa Inc.’s U.S. car-auction business. The money will also be used to fund $1 billion in improvements across 56 of Adesa’s U.S. sites.

©2022 Bloomberg L.P.