Cash Keeps Flowing Into ESG While Markets Tank

Cash Keeps Flowing Into ESG While Markets Tank

(Bloomberg) --

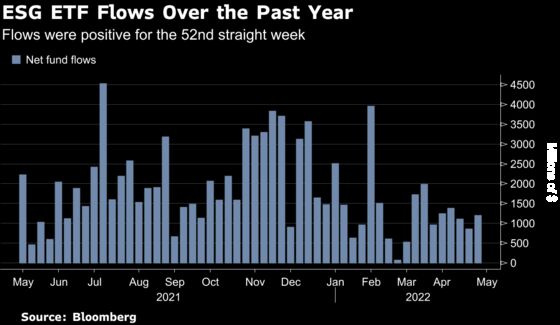

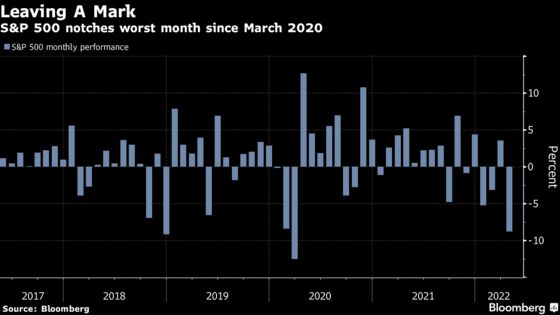

Even with the worst April slump in the S&P 500 since 1970, money keeps pouring into ESG-labeled funds at a seemingly unrelenting pace.

More than $1.2 billion went into ESG-focused exchange-traded funds last week as the S&P 500 dropped 3.8%, bringing the index’s full-month decline to 8.8% on concerns about inflation, rising interest rates and Russia’s war on Ukraine.

So far this year, ESG funds have attracted more than $22 billion, including almost $5 billion for U.S. offerings led by BlackRock Inc.-managed funds, according to data compiled by Bloomberg.

Looking at these inflow numbers, one would think the broader market was doing just fine.

It’s especially surprising given that the U.S. funds which follow environmental, social and governance investment principles have fallen as much as the S&P 500 this year: they’re down 13% as of April 29. The largest ESG fund—BlackRock’s $23.5 billion iShares ESG Aware MSCI USA ETF—has dropped 14.5%.

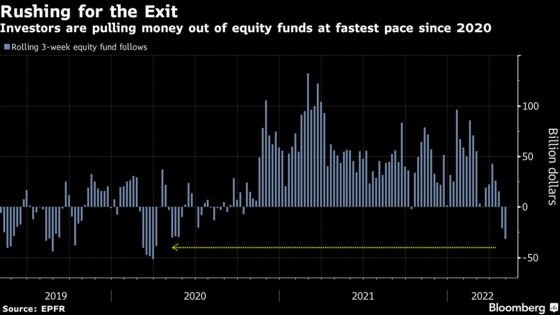

While ESG funds nevertheless keep posting inflows, equity funds suffered net redemptions for three straight weeks through April 27, the longest streak of withdrawals since August 2020, data compiled by EPFR Global show. Over those three weeks, $32 billion was pulled out. In the first three months of 2022, stock funds took in almost $200 billion.

But there may be an explanation for this dissonance, and it’s not good news for ESG investors. Bloomberg Intelligence analysts Shaheen Contractor and Athanasios Psarofagis issued a report last week noting that the assets of ESG-related ETFs posted “a rare decline” in the first quarter, and that they “think a slowdown after record growth could be prolonged, at least in the U.S., as ESG returns continue to face challenges.”

While inflows are likely to continue for now, the biggest problem is that asset gains are “being driven by large one-off allocations by institutional investors rather than organic growth,” the analysts wrote. “A wider investor base will be needed to sustain growth.”

Especially given the market outlook about inflation and Russia’s war, it will be surprising if ESG is able to keep expanding. The heads of America’s biggest banks certainly didn’t paint a rosy macro picture when their companies reported first-quarter results last month.

The crisis in Europe has created geopolitical uncertainty that's likely to outlast the war itself, Goldman Sachs Group Inc. Chief Executive Officer David Solomon said during his bank’s earnings call. And JPMorgan Chase & Co. CEO Jamie Dimon said there are “storm clouds on the horizon that may disappear.”

Or not. “I hope those things all disappear and go away,” so “we have a soft landing and the war is resolved,” Dimon said. “I just wouldn’t bet on all that.”

Bloomberg Green publishes Good Business every week, providing unique insights on ESG and climate-conscious investing.

©2022 Bloomberg L.P.