Trauma Over, Hedge Funds Race Their Bull Market Engines Again

Trauma Over, Hedge Funds Race Their Bull Market Engines Again

(Bloomberg) -- After a bloody week battling day traders, professional speculators are ramping up risk again, pushing their equity exposure to the highest level on record.

Hedge funds, which were forced to retreat furiously last week amid a retail-fueled short squeeze, have since been busy adding stocks on both the long and short side of their book. Their gross trading flow jumped on Tuesday at the fastest pace since the bear market bottom in March, according to data compiled by Goldman Sachs Group Inc.’s prime brokerage unit.

The process was also on display among hedge fund clients at Morgan Stanley and JPMorgan Chase & Co., easing concern that the industry’s latest chaos may spread. As the S&P 500 sets an all-time high, fund managers are starting to chase gains to make up for losses that for some reached double digits in January. They’re tilting bullish more than ever, with the industry’s long-short ratio climbing to the highest since Goldman began tracking the data in 2011.

“There has been an obvious ‘everything up’ trade across themes/factors this week,” Charlie McElligott, a cross-asset strategist at Nomura Securities, wrote in a note to clients. “As everybody shed exposure, the point of pain then became a market move ‘higher.’”

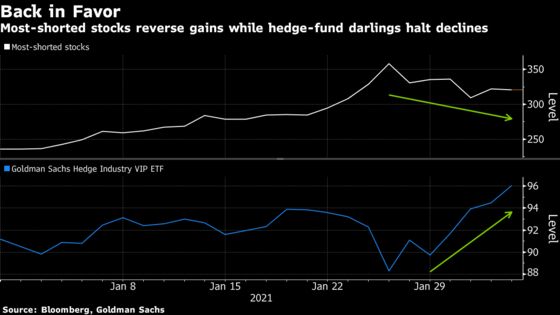

Risk-off attitudes started to subside on Thursday, when a Morgan Stanley index tracking the industry’s most popular versus the least popular stocks not only turned back in hedge funds’ favor, but delivered the best daily return on record. Since then, fund managers have boosted bets particularly on the long side.

It’s hard to tell whether a stabilizing market has encouraged risk taking or the risk-on mode contributed to equity gains. For now, the double blow -- longs were down while shorts were up -- has come to a halt.

A Goldman exchange-traded fund tracking hedge funds’ favorite stocks has jumped 7% this week, reversing the worst weekly decline since October. Meanwhile, heavily-shorted companies such as GameStop Corp. -- the ones inflicting hedge fund pain when Reddit traders joined forces to bid up their prices last week-- have collapsed, easing pressure for short sellers. A basket of the most-shorted shares is down 4.5%, poised for its first weekly slide in five.

The favorable performance, along with a rising market, has allowed money managers to make up some lost ground. By JPMorgan’s estimates, long/short hedge funds suffered losses averaging about 6% to 7% in January. Now, their year-to-date losses have more than halved. While data from Goldman and Morgan Stanley pointed to a less painful January, both showed similar improvement this month.

“The performance rebound likely reduces odds of larger de-risking,” JPMorgan’s prime brokerage unit wrote in a note. “However, that doesn’t mean we couldn’t still see some aftershocks over the next 2-4 weeks given exposure levels (both gross and net) are still quite high, performance is mixed, and the recent events are still very fresh.”

©2021 Bloomberg L.P.