Buffett Talks About Buybacks, Kraft Heinz, Amazon at Shareholders’ Meeting

Buffett Talks About Buybacks, Kraft Heinz, Amazon at Shareholders’ Meeting

(Bloomberg) -- Warren Buffett’s Berkshire Hathaway Inc. held its annual shareholders’ meeting in Omaha, Nebraska, today. Below are the key takeaways from the live blog covering the event, followed by a complete transcript of blog entries in the order they were originally posted.

05/04 16:50 ET

Thanks for joining us today! It’s been a packed day of questions for Warren Buffett and business partner Charles Munger. Here’s what we learned:

- The pair faced lots of questions about share buybacks. For most companies, that might be old news. But Berkshire tweaked its policy last year, opening up that avenue for more potential capital deployment. It’s key for Berkshire because of the swelling cash pile that reached $114 billion at the end of the quarter. Buffett was clear on his point that he doesn’t want to do buybacks just for the sake of it: He wants to make sure he repurchases stock when its below intrinsic value.

- Shareholders got to hear Ajit Jain and Greg Abel, who were named last year as vice chairmen, answer a range of questions. That could assuage concerns about succession at Berkshire as Buffett, 88, and Munger, 95, gave the pair more speaking room.

- Kraft Heinz came up frequently during the meeting. Berkshire was stung by the writedown earlier this year. Buffett emphasized that the problems with the business largely lie with the fact that 3G and Berkshire overpaid for Kraft, even while admitting that brands’s pricing power has changed.

- One of Buffett’s investing deputies, Todd Combs or Ted Weschler, bought up Amazon stock, venturing more into the technology realm. While Buffett’s praised Amazon and Jeff Bezos, the move by the deputy shows the growing influence. Buffett said that the Amazon investment fits within a value investing framework, which is interesting given that investing style’s conflicted opinions about valuing technology firms. And on an interesting insider note: Buffett revealed that one of the investing deputies is slightly ahead of the S&P, while one is slightly behind.

- Buffett tried to address the future of Berkshire more at the meeting. When questioned about the possibility of an activist coming into the stock, he noted it could happen but it might not occur for a while. Berkshire will have to prove itself over time, he says.

Katherine Chiglinsky Finance Reporter

05/04 09:22 ET

Warren Buffett’s Berkshire Hathaway is holding its annual shareholders’ meeting in Omaha, Nebraska, today. The event doubles as a showcase for Berkshire’s dozens of businesses and a platform for its billionaire chairman and CEO to share his investing philosophy with thousands of fans. Join TOPLive as we provide news and live analysis.

To set up a pop-up alert when the blog starts, click here and then SAVE SEARCH. For the full lineup of TOPLive events, please visit TLIV.

Anny Kuo TOPLive Editor

05/04 09:50 ET

Greetings from Omaha! I’m Katherine Chiglinsky, a finance reporter at Bloomberg News, covering Berkshire Hathaway. Together with my colleagues, we’ll take you through today’s events.

I’m all set up here at the Berkshire annual meeting where we’re getting ready to kick off the extravaganza. The event normally draws thousands of shareholders from all over the globe. Omaha has been preparing for the event, with hotels packed full and See’s Candies stands greeting visitors at the airport.

Katherine Chiglinsky Finance Reporter

05/04 09:51 ET

We kicked off this morning with earnings. Both operating earnings and net income climbed, reflecting broad-based gains.

But perhaps more interesting is that Berkshire snapped up $1.7 billion of its own stock in the quarter. Buffett’s been struggling to find ways to put his $114 billion cash pile to work, but the company’s board loosened its buyback policy last year and created another avenue for capital deployment.

This topic will probably come up today --- has Buffett been seeing opportunities to put more money to work (and therefore generate some higher returns)?

Read more here:

Berkshire Ramps Up Stock Buybacks as Cash Pile Keeps Growing

Katherine Chiglinsky Finance Reporter

05/04 09:52 ET

For hours today, Buffett and his business partner Charles Munger will field questions from shareholders, journalists and analysts. The range can be pretty wide, touching on Berkshire’s inner workings, the economy, and even quips about investing and life.

Before the event kicks off, let’s run through some topics that might come up.

Katherine Chiglinsky Finance Reporter

05/04 09:53 ET

Buffett just dropped some fresh news that’s sure to draw questions today. He waded into the fight for Anadarko by agreeing to inject $10 billion into Occidental, which is contingent on that company winning the bid for Anadarko.

It’s a classic Buffett play --- lend the money and get the Buffett halo in exchange for preferred stock and warrants. The preferred stock accrues 8 percent dividends, a hefty sum.

In a sense, it’s a good sign for Buffett. These moves have often been lucrative for him and it answers part of the question of what he’ll do with part of that $112 billion cash pile. Then again, what’s $10 billion to a guy who has 10 times that in funds?

The question today: Why did he choose to get in on this deal, beyond just the financial terms? And does he see more deals like this on the horizon?

Read more:

Katherine Chiglinsky Finance Reporter

05/04 09:54 ET

One of the Berkshire-tied companies that’s been in the news recently is Kraft Heinz. Buffett has a solid amount of ties to the company. He teamed up with 3G Capital to put together Kraft Heinz and his deputies, Greg Abel and Tracy Britt Cool, sit on the packaged food giant’s board.

It’s been a rough few months for the packaged food giant. Kraft Heinz announced a $15.4 billion writedown earlier this year, stinging Berkshire with a $2.7 billion hit. Just a few weeks ago, Kraft Heinz named a new CEO.

Katherine Chiglinsky Finance Reporter

05/04 09:56 ET

Buffett’s response about Kraft Heinz’s issues in February was particularly interesting. He wouldn’t sell shares, but he wasn’t particularly interested in buying more. He even admitted that the Berkshire and 3G Capital overpaid for Kraft.

What does Buffett think of the Kraft Heinz’s new CEO? And to what extent has he influenced the recent leadership shakeup at the company?

Read more:

Katherine Chiglinsky Finance Reporter

05/04 09:57 ET

Buffett’s cash hoard has everyone wondering when the billionaire investor might pull the trigger on his elephant gun. He hasn’t found many major acquisitions in recent years because of high prices for decent businesses, but we know he’s been looking.

There’s been a few reports out there (some of them have been shot down) about what Buffett might be eyeing. We just recently had the announcement of the preferred stake in Occidental. Just recently, SparkSpread reported the Berkshire was in talks to buy bankrupt California utility PG&E. Buffett said that the companies weren’t in talks. Then there’s the rumor that crops up every few months that Buffett might want to buy an airline.

What businesses does Buffett actually want to buy? Are there any potential acquisitions in the pipeline?

Katherine Chiglinsky Finance Reporter

05/04 09:59 ET

What a time to be a CEO in America right now. With the political tension, the trade issues, and the arguments about stock buybacks, there’s plenty of topics that executives are being asked to offer thoughts on. Buffett played those issues carefully at last year’s meeting, navigating questions about trade issues and explaining that he doesn’t feel he should impose his political opinions on his businesses’ activities.

How will he handle those topics this year? Will Buffett reveal his preference for the upcoming presidential election (He supported Hillary Clinton in the most recent one)?

Here’s what he told Bloomberg News about his view on modern monetary theory, which has been discussed by politicians including Alexandria Ocasio-Cortez:

Katherine Chiglinsky Finance Reporter

05/04 10:00 ET

It’s the perennial question for Berkshire. Buffett turned 88 last year and his business partner Charles Munger is now 95. What will Berkshire’s leadership look like when it’s time to hand over the reins?

In 2018, Berkshire promoted Greg Abel and Ajit Jain to vice chairmen, in a change that was part of a movement toward succession. While many investors believe it’s likely that one of those individuals will take charge, we’re still left in the dark about exactly how succession would play out. Will Buffett give us any more clues this year? And will either of the executives get more of a chance to speak today?

Read more here:

Katherine Chiglinsky Finance Reporter

05/04 10:02 ET

There are plenty of topics that Buffett and Munger could touch on. But perhaps some of the best moments are those unexpected exchanges.

Last year’s meeting featured a few sparring words from Munger about Elon Musk’s claim that "moats are lame." Buffett then said Musk wouldn’t want to take Berkshire on in the candy business (Berkshire owns See’s Candies).

Boy was he wrong about Musk’s fighting words. Musk fired back on Twitter that same day saying that he’d start a candy company.

