Corporate Bonds See Wild Swings as Bank Inventories Shrink

Corporate Bonds See Wild Swings as Bank Inventories Shrink

(Bloomberg) -- Wall Street dealers are increasingly reluctant to trade corporate bonds that they can’t immediately offload, and their hesitation has contributed to sharp moves in prices this year.

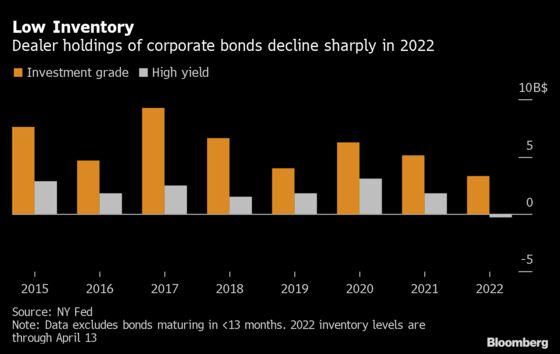

Banks’ reticence to buy company debt from investors is showing up in inventory data, which tallies the securities that firms hold on their books rather than sell quickly. Dealer inventories of high-grade corporate bonds averaged just $3.3 billion this year through April 13, according to data from the Federal Reserve Bank of New York. These figures have broadly been falling for years, but 2022 levels are nearly 50% below the 2015-2021 average.

For junk bonds, the shift is even more drastic, with the banks having sold more than they bought, a net short position that will be profitable if the market deteriorates further. Keeping a net short position for multiple weeks in high yield is unusual, and hasn’t happened since March and early April 2021.

The impact of low inventories has been clear: In March, Asian investors sought to buy more than $1 billion of bonds overnight, and dealers didn’t have enough securities on their books to handle the demand, according to Matt Brill, head of North American investment grade and senior portfolio manager at Invesco Ltd. That pushed risk premiums on high-grade corporate bonds about 10 basis points, or 0.1 percentage point, tighter in one day last month, he said, an unusually sharp move in a market where for much of last year, spreads moved 1 or 2 basis points a day.

“We’re seeing moves like that, that didn’t historically happen, where dealers would have had the balance sheet to supply the bonds,” Brill said.

One dealer confirmed seeing large moves in mid-March because of heavy demand from Asia. And it can work the other way too: when investors are looking to sell, corporate bond spreads can widen fast. On Dec. 31, spreads averaged 0.92 percentage point, and by mid-March they had jumped to 1.43 percentage point. That came as U.S. Treasury yields were spiking and inflation fears were rising, but tight dealer inventories may have also been a factor.

Money managers have been fretting about the potential for these kinds of steep moves for a decade, after the financial crisis spurred regulators to reshape financial markets to reduce the chances of big banks failing again. New rules have pressed systemically important banks to hold fewer risky securities. At the same time, the corporate bond market has essentially doubled in size in the U.S. as low rates have made it cheaper for companies to borrow. Investors feared that whenever the market weakened, large numbers of fund managers would look to sell their holdings, dealers would be unwilling to buy, other buyers would take time to emerge, and prices would plunge.

Extraordinary Support

Those fears proved prescient in March 2020, when the pandemic shut down large swaths of the economy and corporate bonds were clobbered. The Fed restored order to the market by offering extraordinary support, including buying securities when necessary.

But now the central bank is looking to tame inflation, and is less likely to help. Whether the market needs assistance now is debatable. Exchange-traded funds can make it easier for banks and other participants to get bonds quickly than they could two decades ago, by buying funds in the market and breaking them into their constitutent parts. Online trading venues can also make it easier for parties to quickly find buyers or sellers for any particular security.

“Dealers are facilitating trades, but not necessarily holding large inventories,” said Nicholas Elfner, co-head of research at Breckinridge Capital Advisors, an asset manager with around $42 billion under management. “Some of the electronic enhancements have allowed for that.”

