Key Source of Corporate Cash Seizing Up Amid Credit Market Rout

Key Source of Corporate Cash Seizing Up Amid Credit Market Rout

(Bloomberg) -- A corner of the financial system that provides corporate America with short-term IOUs to buy inventory or make payrolls is seizing up, triggering a scramble for cash elsewhere and fueling speculation that the Federal Reserve will intervene.

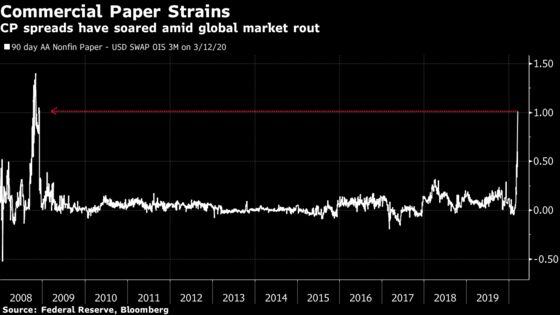

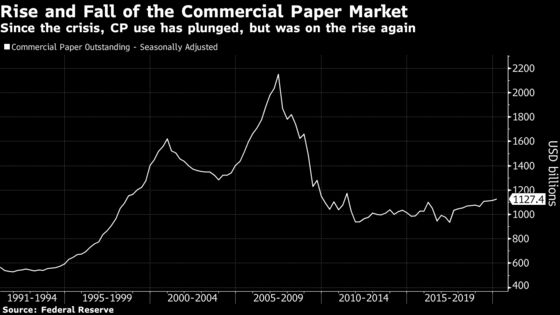

In the $1.13 trillion commercial paper market, yields over risk-free rates have surged to levels last seen during the 2008 financial crisis. The strains are causing companies to draw down on backup credit lines, according to people with knowledge of the situation.

The longer the commercial paper market remains stressed, the more companies will look to tap credit lines, increasing the risk that banks will need to raise funds themselves, Bank of America Corp. strategists Mark Cabana and Olivia Lima wrote in a March 13 note. Cabana said the Fed needs to start buying commercial paper to unclog the market.

Money Fund Risks

“It’s prudent for everyone to try and raise liquidity, and the Fed needs to facilitate this,” he said. If not contained, the turmoil could increase risks for money-market funds that hold the debt, he said.

In a surprise action Sunday, the Fed slashed benchmark interest rates by a full percentage point, promised to boost its bond holdings by $700 billion and coordinated central bank dollar liquidity lines to other central banks. But it stopped short from announcing specific measures to alleviate pressures in the commercial-paper market.

“We’ve given broad general guidance to the banks,” Chairman Jerome Powell said during a teleconference. “We’d like them to use their buffers to provide loans and accommodate. They’re saying that’s what they’re going to do. We have nothing to announce on direct lending.”

Companies have been drawing down billions from credit lines and other bank loans that act as a backstop to markets for short-term funding. They’re shoring up cash as the coronavirus pandemic brings parts of the economy to a halt.

“What we are dealing with is something more like a 9/11 event,” said Tad Rivelle, chief investment officer for fixed income at asset manager TCW Group Inc. “There is a general shutdown of economic activity in a lot of different places.”

Planemaker Boeing Co. drew down a $13.8 billion term loan, people familiar with the situation said last week. Casino operator Wynn Resorts Ltd. and aircraft lessor AerCap Holdings NV were among companies tapping into their credit lines, people with knowledge of those loans said. And private equity firms Blackstone Group Inc. and Carlyle Group Inc. advised some of the businesses they control to consider similar measures.

U.S. banks had a total of $2.5 trillion of credit commitments to companies that weren’t used at the end of 2019, according to the latest data from the Federal Deposit Insurance Corp. Regulatory filings show about 64% of those commitments had been made by the nation’s four biggest banks: JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co.

A number of lenders have been ringing up credit-focused investment firms and hedge funds in recent weeks seeking to drum up interest in providing financing to companies in industries upended by the coronavirus, according to people involved in the talks.

