Diesel Squeeze Intensifies as Traders Scramble to Exit Shorts

New York Diesel Soars as Dwindling Inventories Unnerve Market

(Bloomberg) -- U.S. diesel prices in New York extended a historic rally as trading for the month of May concludes and some traders rushed to exit short paper positions, amplifying a price surge triggered by supply shortages.

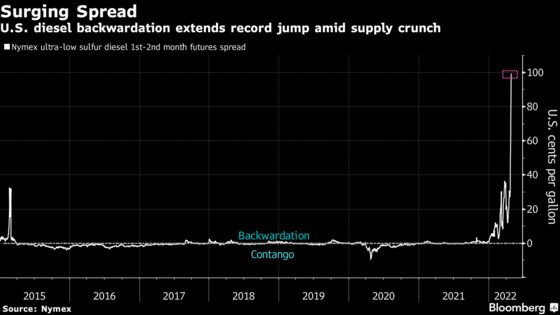

Benchmark U.S. diesel futures on the New York Mercantile Exchange surged to a fresh record. The gap between the front-month, May, and the second month blew out to $1 a gallon, the widest in history, signaling a premium for barrels available in the near term.

The war in Ukraine touched off a surge in diesel prices as bans against Russian crude restrict supplies from one of Europe’s most important producer of fuels. U.S. Gulf Coast refiners have stepped up to fill the global void, sending more exports to Europe and Latin America at the expense of the U.S. East Coast. Stockpiles in the East Coast region have plummeted to the lowest since 1996. With New York serving as the delivery point for benchmark futures trading, the outsized price moves have reverberated through the market.

“U.S. diesel inventories remain well below their normal range, and international buyers are frantic,” wholesale-fuel distributor TACenergy wrote in a note to clients. As a result, it’s unclear when this rally will come to an end.

With the end of the trading cycle approaching, financial traders who are still holding diesel contracts are trying to unwind those commitments. Holding the contract until the end of the month would obligate them to deliver a cargo of diesel. Given the shortage in inventories, those with actual barrels in tank stand to make a killing with New York Harbor physical diesel prices at the highest since at least 2006.

In earnings calls this week, U.S. and international refiners, which are profiting from the run up in fuel prices, also made note of the extraordinary state of diesel markets.

Refiners are doing “everything in their power to turn every drop of gasoline” into jet fuel or diesel because of the current market structure, PBF Energy Chief Executive Officer Tom Nimbley said in conference call with analysts. Patrick Pouyanne, the CEO of French oil major TotalEnergies, said on Thursday that he expects to see the premium of diesel to crude keep rising.

©2022 Bloomberg L.P.