The growth of ‘all-to-all’ platforms like those from MarketAxess Holdings Inc. and Tradeweb Markets Inc., where buyers and sellers of corporate debt can be matched up directly without a dealer, has allowed banks to carry fewer bonds, said Sean Savage, a market-structure analyst with Bloomberg Intelligence.

Getting Creative

But the downside of smaller dealer inventories is that, in addition to prices potentially moving steeply in short periods of time, buying and selling bonds has often become more difficult in recent years. A money manager that wants to trade may have to do more than just call a few banks.

“Especially in high yield, low dealer inventory has made it harder to execute trades. We’ve had to get creative to build positions, using other methods like portfolio trading and ETFs,” said Elaine Stokes, a portfolio manager and co-head of the full discretion team at Loomis Sayles & Co. Portfolio trading entails buying and selling large numbers of bonds in one go.

“Back when I was trading we used to joke that the dealers would just stop answering the phones, and there are days now that it almost feels that way,” Stokes said.

It makes sense for dealers to take less risk now. High-grade U.S. corporate bonds have lost 12% this year through Wednesday’s close, even after accounting for interest income, similar to the losses for U.S. equities. And for decades, even before the structure of the market changed, banks have been reluctant to buy when prices were dropping, because holding those securities results in an instant hit to earnings.

Prices have moved around much more than usual this year, and margins on trades haven’t risen much, said Yoni Gorelov, co-head of U.S. credit trading at Barclays Plc in New York. One of those two things needs to change for dealers to have incentive to take higher levels of inventory back on, he said.

“Executing on either side of the market has become difficult with the volatility we’ve seen, not just in credit but in rates as well,” Gorelov said. “We have brought the balance sheet down and I think we’re not alone in that strategy.”

Elsewhere in credit markets:

Americas

Two borrowers were in the high-grade bond market on Thursday, including a sustainability deal from American Express.

- Utility giant PG&E Corp. is wading into the bond market with a relatively rare type of offering -- $3 billion of so-called recovery bonds -- in a bid to recapture losses caused by the wildfires that ravaged California in 2017

- SLC Management, the fixed income and alternative asset manager of Sun Life Financial Inc., is turning to a mix of public and private debt strategies to lure investors looking to navigate global political and economic uncertainties

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Nine borrowers sold bonds on Thursday. They include Banco Santander, which priced a two-year FRN, and a 3 billion-euro ($3.2 billion) 10-year green bond from KfW. The weekly sales tally beat expectations of 59% of respondents to a Bloomberg News survey, who expected volume to stay below 20 billion euros-equivalent.

- Banks are preparing to offload 1.7 billion pounds ($2.13 billion) of debt to back online gambling operator 888 Holdings Plc’s acquisition of bookmaker William Hill Ltd.’s international assets

- Banca Generali SpA’s institutional clients are facing writedowns of about 15 million euros on structured notes linked to emerging-market debt

- Gucci owner Kering SA snapped the longest dry spell for Europe’s corporate debt sales since 2020, with May’s approach likely to prompt more activity before the end of market support

- The French luxury fashion group has attracted over 6.6 billion euros of demand for a 1.5 billion-euro bond offering, according to a person with knowledge of the sale

- The deal is set to boost the meager 6.53 billion euros of non-financial corporate issuance so far this month and it’s the first new investment-grade debt deal from a non-financial company since April 12, ending the longest barren run since August 2020

Asia

Asia’s primary dollar-bond market became livelier Thursday as risk appetite recovered slightly, with at least two borrowers marketing new debt following a lull in the previous session.

- Investor mood steadied after Beijing vowed to support a weakening economy with steps including boosting infrastructure building

- That has helped Chinese three-year AA rated onshore corporate bond spreads reach their narrowest level since October 2016

- Chinese firms’ 2022 defaults have been heavily skewed toward offshore bonds, a sharp reversal from prior years, according to data compiled by Bloomberg, with nearly every missed payment by a developerWall Street dealers are increasingly reluctant to trade corporate bonds that they can’t immediately offload, and their hesitance has contributed to sharp moves in prices this year.

©2022 Bloomberg L.P.