Yields on commercial paper surged last week as the virus continued its spread around the world, helping to send stock markets into a freefall and prompting the Fed to take measures to shore up debt market liquidity before its latest dramatic action.

Robert Sabatino, head of global liquidity investments at UBS Asset Management, said the market is probably going to need additional support that could lead the Fed to resurrect the “alphabet soup” of programs used during the financial crisis.

“The Fed has given bank balance sheets more breathing room by removing capital requirements and reducing the rate at the discount window but it doesn’t give me as a portfolio manager enough confidence to buy CP past overnight maturities,” he said in an email.

Read more about the Fed’s measures

TCW’s Rivelle said that commercial paper issued by Apple Inc. was recently quoted at a spread of 80 basis points to Treasury bills. In a normal market, that spread would be 5 basis points for 30-day or 60-day paper, he said.

Rates on three-month commercial paper for non-financial companies reached the highest level since the financial crisis relative to a funding benchmark known as overnight indexed swaps.

If the strains continue, more companies are likely to turn to their credit lines for cash, market watchers say.

“For some of these folks that normally would tap the commercial paper market for funding, they’re going to have to think about alternative funding sources,” said Teresa Ho, a short-term duration strategist at JPMorgan.

Commercial paper got its start in the late 1800s, when merchants would sell their promissory notes to dealers such as Marcus Goldman, who went on to found the legendary Wall Street firm Goldman Sachs Group Inc.

In the early 2000s, the financing flourished with the amount of such outstanding debt reaching $2.1 trillion in 2007. But the market screeched to a halt in 2008 as losses on risky U.S. mortgage bonds spread throughout the financial system. After the bankruptcy of securities firm Lehman Brothers that September, the $62.5 billion Reserve Primary Fund collapsed.

The Fed created the Commercial Paper Funding Facility in October 2008 to buy commercial paper from corporate issuers and restore confidence in the market.

Amid market reforms intended to prevent another money-fund blowup, outstanding commercial paper plunged below $1 trillion. But use of the market has increased again in recent years.

Peter Crane, president of money fund tracking firm Crane Data LLC, said that so far there are no signs of stress among money-market mutual funds or institutional cash management accounts. Because of changes since the 2008 crisis, the ability of money funds to contribute to a corporate cash crunch is much more limited, he said.

Money-market funds hold just 1.5% of non-financial commercial paper. “It’s a shadow of what it was back in 2007 and 2008,” he said.

The reforms, however, weren’t designed to contain an economic shock of this scale, BofA’s Cabana said.

Money-market funds, anticipating investor cash outflows, are trying to sell the paper in order to meet requirements for thick liquidity buffers that were implemented after the financial crisis to prevent runs, Cabana said. But dealers don’t have the capacity to take the debt onto their balance sheets, he said.

Several analysts said they still expect the Fed will need to intervene in the commercial paper market.

The launch of a special lending facility would require the Fed to consult with the Treasury secretary and to give Congress details on borrowers, amounts and collateral, according to laws put in place under the 2010 Dodd-Frank Act. The laws also prohibit the Fed from using such a facility to help a single company or a company that is insolvent.

“We do think some sort of facility along those lines is coming, it may just take more time to line up than the Fed was prepared for,” NatWest Markets strategists including John Briggs and Blake Gwinn said in a note Monday.

--With assistance from Craig Torres and Christopher Condon.

To contact the reporters on this story: Jenny Surane in New York at jsurane4@bloomberg.net;Paula Seligson in New York at pseligson@bloomberg.net;Alexandra Harris in New York at aharris48@bloomberg.net;Liz Capo McCormick in New York at emccormick7@bloomberg.net

To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net, ;Benjamin Purvis at bpurvis@bloomberg.net, ;Natalie Harrison at nharrison73@bloomberg.net, Shannon D. Harrington, Nikolaj Gammeltoft

©2020 Bloomberg L.P.