To my knowledge, that hasn’t yet happened. But what other fun exchanges will we get this year?

Katherine Chiglinsky Finance Reporter

05/04 10:03 ET

Buffett dropped some news earlier this week. One of his investing deputies has been buying shares of Amazon, an interesting shift as Buffett has often praised Jeff Bezos and lamented not purchasing earlier.

It also shows the rising influence of his deputies, Todd Combs and Ted Weschler. It’s likely that Combs and Weschler will continue to have important roles in the post-Buffett era, so hearing more about their investing mindset (which obviously differs a bit from Buffett’s if they’re buying Amazon and he’s not) would be interesting for Berkshire.

Katherine Chiglinsky Finance Reporter

05/04 10:04 ET

The event is being livestreamed by Yahoo Finance. You can watch it live by clicking here.

Anny Kuo TOPLive Editor

05/04 10:05 ET

Attendees entering the convention center earlier this morning:

Anny Kuo TOPLive Editor

05/04 10:06 ET

Buffett himself arrived at the venue as well:

Anny Kuo TOPLive Editor

05/04 10:07 ET

Yahoo Finance is airing an interview with Buffett in the run-up to the meeting. He’s talking politics.

Buffett said he wants a president who has two objectives with the economy:

1) to make sure that this “marvelous goose we have keeps laying golden eggs,” and 2) that no one gets left behind.

Hannah Levitt Finance Reporter

05/04 10:10 ET

One booth stood out among all the companies: A campaign for Charlie for Chairman.

Munger’s served in that number two role at Berkshire for decades, but it’s a role he’s always seemed to prefer. The campaign was a good joke about Munger’s potential ambitions for more power at age 95.

Katherine Chiglinsky Finance Reporter

05/04 10:12 ET

Buffett’s now kicking it off with his video showcasing some of the Berkshire companies. We’ve had an appearance by the Geico camel, Dairy Queen, Clayton Homes, Oriental Trading (about its flood relief effort), Berkshire Hathaway Homeservices and some Brooks runners.

Katherine Chiglinsky Finance Reporter

05/04 10:13 ET

Part of it is a highlight reel of Charlie Munger’s quips at the Daily Journal meeting (Here’s what he told Bloomberg News after that event) and there’s even a clip of Buffett in front of Congress back in the Salomon Brothers. There’s a clip of a woman driving in the Middle East with Coke. We’re getting some Lin-Manuel Miranda action with an ad for American Express. Fruit of the Loom had a solidly funny joke about men taking pictures without shirts, saying they’re starting a campaign since those men obviously have problems with shirts falling apart.

Katherine Chiglinsky Finance Reporter

05/04 10:14 ET

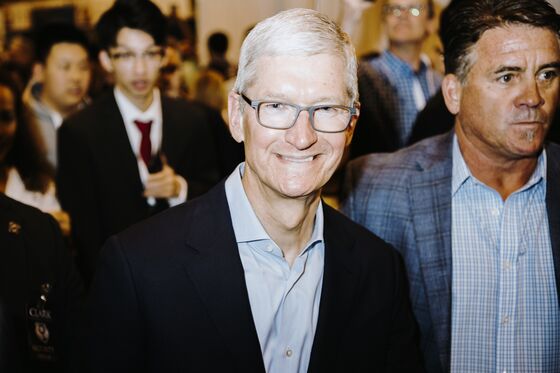

There’s a bit with some comedians joking about brokers giving investment advice with some nervous consumers. Apple’s Tim Cook made an appearance, using some odd facial technology, and Buffett and the Apple CEO joked about their partnership on a top secret project (a Macbook made out of See’s Candies? A time machine that allows Buffett to tell his younger self to buy Apple stock?). In the end, he made a newspaper toss app, harkening back to his days as a paper boy.

Katherine Chiglinsky Finance Reporter

05/04 10:15 ET

I have confirmed, Warren Buffett’s Paper Wizard app appears to be real.

The video’s continuing with a solid rendition of "Too Hot" with all the different business subsidiaries: A "Berkshire, Hallelujah" refrain.

Katherine Chiglinsky Finance Reporter

05/04 10:17 ET

The top five most valuable companies in the world are tech giants -- names recognizable to most everyone. The sixth? Berkshire Hathaway. And while it may not be a household name like Amazon or Google, lots of the businesses Berkshire owns are.

Tara Lachapelle Bloomberg Opinion

05/04 10:17 ET

The pair have taken the stage. Buffett’s welcoming all the guests from around the world.

Katherine Chiglinsky Finance Reporter

05/04 10:18 ET

Buffett’s addressing the campaign about Charlie for Chairman, joking about people constantly asking them about succession.

A timely joke as succession routinely comes up for Buffett, who’s 88, and Munger, who is now 95.

Katherine Chiglinsky Finance Reporter

05/04 10:24 ET

Buffett’s now talking about earnings, using a slideshow to go through some of the numbers. He’s reminding folks to look at operating earnings, not net income. This has been a common refrain we’ve heard over the past year from him, because the accounting rules now require him to include unrealized gains and losses from his $190 billion stock portfolio into net income. That makes for some wild swings.

Katherine Chiglinsky Finance Reporter

05/04 10:25 ET

More from Buffett on earnings:

“The bottom line figures are going to be totally capricious, and what I worry about is that not everybody studied accounting in school,” he said.

The bottom line figures are potentially harmful to shareholders, Buffett said, encouraging the audience to focus on operating earnings. Capital gains are “enormously important” over time, but not on a quarterly or annual basis, he said.

Hannah Levitt Finance Reporter

05/04 10:25 ET

He points out that Kraft Heinz hasn’t yet filed its 10-K yet, so they have not yet released first quarter earning. That means Berkshire isn’t including them in its results.

It’s an "unusual" item, he said.

Katherine Chiglinsky Finance Reporter

05/04 10:28 ET

The last time Berkshire reported results, the contribution from its stake in Kraft Heinz was a $2.7 billion charge. This time, it was a blank space.

Read more on the Kraft Heinz situation here:

Katherine Chiglinsky Finance Reporter

05/04 10:28 ET

Buffett’s now talking about Kiewit Corp., which owns the building that Berkshire Hathaway’s headquarters is in. That company is moving its headquarters, but Buffett just signed a new lease on that.

Katherine Chiglinsky Finance Reporter

05/04 10:31 ET

Buffett says he signed a 20-year lease for two floors in the building that houses Berkshire’s headquarters. The company only currently uses one floor as it tries to keep a lean management staff.

Michael Moore Finance Team Leader

05/04 10:31 ET

Buffett’s talking about the amount of business that Nebraska Furniture Mart, which he owns, has done this week.

I always find it so interesting that Berkshire ends up turning their annual meeting into a sales opportunity. The booths outside contain a variety of trinkets for sale (rubber ducks that look like Buffett and Munger, a Warhol-esque version of the pair) and some, like Geico, even help you with your insurance.

I can’t think of many other companies that make an annual business meeting into this heavy of a sales pitch.

Katherine Chiglinsky Finance Reporter

05/04 10:32 ET

And now we’re about to kick off with some Q&A. The questions come from shareholders, as well as select journalists and analysts. (Crossing my fingers that we’ll kick off with an Amazon question).

Katherine Chiglinsky Finance Reporter

05/04 10:35 ET

First question comes from journalist Carol Loomis, who has long been close to Buffett. She’s giving shareholders some tips about questions to ask.

Now she’s asking about repurchases of Berkshire stock. Remember: the board tweaked the policy last year and Buffett snapped up $1.7 billion in the first quarter.

Katherine Chiglinsky Finance Reporter

05/04 10:37 ET

“Charlie for Chairman” watch:

Munger is having a Diet Coke in a wine glass and See’s peanut brittle while Buffett answers the stock buybacks question.

Hannah Levitt Finance Reporter

05/04 10:37 ET

Buffett is saying whether we had $100 billion or $200 billion would not make a difference in the approach to repurchasing shares. "We used to have a policy of tying it to book value, but that became, really became obsolete," he said.

The idea is to do it at a price where remaining shareholders have stock worth more the moment after you purchase the stock, he said.

Sonali Basak Finance Reporter

05/04 10:38 ET

Buffett is using an example of a three-person partnership in determining how the company would choose to buy back stock. That’s significant in that Buffett has long thought of many shareholders as partners, really harkening back to his days running a smaller shop with money from friends and family.

