Banks Sell First European Junk Bond in Months at Steep Discount

Banks Sell First European Junk Bond in Months at Steep Discount

(Bloomberg) -- The first high-yield deal to come to the European market in months, a bond issued by Apollo-owned Miller Homes Ltd, was sold to investors at a steep discount amid a challenging market backdrop for junk credit.

Banks led by Barclays Plc and HSBC Holdings Plc allocated the bond, totaling 815 million pounds ($1.02 billion) and split into a fixed sterling-denominated tranche and a floating euro-denominated one, at wider margins and greater issue discounts than originally expected, after sweetening the terms of the sale to attract investor demand.

Banks Forced to Sweeten Price of Europe’s Milestone Junk Bond

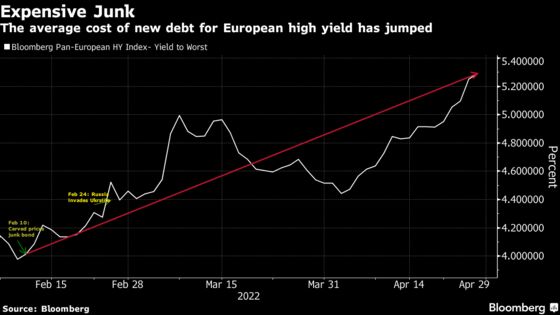

While the deal ends an 11-week long drought for European junk bonds, its outcome indicates that this corner of credit is vulnerable to some challenging times ahead, with soaring inflation, a tightening of monetary policy and spillovers from the war in Ukraine likely to sour sentiment further. Investors have already taken funds away from high yield, leading to large outflows and lower demand for new paper.

The cost of insuring European junk bonds rose to around 430 basis points on Friday, close to a two-year high. Meanwhile, European-based high-yield funds recorded their third week of outflows in a row. They have lost 5.8% of assets under management since the start of the year, according to EPFR Global data cited by Bank of America analysts.

The 425 million pound sterling tranche priced with a 7% coupon and at an original issue discount of 93.45, yielding 8.25%, according to a person familiar with the matter. Initial price talk was in the mid-to-high 7s range, as reported by Bloomberg. The 465 million euro floater was placed at 525 basis points over the Euribor margin and at a original issue discount of 97 pence.

The proceeds from the bond will be used to repay a bridge facility provided by the banks to finance Apollo Global Management’s acquisition of the U.K.-based house builder.

©2022 Bloomberg L.P.