Crude’s Monster Meltdown in Three Charts

Here are three charts showing Monday’s wild market action

(Bloomberg) -- Crude crashed into negative territory for the first time ever, signaling the extreme disconnect between supply and demand as storage tanks brim to capacity and the coronavirus-led economic slowdown pushes demand to a standstill.

Here are three charts showing Monday’s wild market action:

Selling Frenzy

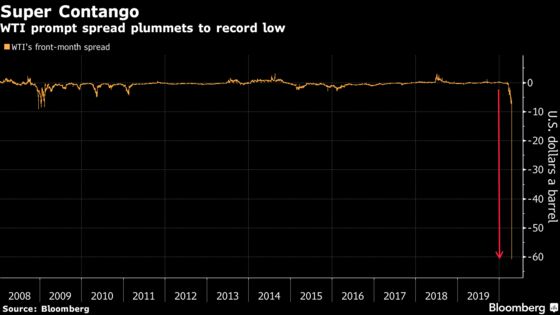

Take a look at the spread between West Texas Intermediate crude’s front-month contract and its second-month. The May contract closed at a more-than $50-a-barrel discount to the June contract, the biggest discount on record. The mega contango is partly due to traders rushing to sell the May contract ahead of its expiration on Tuesday, as the physically traded commodity converged with the financial pricing. It also underscores the concerns traders, producers and investors have over where to store crude oil that nobody wants as tanks fill up.

Wild Swings

With crude oil breaking down barrier after barrier on Monday -- below $10 a barrel, below zero and deep into the land of negative -- a measure of oil volatility skyrocketed to more than 400%. “Oil prices in our opinion have nowhere to go but lower from here on the June contract,” said Tariq Zahir, a commodity fund manager at Tyche Capital Advisors LLC. “Demand is not coming back anytime soon. We will have a massive glut to work off for months to come.”

Mega Moves

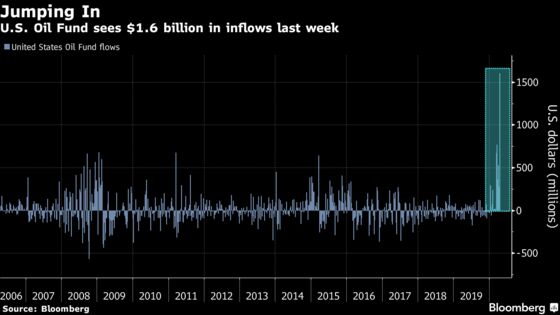

The market mayhem stirred up activity in the biggest exchange-traded fund tracking crude, the United States Oil Fund. After investors poured more than $1.6 billion into the fund last week -- betting on a bottom in crude oil that has yet to be found -- over $3 billion exchanged hands on Monday, the highest value traded on a daily basis since the fund’s inception.

©2020 Bloomberg L.P.