He says most companies have repurchase programs and just say that they’re going to spend that much. Berkshire will buy stock when it thinks it’s selling below a conservative estimate of its intrinsic value.

Katherine Chiglinsky Finance Reporter

05/04 10:42 ET

Now we’re getting a question about precision scheduled railroading, essentially a play on boosting efficiency at railroads. Berkshire’s BNSF has long spurned that while its competitors have been jumping on that train essentially.

Buffett is talking about the history of the system which is tied to industry legend Hunter Harrison. He says that they watch very carefully and they’re not above copying anything that’s very successful. They’ve learned a lot by watching it. Buffett says they don’t have to do it today or tomorrow, but they do have to find something that gets equal or better customer satisfaction.

Read Tom Black’s story on this debate here: Buffett’s Railroad Spurns Efficiency ‘Cult’ Boosting Rivals

Katherine Chiglinsky Finance Reporter

05/04 10:47 ET

Munger’s voice is a little quieter here in the arena (granted the press box is in the nosebleeds), but my colleagues caught one of his one-liners about precision scheduled railroading that’s got a good Munger vibe: "I doubt that anybody is very interested in unprecision in railroading."

Katherine Chiglinsky Finance Reporter

05/04 10:49 ET

CNBC’s Becky Quick is now asking about Wells Fargo. Good thing we have our Wells Fargo reporter helping us live blog today.

Quick’s asking about why Berkshire’s been so quiet on this misbehavior at the bank.

Katherine Chiglinsky Finance Reporter

05/04 10:56 ET

Buffett says that Wells Fargo has made some big mistakes and that they incentivized the wrong behavior. He’s comparing the Wells Fargo issue to Salomon Brothers and his work trying to clean that up. Buffett’s point? When you see something wrong, you need to take care of it right away instead of letting it continue.

So far, these frankly aren’t fresh comments about his views on Wells Fargo. He has criticized the mistakes and the system of incentives that fueled it. Buffett told CNBC earlier this week that Wells Fargo CEOs would be "pinatas" for politicians.

Munger says he doesn’t think people should go to jail for honest errors of judgement --- it’s bad enough to lose your job, he said. He says he doesn’t think Tim Sloan was an "accidental casualty."

Katherine Chiglinsky Finance Reporter

05/04 10:56 ET

The Munger comments are a bit more interesting --- he’s said publicly that he supported Tim Sloan, but I don’t think I can recall a time when he said that he doesn’t think people should go to jail for honest errors of judgement.

Katherine Chiglinsky Finance Reporter

05/04 10:56 ET

The Wells Fargo question is the first to get wide applause.

Tara Lachapelle Bloomberg Opinion

05/04 10:56 ET

"Essentially he heard about a pyromaniac and let him keep the box of matches," Buffett says about Salomon’s ex-CEO John Gutfreund.

He said a similar thing happened at Wells Fargo because there was a Los Angeles Times article that pointed out the issues years earlier, and clearly it was ignored, he said.

Sonali Basak Finance Reporter

05/04 10:57 ET

“When you find a problem, you have to do something about it. I think that’s where they probably made a mistake at Wells Fargo,” Buffett said.

Munger said he wishes Tim Sloan, who stepped down as Wells Fargo’s CEO just over a month ago, was still there.

Hannah Levitt Finance Reporter

05/04 10:59 ET

Buffett cites the proxy contest at Barclays when its analysts Jay Gelb looks to ask a question.

Sonali Basak Finance Reporter

05/04 11:01 ET

Gelb is asking about Buffett’s reference to the fact that Berkshire could eventually buy back $100 billion in stock. He asks how he got that number.

Buffett just said he arrived at that number quickly in the interview. He’s more concerned about the fact that the shareholders should get all the disclosure they need if they’re going to sell their stock and Berkshire could buy it back.

Katherine Chiglinsky Finance Reporter

05/04 11:03 ET

The next question is from a shareholder and his young daughter, Brooke. He’s thanking Buffett for the memories of his times coming to the annual meeting.

Again, a weird quirk of the Berkshire meeting --- the desire to have young kids join in and ask Buffett and Munger questions.

Katherine Chiglinsky Finance Reporter

05/04 11:04 ET

The question was about their favorite personal stocks.

Buffett says they’re always fun when you make money off of it.

Katherine Chiglinsky Finance Reporter

05/04 11:06 ET

Oohhh, now we’re getting a question about politics.

Katherine Chiglinsky Finance Reporter

05/04 11:08 ET

The question is about the potential for Democrats if they win. How does Buffett think that would affect the business? And what does Buffett think? His personal political views and its effect on Berkshire?

Katherine Chiglinsky Finance Reporter

05/04 11:08 ET

Buffett says that Berkshire certainly has never, and will never, make a contribution to a presidential candidate.

Katherine Chiglinsky Finance Reporter

05/04 11:10 ET

On lobbying, Buffett says “as a practical matter,” Berkshire’s railroad and utility companies have to have a presence in Washington, and in legislatures where the companies operate.

Hannah Levitt Finance Reporter

05/04 11:11 ET

Overhead in the rafters: a baby crying. Guess it’s never too early to start learning about value investing?

Tara Lachapelle Bloomberg Opinion

05/04 11:11 ET

Buffett says people do not pursue their own political interests with your money here. He’s drawing the distinction that he doesn’t think Berkshire dives into political views, but he does note that personally, he has been known to share his own.

Remember: He supported Hillary Clinton in the past election, which is why this is drawing some interest ahead of what’s likely to be a heated 2020 election.

Katherine Chiglinsky Finance Reporter

05/04 11:12 ET

“I’m a card-carrying capitalist,” Buffett said, to applause in the audience.

He said he also thinks capitalism involves regulation and taking care of those left behind.

Hannah Levitt Finance Reporter

05/04 11:14 ET

Buffett says that part of the reason they’re doing this partnership with JPMorgan and Amazon on this health-care venture is that there’s so much money that’s being thrown toward medical care.

He hopes that there’s some major improvements from the private sector (he thinks the private sector tends to do a better job than the public sector).

Katherine Chiglinsky Finance Reporter

05/04 11:14 ET

Political questions can be an intriguing draw for the pair --- Buffett has been down to lean more toward the left, while Munger sometimes tends to be a bit more on the right politically. A sign of bipartisanship that the pair can get along?

Katherine Chiglinsky Finance Reporter

05/04 11:15 ET

Now Greggory Warren from Morningstar is asking about buybacks.

Buffett says when they’re repurchasing shares, they’re going to spend more on Class B because the trading volumes are quite higher (Class A can sometimes be pretty illiquid).

Katherine Chiglinsky Finance Reporter

05/04 11:16 ET

Buffett also said:

"I don’t think the country will go into socialism in 2020 or 2040 or 2060."

Michael Moore Finance Team Leader

05/04 11:16 ET

Munger’s answer is pretty simple. He doesn’t think they care much about which class of stock they buy.

Katherine Chiglinsky Finance Reporter

05/04 11:19 ET

A sidenote on politics: Munger, in a recent WSJ interview, said he was "fascinated" by South Bend, Indiana, Mayor Pete Buttigieg.

Katherine Chiglinsky Finance Reporter

05/04 11:21 ET

Buffett’s talking now about how Berkshire has a bunch of experts running the different businesses, and not too many people in the central office trying to do that.

That’s kind of a key feature of Berkshire --- the decentralized setup, where headquarters has just about two dozen staff members and the rest of the businesses are run largely on their own.

Katherine Chiglinsky Finance Reporter

05/04 11:22 ET

Buffett points out that the world’s changed dramatically in years and that’s affected a lot of Berkshire’s businesses (take the namesake textile mill for example).

Katherine Chiglinsky Finance Reporter

05/04 11:23 ET

Buffett says they welcome change and they want to stay ahead. But sometimes they’ll be wrong.

It’s kind of a blunt response on how change infiltrates all of Berkshire’s empire.

Katherine Chiglinsky Finance Reporter

05/04 11:23 ET

Buffett is answering a question regarding 5G and how it might change the competitive moat of Berkshire’s business.

"The world is going to change in dramatic ways... And some of those changes hurt us," he said. Including shoes and trading stamps. "But we do adjust and we’ve got a group, overall, of very good businesses."

He says some businesses may be "destroyed" but competition in capitalism is a good thing.

Sonali Basak Finance Reporter

05/04 11:25 ET

Perfect. A question now from Carol Loomis on Kraft Heinz. The question touches on consumer brands --- will those have any moat in the future?

