The Oil Market's Reaction to Saudi Arabian Attack in Five Charts

Brent futures soared as much as $11.73 a barrel in intraday trading, the biggest increase since the contract launched in 1988.

(Bloomberg) -- The record surge in Brent crude futures on Monday only tells part of the story of how the oil market is reacting to a strike on a Saudi Arabian oil facility that’s removed about 5% of global supplies. Here are five charts that shed more light on the granular impact.

Historical Perspective

Brent futures soared as much as $11.73 a barrel in intraday trading, the biggest increase since the contract launched in 1988. The global benchmark surged as much as 19.48% in percentage terms, the biggest jump since the first Gulf War in 1991.

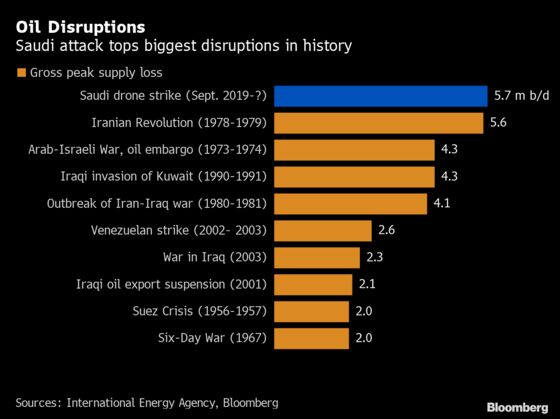

Scale of Disruption

The estimated 5.7 million barrels a day of lost Saudi production is the single biggest sudden disruption on record. It surpasses the loss of Kuwaiti and Iraqi supply during the Gulf War in August 1990, and the hit to Iranian output in 1979 from the Islamic Revolution, according to the International Energy Agency.

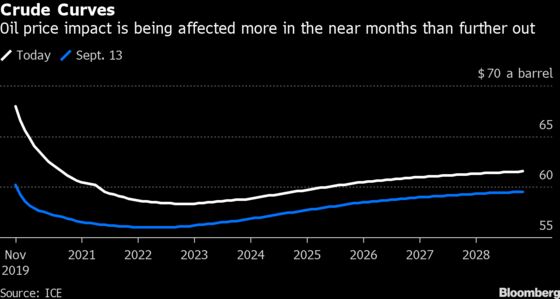

Timing is Everything

Because the loss of oil is sudden, the impact is being felt more heavily in contracts for near-term delivery than further down the curve. The price gap between Brent for delivery this November and December 2020 doubled from $3.57 a barrel at the close of trading Friday to more than $7 on Monday.

Protection Money

The options market shows traders are still nervous that prices will risen even further, and are now paying up to protect against it. Calls on West Texas Intermediate crude futures are pricier than puts for the first time since 2018.

Location, Location, Location

Global oil prices are feeling the impact of the attack more intensely than those in the U.S., where the benchmark is slightly buffered by being delivered to a land-locked oil hub in Oklahoma. Brent’s premium to West Texas Intermediate widened as much as 37% to $7.40 a barrel, the biggest gap since July.

--With assistance from Javier Blas and David Marino.

To contact the reporters on this story: Dan Murtaugh in Singapore at dmurtaugh@bloomberg.net;Alfred Cang in Singapore at acang@bloomberg.net

To contact the editors responsible for this story: Ramsey Al-Rikabi at ralrikabi@bloomberg.net, Andrew Janes

©2019 Bloomberg L.P.