BofA Clients With $561 Billion Say Bitcoin Is Most Crowded Trade

BofA Clients With $561 Billion Say Bitcoin Is Most Crowded Trade

(Bloomberg) -- For the first time since 2017, Bank of America Corp. clients with $561 billion combined say Bitcoin is the world’s most crowded trade as speculative euphoria hits Wall Street.

Investors surveyed by the investment bank this month see signs that long positions in the largest digital currency are reaching unprecedented levels, while retail traders and institutional names join the crypto boom.

The BofA poll doesn’t necessarily mean that more fund managers own Bitcoin. But it’s another temperature check on the token’s 400% rally over the past year that’s dividing some of the biggest names in finance.

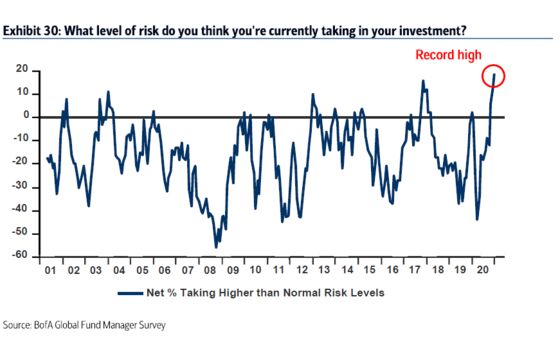

The survey also shows investor positioning is booming across reflation strategies from small caps and value companies to emerging markets. Stock allocations have spiked to the highest level in three years as conviction on an early-cycle economy rises to the highest in more than a decade.

With BofA clients the most optimistic on profit expansion since 2002, “extremely bullish” sentiment raises the risk that a market correction is “imminent,” strategists led by Michael Hartnett wrote in a report Tuesday.

With 73% of investors projecting the global economy is in the throes of an early-cycle expansion -- the most since 2010 -- investors are wagering on companies tied to the economic cycle even as fresh lockdowns and valuation risks bite. U.S. fiscal stimulus and vaccine hopes are also spurring a record number of traders to brace for a steeper yield curve and higher inflation.

As Joe Biden takes over the White House this week, surveyed managers say healthcare is set to be his top priority in the first 100 days, followed by efforts to address the infrastructure deficit and inequality. They also said that higher taxes are coming to redress historic debt levels.

Other highlights from the survey conducted Jan. 8 to 14 include:

- Investors in January boosted allocation to energy, materials, banks, small caps, emerging markets and rotated out of healthcare, tech, U.S. stocks

- Cash allocation fell to 3.9% from 4%, a sell signal to BofA

- Biggest tail risks are Covid-19 vaccine rollout, followed by a “tantrum” in the bond market and a bubble on Wall Street

- Share of investors saying companies are over-leveraged fell 2 percentage points to 39%

- Investor allocation to bonds fell 3 percentage points to net 59% underweight, lowest since March 2018

- Allocation to U.S. stocks fell 11 percentage points to net 4% overweight, while exposure to euro-area stocks increased 4 percentage points to net 29% overweight

- Exposure to EM stocks increased 7 percentage points to a net 62% overweight, making it the most preferred region and highest overweight for EM on record

- Allocation to U.K. stocks rose 3 percentage points to 15% underweight, remaining the biggest regional underweight

©2021 Bloomberg L.P.