Katherine Chiglinsky Finance Reporter

05/04 11:27 ET

Buffett points out that they paid too much for Kraft (he made that point in February, soon after Kraft Heinz’s writedown).

To some extent, he says their own actions had driven up the prices. Kraft Heinz is a wonderful business, but you can pay too much for a wonderful business, he says. The business does not know how much you paid for it --- it’s going to earn based on its fundamentals, he said.

The profitability has been improved, he says. But now Amazon itself has become a brand. And Costco has Kirkland. He’s pointing out just how competitive it is for those consumer product brands.

Katherine Chiglinsky Finance Reporter

05/04 11:27 ET

“To some extent our own actions had driven up the prices,” Buffett said of Kraft.

This statement begs an interesting question of how often Berkshire -- a $739 billion behemoth -- runs into this kind of problem.

Hannah Levitt Finance Reporter

05/04 11:28 ET

Brands and retailers are always struggling in who gets the upper hand in moving the product to some consumers, Buffett says. Retailers certainly have gained some power and particularly in the case of Amazon, Walmart and Costco.

Katherine Chiglinsky Finance Reporter

05/04 11:29 ET

Kraft Heinz is still doing well operationally, he notes. You can turn any investment into a bad deal by paying too much, he says.

These are some pretty direct comments that elaborate on his point that they paid too much for Kraft. It sounds like he’s trying to explain that a lot of the issue lies in that transaction a few years ago and how they essentially overpriced it.

Katherine Chiglinsky Finance Reporter

05/04 11:30 ET

Munger:

"It’s not a tragedy that out of two transactions one worked wonderfully, and the other didn’t work so well. That happens."

Sonali Basak Finance Reporter

05/04 11:30 ET

Jonathan Brandt from Ruane, Cunniff & Goldfarb is asking about online retailers, like Wayfair, and the impact on some of Berkshire’s furniture businesses.

Katherine Chiglinsky Finance Reporter

05/04 11:32 ET

"The jury’s still out on that, whether the operations which have grown very rapidly in size but still are incurring losses, how they will do over time,” Buffett said.

He said investors are willing to get comfortable with losses so long as sales are increasing, Amazon being a dramatic example.

Sonali Basak Finance Reporter

05/04 11:34 ET

Remember: Berkshire owns Nebraska Furniture Mart, a big home furnishings business based here in Omaha.

He says they do a fairly high percentage of the sales online and sometimes consumers come in to pick up the items in stores. Essentially, he’s arguing there’s a benefit to having that brick-and-mortar presence as well.

The first quarter was weak at all four of Berkshire’s furniture operations, he notes. Buffett says the model has shifted to more people living in apartment rentals and people are just not moving to houses as rapidly as he would have guessed.

Katherine Chiglinsky Finance Reporter

05/04 11:35 ET

Munger says he thinks they will do better than most furniture retailers.

Katherine Chiglinsky Finance Reporter

05/04 11:38 ET

We get accustomed to the uniqueness of the Berkshire annual meeting, but sometimes it is striking. I’ve been to quite a few banks’ shareholder meetings and never heard someone thank the CEO for helping them become a better husband and father.

Michael Moore Finance Team Leader

05/04 11:40 ET

Next question is for Buffett’s and Munger’s views on private, alternative investments and their relevance in public pensions fund.

"A leveraged investment in a business is going to beat an unleveraged investment, in a good business, a good bit of the time," Buffett said, but "the covenants to protect debtholders have really deteriorated in the business."

"We’re not going to leverage up Berkshire," Buffett said, adding that he’s seen destruction from leverage -- citing hedge fund Long-Term Capital Management in the 90s.

Hannah Levitt Finance Reporter

05/04 11:41 ET

Buffett warns not to get excited about "so-called alternative investments."

Hannah Levitt Finance Reporter

05/04 11:41 ET

"Covenants to protect debtholders have really deteriorated," Buffett said. Still, borrowing cheaply to buy assets that would yield 7% or 8% could have a lot of good opportunities, even with some bankruptcies.

Sonali Basak Finance Reporter

05/04 11:41 ET

Private equity returns are sometimes "not calculated in a manner that I would regard as honest," Buffett said.

Sonali Basak Finance Reporter

05/04 11:45 ET

Buffett makes a common critique on the 2-and-20 fee model.

Munger says pensions have a "silly reason to buy something" by buying private equity just because you don’t need to mark down assets as steeply in a downturn.

Sonali Basak Finance Reporter

05/04 11:45 ET

To Mike’s point on the uniqueness of this event, it’s a question that comes up frequently when I talk to shareholders nowadays. Part of the aura of Berkshire is the emotional ties that investors have to Buffett and Munger. You can call it intrigue, or sometimes worship, but either way, something keeps them coming back to see these two guys.

Will the next CEO have that? It’s a bit unclear. And even after the promotion of Greg Abel and Ajit Jain to vice chairmen, we still really haven’t heard them talk publicly much.

Partially that’s because Buffett and Munger still are willing to share hours of their time. But shareholders have started to ask more --- when will Berkshire start putting the not-yet named successor out in the public spotlight more?

Katherine Chiglinsky Finance Reporter

05/04 11:51 ET

Oh perfect, now a question on Amazon and Berkshire’s recent purchase. It’s important to note --- that wasn’t a Buffett choice specifically --- but it brings up the question, is this a change in philosophy?

Buffett says that people making decisions on Amazon can definitely be value investors. That’s kind of an interesting point --- value investing has sometimes been burned by this technology boom. Buffett’s essentially implying that you can be a value investor and still analyze Amazon that way and decide it’s a good investment.

Katherine Chiglinsky Finance Reporter

05/04 11:52 ET

In giving his insight on value investing, Munger said: “Warren and I are a little older than some people.”

“Damn near everybody,” Buffett responded.

Hannah Levitt Finance Reporter

05/04 11:53 ET

“We just sat there sucking our thumbs,” Munger said on not buying Google. “We’re ashamed.” He said maybe they made up for it with Apple.

Hannah Levitt Finance Reporter

05/04 11:53 ET

Munger says that maybe the Apple investment was atonement for missing out on some other investments.

Reminds me of this story two years ago: Buffett Says His IBM Thesis Was Flawed, He Blew It on Google

Katherine Chiglinsky Finance Reporter

05/04 11:53 ET

Munger says he gives himself a pass on missing Amazon because Bezos is a “miracle worker,” but kicks himself for missing Google.

Michael Moore Finance Team Leader

05/04 11:54 ET

Side note: Munger is still enjoying his peanut brittle.

Hannah Levitt Finance Reporter

05/04 11:54 ET

Markets Live blogger Andrew Cinko noted yesterday that Berkshire’s investment in Amazon was a "tacit admission that Amazon is gobbling up large swaths of the world."

"Berkshire’s move comes as the FANG cohort plus two more biggies, Apple and Microsoft, account for a larger and faster growing part of the S&P 500. It’s hard to beat the benchmark if you don’t own some or all of those six stocks, as they now account for nearly 19% of the S&P 500’s market cap."

Anny Kuo TOPLive Editor

05/04 12:00 ET

Buffett’s praising his insurance businesses and giving a shout out to Tony Nicely, the former Geico CEO who recently stepped down for that role. He’s pointed out that Nicely has made more than $50 billion in value for Berkshire.

Read more: Buffett Praises Geico’s $50 Billion Man Who Quietly Stepped Down

Katherine Chiglinsky Finance Reporter

05/04 12:02 ET

He’s saying that it’s worth more within Berkshire than it would be on its own. That’s partially due to Berkshire’s ability to protect the insurers --- if one were to go broke, Berkshire could step in to pay the rest of those claims, giving buyers a bit of peace of mind.

Katherine Chiglinsky Finance Reporter

05/04 12:03 ET

We’re getting another question from a child.

Katherine Chiglinsky Finance Reporter

05/04 12:03 ET

He asks how can kids develop a delayed gratification skill (I type as I stare at See’s Candies).

Katherine Chiglinsky Finance Reporter

05/04 12:06 ET

Munger, 95, says he’s a specialist in delayed gratification because he’s had a long time to delay it.

Hannah Levitt Finance Reporter

05/04 12:06 ET

Munger says they come out of the womb with that delayed gratification skill.

Buffett’s now using an example of 30-year government bonds to talk about delayed gratification.

