Oil Traders Are Already Treating Russian Crude Like It’s Banned

Oil Traders Are Already Treating Russian Crude Like It’s Banned

(Bloomberg) -- Within the next few days, it seems increasingly likely that the European Union will announce some kind of gradual embargo that prevents member states from purchasing Russian oil in response to the invasion of Ukraine.

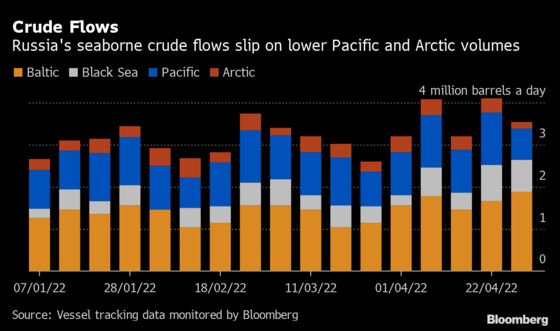

In practice, though, there are already de facto curbs on swaths of purchases from Russia that are likely to restrict the nation’s trade -- not just with Europe but further afield.

The world’s top traders are already retreating from handling Russian crude because of an abundance of caution in how they’re interpreting existing rules. Likewise, many of the continent’s largest oil companies have also been disentangling themselves from Moscow since the attack on Ukraine began.

The top trading houses are interpreting existing regulations as prohibiting them from paying Rosneft PJSC, Gasprom Neft PJSC and Transneft PJSC for products that are not ‘strictly necessary’ beyond a May 15 deadline. Rosneft is the main state oil company while Transneft is Russia’s pipeline operator.

New Contracts

Vitol Group, the world’s biggest trader of oil, has said it won’t enter into new contracts for Russian crude and refined fuels.

“Volumes of oil will diminish significantly in the second quarter as current term contractual obligations decline, and we anticipate this will be completed by end of 2022,” Vitol said in a statement last month.

Meanwhile, Trafigura Group will cease purchases of crude from Rosneft in advance of May 15 and is also lowering refined-fuel buying. Likewise, Glencore Plc has said it will stop all new trading business involving Russian commodities.

Between them, the three firms handled about two-fifths of seaborne Urals cargoes in the six months through March, according to data compiled by Bloomberg.

Logistics Too

As well as the important May 15 date, logistical difficulties in handling Urals -- Russia’s flagship crude -- are further impeding exports.

Many European oil refiners are saying they will no longer accept Russian crude, meaning the network of traditional destinations is shrinking. Even bids for refined fuels are frequently ruling out Russia-origin supply.

On Tuesday, energy major BP Plc said its four European refineries are now running without any Russian feedstock. Some smaller firms, such as Hungary’s Mol Nyrt, have said a transition off of Russian supply will take time.

Already Challenging

Put simply, though, the traders are unwilling to charter expensive tankers to load Urals without a confirmed buyer at destination being in place. The risk of being saddled with a stranded crude oil cargo, in what is a strongly backwardated market -- in which oil prices for future months are lower -- is seen as too great.

This doesn’t necessarily mean a halt to Russian oil exports, but it means flows to Europe have already become more challenging even before any formal ban might get imposed. Shipments to Asia have also gotten more complicated.

The current situation places already greater pressure on Russia and the companies and nations willing to buy its oil to sort out their own shipping, insurance and finance.

Urals is on sale at significantly higher prices in Asia than it is in Europe, but to get it to Asia requires ships, insurance and financing over a longer period of time because of the distance involved in moving the grade east.

The question is whether other firms will fill the void left by the big traders’ stepping back.

Rosneft or its buyers may have to get more involved in deliveries. Equally, another trader may try to wedge itself more aggressively into the Russian export trade -- with all the risk that might encompass if Europe really does impose a formal ban.

For now, though, traders say there are already notable restrictions on Russian crude exports to Europe because of decisions that large traders and oil companies have already taken.

A ban would compound that.

©2022 Bloomberg L.P.