Hedge Funds Cut High-Conviction Stock Bets to Seven-Year Low

Hedge Funds Cut High-Conviction Stock Bets to Seven-Year Low

(Bloomberg) -- In a stock market where no bounce can be trusted and single-name blow-ups are multiplying, professional speculators are ditching some of their long-held darlings.

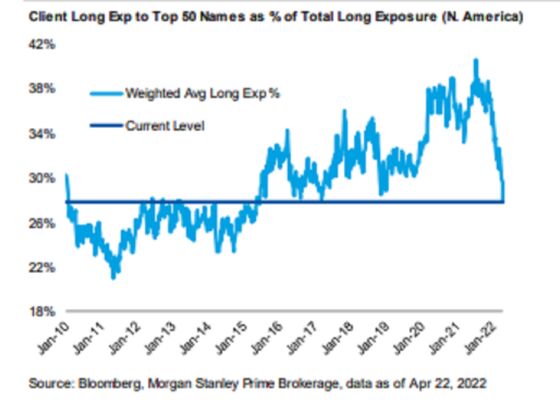

That’s a regime shift for hedge funds who have famously crowded into the same companies over the past decade. Now the cohort’s exposure to the 50 most-popular stocks has just collapsed to the lowest since 2015 in Morgan Stanley’s prime brokerage data.

The most-crowded stocks make up only 27% of the long book, down from a peak of over 40% seen last year.

The fast money’s new-found aversion to high-conviction buys looks like an attempt to diversify holdings after many funds were burned by concentrated bets in expensive technology shares. Netflix Inc. and Alphabet Inc. were the latest tech giants to stumble after earnings, part of a broader beat-down in the sector that’s taken the Nasdaq 100 more than 20% off its all-time high.

Hedge funds tracked by Morgan Stanley have also cut their net leverage -- a measure of risk appetite that takes into account long versus short positions -- to a two-year low.

“Hedge funds seem to be playing not to lose, at least in the short term,” Chris Harvey, head of equity strategy at Wells Fargo, said in an interview. “After a difficult run post-Thanksgiving, they seem to have limited risk budgets and confidence.”

One silver lining: Thanks to less leverage, it appears money managers have been less inclined to cut exposures abruptly during the market carnage of recent weeks.

For most of the last decade, the cohort had been piling into a small pool of stocks -- largely companies that boast faster growth potential -- amid a subdued economy and easy monetary policy from the Federal Reserve. That faith, which turned ever stronger in the pandemic era, is wavering as central bankers embark on a tightening cycle to cool inflation.

“Now the interest rates are going up, people are going back into value stocks,” Shivam Sinha, chief investment officer at Glax Capital LLC, said by phone. “That’s why those crowded stocks are coming out on the books.”

To anyone who witnessed hedge funds’ furious exodus from software and internet shares in January, less crowding is perhaps welcome news. Now there’s less danger for the broader market in the event of mass hedge-fund liquidations given the cohort’s diminished exposure to a small pool of concentrated bets.

In fact, the fast money kept their cool this week when the Nasdaq 100 sank to fresh lows, extending its April decline to more than 10% -- the worst month since the 2008 financial crisis. On Tuesday, when the tech-heavy gauge tumbled almost 4% and the S&P 500 fell more than 2% for a second time in three sessions, hedge funds tracked by Morgan Stanley were still net buyers of shares.

“We’ve been fielding the question about whether the recent move has been a HF ‘selling’ or ‘de-grossing’ event, but from our view, the L/S community has NOT been trimming gross exposure, nor have they been large net sellers in recent sessions,” Morgan Stanley analysts including Bill Meany wrote in a note.

The relative sturdiness was also observed among fund clients at other prime brokers. Goldman Sachs Group Inc. analysts including Vincent Lin described the group’s selling on Tuesday as “modest” and their mood as “calm.”

At JPMorgan Chase & Co., analysts including John Schlegel noted “a lack of strong selling” from hedge funds over the past week.

“This likely reflects prior de-risking in Q1,” Schlegel wrote in a note. “With leverage already pretty low, there’s less need to de-risk aggressively this time.”

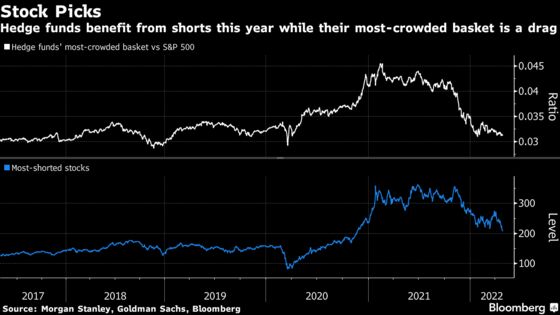

As in past routs, short positions allowed managers to better weather the recent turmoil. Meanwhile, a relatively lighter pivot toward tech stocks may have also made them less vulnerable to the latest carnage.

Of the 20 worst days for the Nasdaq 100 since the start of 2021, long-short funds endured the least amount of downside in relative terms Tuesday -- down only 18% as much as the index, Morgan Stanley found. Over the same stretch, the negative drag from the most-crowded stocks on fund performance ranked the second smallest.

“In addition to broader directional tilts having moderated, there has also been an active rotation out of areas that were more ‘crowded’ in 2021,” Meany said. As a result, “L/S funds feel less of the downside in the Nasdaq and the crowded longs compared to other challenging days.”

©2022 Bloomberg L.P.