Chinese Stock Rally in U.S. Stalls on Growth, Delisting Concerns

Chinese Stock Rally in U.S. Stalls on Growth, Delisting Concerns

(Bloomberg) -- U.S.-listed Chinese stocks extended losses on Friday, as worries over the tech sector’s earnings and the risk of local firms being kicked off U.S. exchanges brought a halt to a recent revival.

The Nasdaq Golden Dragon China Index closed 4.7% lower, after falling 1.7% in the prior session. E-commerce giant Alibaba Group Holding Ltd. slid 1.9% on Friday, while internet peers JD.com, Baidu Inc. and Pinduoduo Inc. each dropped more than 1.5%.

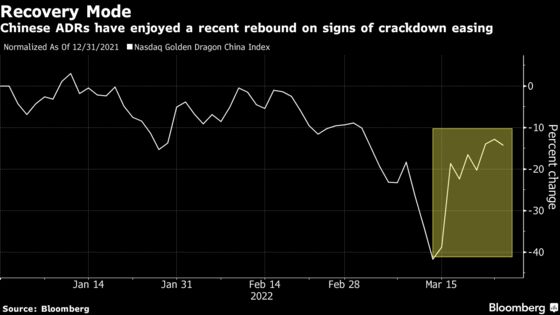

Chinese stocks are coming off a strong rally since the middle of March, with sentiment having been boosted by share buybacks and signs that Beijing’s regulatory crackdown on the sector is easing. The Nasdaq Golden Dragon China Index is up more than 40% since hitting an intraday low on March 15, though remains around 18% down year to date.

“There is a lot of confusion in the market about delistings,” said Jian Shi Cortesi, a portfolio manager at GAM Investment Management. “While Asia specialists have studied the impact in depth, many other investors are not clear how it may unfold.” Heightened concerns among U.S. allies about China’s relationship with Russia amid the Ukraine war is also worrying investors, she said.

Angst over the future of Chinese stocks on U.S. exchanges persists. On Thursday, the U.S. audit watchdog said speculation about a deal that would spare Chinese firms being removed from American stock exchanges was “premature.”

Meanwhile, earnings from peer Meituan on Friday showing a third straight quarter of slowing sales growth led to skepticism to its outlook, especially against a backdrop of rising U.S. interest rates. Meituan’s american depositary receipts dropped 0.4% after falling as much as 7% during the day.

Elsewhere, Chinese electric vehicle manufacturer Nio Inc. sank 9.4%, after it reported worse-than-expected results amid mounting industry supply chain pressures, while its peers Xpeng Inc. and Li Auto Inc. declined 7.6% and 5.2% respectively.

Some are still optimistic. Profit-taking was likely also a factor in today’s market action considering the significant move in growth and tech stocks over the last week and a half, according to a note by Brendan Ahern, chief investment officer at Krane Funds Advisors. This pullback should bring more buyers in from the sidelines, he said.

©2022 Bloomberg L.P.