Katherine Chiglinsky Finance Reporter

05/04 12:08 ET

The next question talks directly about succession planning. Would the pair consider having Greg Abel, Ajit Jain and Ted Weschler and Todd Combs join them on stage?

Katherine Chiglinsky Finance Reporter

05/04 12:11 ET

Buffett says that they have Greg and Ajit here, so any questions could be directed to them too. He said this format isn’t set in stone. He jokes that they’re afraid because those guys are better than he and Munger are.

He praises Abel and Jain. He notes that Combs and Weschler aren’t going to divulge investment tips, which is technically a point that Buffett has generally adhered to (he sometimes names what he’s bought, but generally doesn’t frontrun purchases).

Katherine Chiglinsky Finance Reporter

05/04 12:11 ET

Buffett says they thought about having Greg and Ajit join them on stage, and the current format will not be around forever.

"You could not have two better operating officers than Greg and Ajit," Buffett said.

Hannah Levitt Finance Reporter

05/04 12:12 ET

That comment that the format isn’t set in stone seems to be one of the more direct ways in which Buffett’s addressed this question.

Katherine Chiglinsky Finance Reporter

05/04 12:15 ET

"I think you’re just gonna have to endure us," Munger said, as he and Buffett tout the ways that Berkshire is different from other companies.

Hannah Levitt Finance Reporter

05/04 12:18 ET

Munger jokes that he’s been invited to a happy hour for bitcoin people. He, uh, is not a big fan of bitcoin, having previously called it a "noxious poison."

Katherine Chiglinsky Finance Reporter

05/04 12:20 ET

Warren Buffett says the bitcoin speculation rekindles the feeling he had watching people gamble in Vegas. Both make him confident he can make money in a world where people speculate when they know they’re likely to lose.

Michael Moore Finance Team Leader

05/04 12:23 ET

The Morningstar analyst is now asking about how Buffett tries to keep many of his stakes below 10 percent of a particular company (he’s been pretty strict on that with banks, even trimming his Wells Fargo stake, because of the regulatory requirements).

Katherine Chiglinsky Finance Reporter

05/04 12:23 ET

Buffett says that if you own over 10 percent of a security, it restricts your ability to change your mind or reverse your position.

And you then have to report every purchase. That’s particularly important for Buffett because anytime he takes a new stake, that stock tends to jump in value, making it that much harder for him to buy more at a low cost. He essentially said in February that because of the size of the stock portfolio (more than $190 billion now), it’s similar to dancing like an elephant when you try to change positions.

Katherine Chiglinsky Finance Reporter

05/04 12:24 ET

“If we like 9.5 percent of a company, we’d like 15 percent better,” Buffett said.

Hannah Levitt Finance Reporter

05/04 12:31 ET

Loomis is asking a question about Berkshire and foreign stocks. Does the company hold any?

Buffett says they disclose what they have to disclose. He says that shareholder question is correct that Berkshire does not have to report foreign stocks. He says that in certain countries, there’s different thresholds at which he has to report. But he points out that unless he’s required by law, he won’t give investment disclosure.

Katherine Chiglinsky Finance Reporter

05/04 12:32 ET

This harkens back to his point about why Combs and Weschler aren’t up there. They’re not going to give away investing secrets.

Katherine Chiglinsky Finance Reporter

05/04 12:35 ET

Now we’re getting a question about Precision Castparts. That business, which was one of Buffett’s most recent massive deal, has been facing some pressure. Is that more of a trend or a one off?

Buffett says that they’ve improved somewhat. He believes that those earnings will continue to improve. They’ve been recently below what he thought they would be.

Read more: Buffett’s Bottleneck on Jet-Engine Blades Crimps Boeing, Airbus

Katherine Chiglinsky Finance Reporter

05/04 12:37 ET

A good chunk of the questions are ones like this that ask the pair about their views on life, human nature, and larger issues beyond just the business world.

Katherine Chiglinsky Finance Reporter

05/04 12:39 ET

Someone’s taking Buffett up on his offer to have Ajit Jain or Greg Abel answer some questions.

This one’s for Jain and the unique insurance contracts they strike.

Katherine Chiglinsky Finance Reporter

05/04 12:43 ET

A good example of one of these unique contracts is the one they struck with AIG to pay to backstop billions of liabilities in older policies.

Jain says that the company tries to make sure they cap their exposure so if something goes wrong they try to make sure they know their max exposure. They want to make sure they have a significant margin of safety with pricing on the deal.

Katherine Chiglinsky Finance Reporter

05/04 12:43 ET

Mark that down guys. The first question we’ve gotten today where one of the recently named vice chairmen gets to answer.

Katherine Chiglinsky Finance Reporter

05/04 12:46 ET

Buffett is giving an example of the aftermath of 9/11 to explain these kinds of insurance deals. Cathay Pacific needed liability insurance to land, mortgage-holders on towers wanted insurance, and so on -- there was demand for things people hadn’t even been thinking about a week earlier.

“There were really only a couple people in the world that would even listen, and had the capacity to take on a lot of the deals we were proposed,” Buffett said.

Hannah Levitt Finance Reporter

05/04 12:47 ET

Buffett says that Jain and himself think similarly on deals like this. Jain is an asset that no other company in the world has, he says.

These insurance contracts are complicated, but I think these types of deals really tap into Jain and Buffett’s ability to calculate outcomes in a way that’s fairly impressive. And it doesn’t hurt to be the company will billions in capital to back up any unique policy like that.

Katherine Chiglinsky Finance Reporter

05/04 12:47 ET

"You can’t hire people like Ajit, you get them once in a lifetime," Buffett says of Ajit Jain. On debating pricing in the insurance industry, "it’s a lot of fun and its made us a lot of money."

Sonali Basak Finance Reporter

05/04 12:47 ET

The next question is about 3G Capital -- would Berkshire still be open to partnering with them in the future?

Katherine Chiglinsky Finance Reporter

05/04 12:48 ET

He praises Jorge Paulo Lemann and implies there’s a willingness to do more together. He notes that 3G has more of a taste for leverage and for paying up than Berkshire does, but at some point, they can be better operators than Berkshire can.

Katherine Chiglinsky Finance Reporter

05/04 12:48 ET

It’s a timely question --- Kraft Heinz’s large writedowns this year spurred questions about 3G’s cost-cutting strategy.

Read more: Adored by Buffett, 3G Is Scrambling to Fix Its Broken Model

Katherine Chiglinsky Finance Reporter

05/04 12:50 ET

He defends Lemann pretty significantly. He is a "good friend of mine I think he’s a marvelous human being and I’m pleased we are partners," Buffett says.

"They go into situations that need improvement, and they have improved them. I think both they and we, I know we, did underestimate not what the consumer is doing so much, but what the retailer is."

Sonali Basak Finance Reporter

05/04 12:51 ET

On 3G, Munger says that there were a long series of transactions that did very well and there was one finally that didn’t (which I believe alludes to the Kraft deal that Buffett’s said they overpaid for).

Katherine Chiglinsky Finance Reporter

05/04 12:52 ET

And the next question is about consumer tastes’s changing as well.

Katherine Chiglinsky Finance Reporter

05/04 12:53 ET

Munger adds that one failure in a string of success is a "very normal outcome" for a "place with a lot of young men who want to get rich quick."

Sonali Basak Finance Reporter

05/04 12:53 ET

Munger says the problem really was just that they paid a bit too much for the acquisition.

Buffett says there’s certain brands that decline a bit, and some that are growing. There’s not dramatic changes taking place at all, he says. Kraft Heinz is earning more money than the two companies were earning separately years ago.

Katherine Chiglinsky Finance Reporter

05/04 12:56 ET

From Kraft Heinz to Apple --- we’re now getting a question on the iPhone maker and some the criticisms it’s faced.

Katherine Chiglinsky Finance Reporter

05/04 12:58 ET

Buffett says that what hurts with Apple is that the stock has gone up --- he wants to buy more. Those shares climbed 20 percent in the first quarter.

Katherine Chiglinsky Finance Reporter

05/04 12:59 ET

On changing consumer tastes: just this week, meat-substitute maker Beyond Meat Inc. surged 163 percent after an initial public offering Thursday, marking the biggest IPO pop since the financial crisis.

Read more about it here:

Beyond Meat Extends Gain After Surging 163% in Trading Debut

Tyson Chicken Recall Adds to Challenges Post-Beyond Meats

We’ll Always Eat Meat. But More of It Will Be ‘Meat’: QuickTake

Hannah Levitt Finance Reporter

05/04 12:59 ET

And now we’re breaking a bit for lunch.

Katherine Chiglinsky Finance Reporter

05/04 13:16 ET

If you’re just joining us, here’s what we’ve learned so far on the morning portion of the Berkshire meeting:

- Buffett and Munger have been facing lots of questions about Kraft Heinz. Berkshire was stung earlier this year from the writedowns at the packaged food giant that the company helped create. Buffett has explained that the company overpaid for Kraft and that was one transaction that didn’t end up going well. While Buffett’s addressed the changing position of consumer brands, the pair seem to really hammer home the point that they believe the Kraft Heinz issues come back to overpaying on that acquisition. Buffett praised 3G and implied that he could continue to partner with them on future deals.

- Ajit Jain, who leads the company’s insurance operations, answered a question from shareholders about the unique contracts that Berkshire writes. It was the first time in this meeting that we’ve had one of the newly named vice chairmen address a shareholder question. That could be key for investors because it circles back to the succession issue --- Buffett and Munger were asked earlier if they would let the new guys speak more publicly and they left the option open, saying that Abel and Jain were around to answer questions.

- After one of Buffett’s investing deputies snapped up Amazon stock, the billionaire investor defended that move, saying it was part of a value investing framework. That’s an interesting point as value investors have been struggling for years as technology giants reign. Buffett and Munger have lamented how they missed some early technology bets such as Google.

- Buffett ramped up his criticism of buyout funds, saying that sometimes those returns aren’t calculated in an honest way. He’s normally faulted hedge funds for high fees and it’s interesting to get his thoughts on private equity.

- Berkshire bought back $1.7 billion of its stock in the first quarter, after the board tweaked the policy last year. Buffett was careful to thread that needle --- he wants to make sure that they’re buying those shares when they believe that they’re below intrinsic value instead of just aiming to do as many buybacks as they can.

Katherine Chiglinsky Finance Reporter

05/04 13:17 ET

Amid all the Kraft Heinz questions today, we just got some news that the packaged food giant’s chief marketing officer, Eduardo Luz, is leaving the company, according to a report from CNBC. That comes just weeks after the company announced a CEO change.

Katherine Chiglinsky Finance Reporter

05/04 13:31 ET

As we take a break from Q&A, here are some images that’ll give you a glimpse of the booths and happenings at the Berkshire’s annual meeting.

Anny Kuo TOPLive Editor

05/04 13:33 ET

As Kat noted early on, one of the more interesting sights on the shopping floor is a "Charlie for Chairman" booth:

Anny Kuo TOPLive Editor

05/04 13:36 ET

A juggler wearing "Charlie for Chairman" pins performs:

Anny Kuo TOPLive Editor

05/04 13:38 ET

An attendee takes a look at a "Charlie Munger: The Complete Investor" book:

Anny Kuo TOPLive Editor

05/04 13:41 ET

More reading -- "The Oracle’s Fables" books on display:

Anny Kuo TOPLive Editor

05/04 13:43 ET

Here’s a cutout of an apron-clad Buffett:

Anny Kuo TOPLive Editor

05/04 13:44 ET

An attendee poses for a photograph at the See’s Candies booth:

Anny Kuo TOPLive Editor

05/04 13:46 ET

By the Coca-Cola booth, attendees stood for a photograph with a cardboard cutout of Buffett.

Anny Kuo TOPLive Editor

05/04 13:48 ET

Buffett himself drank a Coke while touring the shopping floor earlier:

Anny Kuo TOPLive Editor

05/04 13:49 ET

Giant inflatable Heinz ketchup bottle greets visitors at the Kraft Heinz booth:

Anny Kuo TOPLive Editor

05/04 13:50 ET

Inside the Kraft Heinz booth:

Anny Kuo TOPLive Editor

05/04 13:52 ET

Attendees took pictures taken with an Oscar Mayer hotdog cutout:

Anny Kuo TOPLive Editor

05/04 13:53 ET

Diary Queen ice cream samples:

Anny Kuo TOPLive Editor

05/04 13:54 ET

Buffett ate a Dairy Queen vanilla orange ice cream bar while touring the shopping floor:

Anny Kuo TOPLive Editor

05/04 13:56 ET

A Geico gecko mascot greets visitors:

Anny Kuo TOPLive Editor

05/04 13:57 ET

An attendee tries on a virtual reality device:

Anny Kuo TOPLive Editor

05/04 13:58 ET

Attendees snap up Tony Lama boots:

Anny Kuo TOPLive Editor

05/04 13:59 ET

At the Brooks Sports booth:

Anny Kuo TOPLive Editor

05/04 14:00 ET

Buffett fans: A shareholder and his son dressed in suits dotted with pictures of Buffett:

Anny Kuo TOPLive Editor

05/04 14:06 ET

And we’re back!

Katherine Chiglinsky Finance Reporter

05/04 14:07 ET

Both Buffett and Munger have taken the stage. We’re kicking it off with a question from Morningstar’s analyst about the railroads --- what’s the difference between BNSF and Union Pacific’s results?

Katherine Chiglinsky Finance Reporter

05/04 14:10 ET

Buffett is comparing the two railroads a bit. He notes that years ago, Union Pacific went "off the tracks" but that the company’s done a good job getting back on track. He points out that they’ve done a good job on expenses.

He notes that they’ve been more efficient but points out that they have cut a bit of people. If changes are needed at BNSF, they’ll do that but he considers it to be a wonderful asset.

Katherine Chiglinsky Finance Reporter

05/04 14:12 ET

I feel like the railroad issue is getting a few more questions than normal. It’s definitely an interesting topic --- BNSF has long spurned the efficiency cult and these questions are really focusing on that. Will this end up putting more pressure on BNSF to adopt something like it?

Katherine Chiglinsky Finance Reporter

05/04 14:12 ET

Buffett says he’s watching Union Pacific closely:

"They’ve cut a lot of people right here in Omaha and we’ll see what that does in terms of shipper satisfaction. But we are measuring ourselves very careful in terms of what they do."

Sonali Basak Finance Reporter

05/04 14:16 ET

Another question on Berkshire’s ownership disclosures. Buffett responds in step with what he said earlier on the topic:

“We’re not in the business of explaining why we own a stock, we’re not looking for people to compete to buy it.”

Hannah Levitt Finance Reporter

05/04 14:18 ET

Interesting question about FlightSafety, which trains pilots. Does Buffett think the Boeing 737 Max controversy would impact demand for that?

Katherine Chiglinsky Finance Reporter

05/04 14:18 ET

He doesn’t think so.

Katherine Chiglinsky Finance Reporter

05/04 14:22 ET

Again! Another child asking a question.

Katherine Chiglinsky Finance Reporter

05/04 14:24 ET

Okay that was adorable. A quick pause to figure out how to pronounce entrepreneur.

Katherine Chiglinsky Finance Reporter

05/04 14:25 ET

For a child, that’s a great question. Does Berkshire need to adapt its model to embrace technology companies and the impact they’re having?

Katherine Chiglinsky Finance Reporter

05/04 14:28 ET

Buffett says he does like moats and says they used to be able to find them often. He says he doesn’t want to play at a game they don’t understand.

He does note that’s where Todd and Ted come in handy --- they know about some different areas (i.e. the Amazon stake that one of them recently took).

But the principles haven’t changed. Some of the old businesses have lost the moat, he says. But they’ll still stay where they think they know what they’re doing. They won’t go into something because someone else think it’s a good idea.

Katherine Chiglinsky Finance Reporter

05/04 14:31 ET

The next question touches on activists. CNBC’s Becky Quick notes that now it’s hard for an activist to come in (Buffett owns a significant amount of shares, etc.), but is that a concern when his successor takes over?

Buffett says it can happen, but might not happen for a lot of years. He says, in the end, Berkshire should prove itself over time.

Katherine Chiglinsky Finance Reporter

05/04 14:32 ET

"It’s going to happen quite a few decades after my death, I don’t think I’ll be bothered much by it," Munger says of an activist targeting Berkshire.

Sonali Basak Finance Reporter

05/04 14:34 ET

We touched a bit on this earlier this year when Buffett released his annual letter. He spent a chunk of the letter going through how Berkshire’s organized, trying to make a clear outline of why it made sense that businesses like Geico and Dairy Queen and BNSF should be under one company. That could help his successor if an activist comes knocking.

Read more: Buffett Makes Case for His Successor to Keep Berkshire Together

Katherine Chiglinsky Finance Reporter

05/04 14:34 ET

Buffett’s talking about Geico and its competitor Progressive. He’s been praising Progressive, calling it an excellent company, and saying that both companies will be watching what each other does.

Katherine Chiglinsky Finance Reporter

05/04 14:36 ET

Jain says that Geico has a significant advantage over Progressive on the expense ratio. But there’s been a bit of a gap between the two companies recently on the loss ratio. Jain says they’re working to address that.

Katherine Chiglinsky Finance Reporter

05/04 14:38 ET

That’s two questions we’ve had answered by Jain. I know it seems small, two questions out of the six or so hours of questions we get all day. But to hear him speak more publicly is really important. He’s always been a crucial part of Berkshire behind the scenes and it’s interesting to see him publicly speaking to shareholders.

That could raise more confidence in Berkshire’s succession planning.

Katherine Chiglinsky Finance Reporter

05/04 14:41 ET

You might be hearing a lot of the phrase "circle of competence." That’s been Buffett’s way of saying he prefers to invest in companies in sectors that he can understand.

It’s a bit of the reason why he had typically avoided technology stocks --- Buffett wasn’t as familiar with it, even using a flip phone for years. But I think that’s started to change a little. Buffett has explained how he looks at Apple as he looks at many of the other consumer companies he invests in, analyzing how consumers glom on to the products and figuring out the pricing power those operations have.

Katherine Chiglinsky Finance Reporter

05/04 14:44 ET

We’re getting into ESG now, with a question about how Berkshire scores on that.

Katherine Chiglinsky Finance Reporter

05/04 14:46 ET

Buffett is explaining how the energy businesses have wind investments. But he doesn’t want to have their businesses spending time filling out reports about all those things to just score well for ESG.

Katherine Chiglinsky Finance Reporter

05/04 14:46 ET

This is a prime question for Greg Abel, who used to run the energy businesses, to jump in on, but I’m not seeing any microphone guy heading his way.

Katherine Chiglinsky Finance Reporter

05/04 14:48 ET

Here’s a QuickTake on sustainable investing for those interested in learning more about the issue.

Hannah Levitt Finance Reporter

05/04 14:53 ET

Buffett and Munger seemed to enjoy recounting war stories of all the dysfunctional board of directors they’ve served on. Buffett’s point was independent directors aren’t always the advocates for shareholders that one would hope.

Michael Moore Finance Team Leader

05/04 14:56 ET

The Morningstar analyst is asking about Berkshire Hathaway Energy’s business, saying that it seems the annual spending is slowing down a bit. Is there an area where Buffett thinks it needs to spend more?

And now that answer’s coming to Greg Abel, seen as a potential successor. Abel says they have a great portfolio, with a focus on building renewable projects. The footprint in Iowa has been great, he says. Abel says they’ve really just embarked on an expansion with Pacificorp. But because of regulation, a project that was started in 2008, it has really just been getting under way. They don’t add in capital spending for projects that aren’t yet there, but as they firm up, they should continue pursuing some.

Katherine Chiglinsky Finance Reporter

05/04 14:57 ET

Abel says there’s no one ahead of them in the Midwest, let alone Iowa. Berkshire Hathaway Energy is a pretty expansive empire and Buffett and Munger are using this opportunity to highlight all the work it’s doing.

Katherine Chiglinsky Finance Reporter

05/04 14:58 ET

With that answer, we’ve now had both Greg Abel and Ajit Jain take questions. I’ll be interested to hear from shareholders about their reaction to the pair’s answers.

Katherine Chiglinsky Finance Reporter

05/04 15:01 ET

Now we’re getting a question about why Buffett puts his excess cash in Treasury bills versus an index fund. Berkshire owns more than $88 billion in Treasury bills.

Buffett says that it has certain execution problems with hundreds of billions of dollars, implying that Berkshire wouldn’t have had as easy (and successful arguably based on the deals he was able to find) a time during the financial crisis as it did.

Katherine Chiglinsky Finance Reporter

05/04 15:02 ET

"It’s a perfectly rational observation," Buffett said. "I wouldn’t quarrel with the numbers." -- The person who asked the question has calculated that the opportunity cost was equal to more than 12% of Berkshire’s current book value, by keeping money in cash rather than an index fund.

It might make sense for Berkshire to operate that way in the future to invest latent money in an index fund, Buffett said. Munger said he believes in being a little more conservative with the cash.

Sonali Basak Finance Reporter

05/04 15:05 ET

"We have a lot of people who trust us, who really have disproportionate amounts of Berkshire compared to their net worth," Buffett said. That’s a big reason he tries to invest conservatively, he said.

Sonali Basak Finance Reporter

05/04 15:06 ET

If Freddie and Fannie are authorized to do more with manufactured homes, that should be good, Buffett says. Buffett’s Berkshire owns Clayton Homes, a sizable mobile home company.

Katherine Chiglinsky Finance Reporter

05/04 15:09 ET

Oh wow, an 11-week old is with her mom at the microphone to speak. I assume she’s not asking the question herself.

Katherine Chiglinsky Finance Reporter

05/04 15:11 ET

Buffett is talking about how the economy is able to employ more people even as companies seek to be more productive.

Katherine Chiglinsky Finance Reporter

05/04 15:15 ET

Buffett notes we’ve seen a little of creative destruction, which at least on the investment side of the business has been good for Berkshire.

Katherine Chiglinsky Finance Reporter

05/04 15:15 ET

Munger said that people at the top of the economic period got ahead faster than the less-rich because asset prices rose quickly amid ultra-low interest rates.

"Nobody did that because they suddenly loved the rich, that was an accident and it will soon pass," said Munger.

Sonali Basak Finance Reporter

05/04 15:16 ET

The next question is about politics and banks --- do Buffett and Munger think that many of the banks are being run effectively by politicians?

"Sure," Munger says. "But not too much."

Katherine Chiglinsky Finance Reporter

05/04 15:17 ET

Buffett points out that there’s a ton of regulation in the insurance business as well as the banking one. Both of those should have those guardrails, he says.

They’re too important, he notes.

Katherine Chiglinsky Finance Reporter

05/04 15:18 ET

Insurance has been regulated since Berkshire’s been in it, Buffett said.

He added that regulation “can be a pain in the neck,” but they also don’t want a bunch of “charlatans” running the industry.

Hannah Levitt Finance Reporter

05/04 15:20 ET

Buffett on banking systems without regulation:

"We had the Wild West in banking long ago, and it produced a lot of problems in the 19th century."

Sonali Basak Finance Reporter

05/04 15:23 ET

The role regulators and politicians play in running the biggest banks has been top of mind in recent months following Tim Sloan’s resignation as Wells Fargo CEO. Buffett and Munger have repeatedly come to Sloan’s defense -- Munger said earlier today that he wishes Sloan was still there.

Here’s a story from March on the role of Washington in Sloan’s exit:

Wells Fargo’s Insider CEO Failed to Outrun Political Fury.

Hannah Levitt Finance Reporter

05/04 15:23 ET

Barclays analyst Jay Gelb is asking about the decreased disclosures in Berkshire’s reports. Why are investors being provided less information?

Buffett says he doesn’t think they provide less information. They might provide it in a different form. He points to the start of his letter this year, which detailed why he was cutting out the book value comparison.

Katherine Chiglinsky Finance Reporter

05/04 15:23 ET

Insurance lovers: Buffett calls the combined ratio a "dumb term." He says he doesn’t think his portrayal of the insurance business is opaque and he said he’s trying to give people a big picture, rather than too much detail.

Sonali Basak Finance Reporter

05/04 15:26 ET

Next question is on China: Does Buffett have any plans to set up a company there?

“Dairy Queen is all over China, and it’s working fine,” Munger said.

Hannah Levitt Finance Reporter

05/04 15:26 ET

Oh, a question on Brexit. Will Berkshire invest more sums in the UK and Europe?

As to what’s his advice on how to handle Brexit? Buffett laughs at that question.

Katherine Chiglinsky Finance Reporter

05/04 15:27 ET

Back to China, Munger said:

"It really make sense for two countries to get along," he said. It would be "stupid on both sides" if the U.S. and China didn’t get along.

Sonali Basak Finance Reporter

05/04 15:29 ET

He says he wants the Berkshire name to be known more internationally.

Some of his businesses have been pushing more abroad. The real estate brokerage empire has been opening up offices in London and Berlin and has ambitions for even more cities.

Katherine Chiglinsky Finance Reporter

05/04 15:30 ET

"We’d love to put more money into the U.K., if I get a call tomorrow and somebody says I’ve got an X-billion dollar company" that might make sense for you to own, Buffett said, "I’ll get on the plane."

Sonali Basak Finance Reporter

05/04 15:31 ET

Brexit doesn’t destroy the appetite for a large deal in Europe, Buffett said. However, Munger adds:

"It strikes me as a horrible problem, and I’m glad it’s theirs and not mine."

Sonali Basak Finance Reporter

05/04 15:31 ET

Buffett also said, though he’s not an Englishman, he thinks it was a mistake for the U.K. to vote to leave the European Union.

Hannah Levitt Finance Reporter

05/04 15:35 ET

Even on the lookout for deals in Europe -- Buffett stands by a long-standing tradition of tough negotiation. He’s saying he’s not going to entertain a big auction for a takeover.

Munger explains that people on the ground are paying prices that Berkshire doesn’t want to pay.

Sonali Basak Finance Reporter

05/04 15:36 ET

Buffett says Berkshire’s better situated now than it was years ago, but he does point out that size is a drag on performance.

Katherine Chiglinsky Finance Reporter

05/04 15:42 ET

Berkshire is at a corporate disadvantage as opposed to owning an index fund, because of tax reasons, Buffett points out.

Katherine Chiglinsky Finance Reporter

05/04 15:47 ET

Greg Abel takes a question on NV Energy and several Nevada casinos cutting the cord with the utility. Relationships were "strained from day one," Abel said. "We knew we had some challenges there."

Five customers left the system, but still use distribution, but Berkshire lost the ability to sell them power. Abel says he’s disappointed by that.

Sonali Basak Finance Reporter

05/04 15:49 ET

Abel assured the audience that NV Energy will prosper in the long term.

Hannah Levitt Finance Reporter

05/04 15:49 ET

There are economic reasons for clients leaving, Abel said. They don’t bear the cost of renewable energy after a number of years, he said. For more detail about Buffett’s NV Energy operations in Nevada, see here:

Nevada Upholds Buffett’s Utility Monopoly, Boosts Renewable Goal

Sonali Basak Finance Reporter

05/04 15:51 ET

Interesting --- a question getting proposed for Todd Combs and Ted Weschler. Buffett has said that the pair were slightly behind the S&P 500. What has the pair changed?

Katherine Chiglinsky Finance Reporter

05/04 15:51 ET

Buffett says that one is now modestly ahead and one is modestly behind.

Katherine Chiglinsky Finance Reporter

05/04 15:52 ET

Buffett also points out that the pair help Berkshire on items more than just on investing. Combs is heavily involved in the health care venture with JPMorgan.

Katherine Chiglinsky Finance Reporter

05/04 15:55 ET

Now we’re getting a question on the competitive position of American Express.

Buffett says everybody’s a competitor, including now Apple which teamed up with Goldman Sachs on a card. AmEx is growing around the world with small businesses, he said.

He highlights the deal they just did with Delta: AmEx Renews Credit-Card Partnership With Delta Through 2029

Katherine Chiglinsky Finance Reporter

05/04 15:56 ET

“There will always be, in my view, many many competitors,” Buffett said. “I wouldn’t think of the credit card business as a one-model business.”

Hannah Levitt Finance Reporter

05/04 15:57 ET

Charlie Munger: "I have no opinion about technology."

He’s also still responding to the credit card question.

Sonali Basak Finance Reporter

05/04 15:59 ET

Finally! A question about Occidental from Barclays’s Jay Gelb.

Katherine Chiglinsky Finance Reporter

05/04 16:03 ET

Buffett says he doesn’t think the Occidental deal will be the last they do. They’re very likely to get the call, he says (although he does point it out that it could happen soon or even years from now).

Buffett’s Berkshire agreed to invest $10 billion in Occidental as that company seeks to win the deal for Anadarko Petroleum.

Read more: Bank of Buffett Drops $10 Billion Bomb Into Anadarko Battle

Katherine Chiglinsky Finance Reporter

05/04 16:03 ET

It’s really interesting that Buffett is saying extra funds will be used to help finance deals. In some ways, he’s competing with the banks --- and he has large stakes in many banks.

Sonali Basak Finance Reporter

05/04 16:06 ET

To Sonali’s point, let’s make this even more complicated. Buffett was actually contacted by a banker, specifically Bank of America’s Brian Moynihan, about the Occidental deal.

Buffett kept talking about how Berkshire will continue to be a resource for companies seeking financing. One could argue that the fact a bank CEO called up Buffett to do the financing sort of hammers that home thatBerkshire is a formidable competitor when it comes to financing options.

That might partially be the speed at which Buffett can get deals done. He was contacted last Friday afternoon, he said. And by Tuesday, the companies had an official statement.

Katherine Chiglinsky Finance Reporter

05/04 16:08 ET

To make this even MORE complicated:

Private equity -- which Buffett has criticized -- has also gotten much bigger in financing markets. So are other billionaires, like the Koch brothers and their Koch Equity Development, which has been known to take preferred interests to help finance transactions.

Sonali Basak Finance Reporter

05/04 16:09 ET

Make that two years in a row we’ve gotten questions about Elon Musk.

Katherine Chiglinsky Finance Reporter

05/04 16:10 ET

Buffett says the idea of using telematics is spreading quite widely in the insurance business. It is important to have data on how people drive, he says.

Katherine Chiglinsky Finance Reporter

05/04 16:11 ET

Buffett says he worries much more about Progressive than all of the possibilities he can see for auto companies getting into the insurance business. “It’s not an easy business at all,” he said.

Hannah Levitt Finance Reporter

05/04 16:12 ET

Buffett says online car shopping does not destroy the auto dealer who takes care of customers -- “it’s not an overwhelming threat.” Munger had nothing to add.

Hannah Levitt Finance Reporter

05/04 16:15 ET

Morningstar’s analyst brings up the question --- will a successor have to take Berkshire from an acquisition platform to one that returns more capital to shareholders?

Buffett says that could happen, but it’s a judgment that’ll be made over time.

Katherine Chiglinsky Finance Reporter

05/04 16:20 ET

“In 60 years, we’ve never had an argument,” Buffett said of him and Munger. He qualified it, saying they’ve had disagreements, but never (!) an argument and they don’t second-guess each other.

Hannah Levitt Finance Reporter

05/04 16:22 ET

This question is about the world changing quickly. Should investors expand their circle of competence, or stay with it and risk having a shrinking basket of things to choose from?

Buffett says you should obviously try to expand that circle, but you can’t force it.

Katherine Chiglinsky Finance Reporter

05/04 16:27 ET

Next question is about what Buffett would invest in if he was managing a $1 million portfolio. He said it might be an arbitrage strategy. They’d find a way to make that “one way or another, I can assure you,” with $1 million. If you expand beyond that, the percentage goes down, he said.

Munger said he agrees: “large amounts of money develop their own anchors.”

Hannah Levitt Finance Reporter

05/04 16:27 ET

This question is about See’s Candies --- why hasn’t the company grown to the scale of Mars or Hershey’s?

Katherine Chiglinsky Finance Reporter

05/04 16:30 ET

Buffett says that the business is extraordinarily good in a very small niche, with boxed chocolates being good gifts. But he notes that it doesn’t travel that well.

Munger says they’ve failed to turn their See’s Candies business into Mars for the same reason we’ve all failed to get Nobel Prizes in physics: It’s too hard for us.

Katherine Chiglinsky Finance Reporter

05/04 16:33 ET

And the audience is ramping up applause as we finish the Q&A portion.

Katherine Chiglinsky Finance Reporter

05/04 16:33 ET

They’re getting a standing ovation from some shareholders below the press box area.

Katherine Chiglinsky Finance Reporter

05/04 16:37 ET

As we prepare to wrap up, here’s a sighting worth noting. Our photographer spotted Apple CEO Tim Cook during the shareholder shopping day yesterday:

Anny Kuo TOPLive Editor

To contact the reporter on this story: Katherine Chiglinsky in New York at kchiglinsky@bloomberg.net

To contact the editor responsible for this story: Tal Barak Harif at tbarak@bloomberg.net

©2019 Bloomberg L.P.