U.S. Payrolls Fall 701,000 in March Ahead of Surge in Layoffs

Payrolls fell 701,000 from the prior month -- compared with the median forecast of economists for a 100,000 decline.

(Bloomberg) -- U.S. employment plummeted last month by a degree not seen since the last recession, in just an early glimpse of the devastation from the coronavirus pandemic.

Payrolls fell 701,000 from the prior month -- compared with the median forecast of economists for a 100,000 decline -- according to Labor Department data Friday that mainly covered the early part of March, before government-mandated shutdowns forced firms to lay off millions more workers. This was the first decline in monthly payrolls since 2010.

The jobless rate jumped to 4.4% -- the highest since 2017 -- from a half-century low of 3.5%, and is expected to surge in the coming months. Bloomberg Economics sees the rate rising to 15% soon, while Federal Reserve Bank of St. Louis President James Bullard said it may hit 30% this quarter.

Click here for a transcript of Bloomberg’s TOPLive blog on the jobs report.

The numbers are already outdated. Because the reference period for the jobs report is based on the 12th of the month, it didn’t capture the vast majority of the nearly 10 million people who have filed for unemployment benefits in the last two weeks alone.

Such projections are a dramatic shift from just a month ago, when job gains topped 200,000 and employers were having so much difficulty finding qualified workers that they were hiring previously marginalized populations such as people with criminal records. President Donald Trump has frequently touted strong employment figures as he runs for re-election this year.

But in the last few weeks, the disease known as Covid-19 has rapidly spread across the U.S., killing thousands and leading an increasing number of states to encourage or order their citizens to stay home.

“The abruptness with which the economy has taken this step down is so striking,” FS Investments Inc. Chief U.S. Economist Lara Rhame said on Bloomberg Television. “It’s like a hurricane but hitting the entire country at the exact same time.”

What Bloomberg’s Economists Say

“Workers who were paid for just a few hours during the early part of the month were still counted as a nonfarm payroll, so the March data are only an early snapshot illustrating the start of unprecedented job losses -- in terms of both speed and magnitude -- in the economy. April job losses will be at least 30 times larger, in the vicinity of 20 million. Unemployment will soar toward 15% next month.”

-- Carl Riccadonna, Yelena Shulyatyeva and Andrew Husby

Click here for the full note.

Treasury yields and U.S. stocks were lower Friday following the report. The Bloomberg dollar index held gains.

Congress and the Trump administration are trying to help individuals and small businesses rocked by the economic shutdown, with a loan program for small firms getting off the the ground Friday and direct checks en route to many households in coming weeks.

But the program that provides up to $350 billion in aid to small businesses, aimed at preventing further layoffs, has been mired with website glitches and a lack of communication with lenders. Additionally, some of the $1,200 checks meant to soften the economic toll on Americans may not arrive until September.

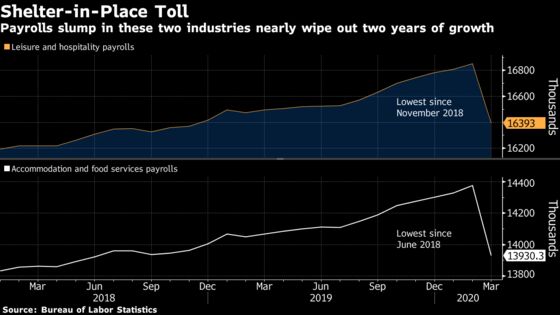

Employment in leisure and hospitality was hit particularly hard, falling by 459,000 in March, nearly wiping out two years of job gains. The losses were mainly in food services and drinking places. Private payrolls overall dropped by 713,000.

Average hourly earnings rose 0.4% from the prior month and were up 3.1% from a year earlier, both above estimates -- and potentially due to the removal of low-wage workers from the ranks of the employed.

The Bureau of Labor Statistics said the unemployment rate would have been almost 1 percentage point higher if workers who were recorded as employed but absent from work due to “other reasons,” were classified as unemployed on temporary layoff. The BLS said that this discrepancy might result from respondents misunderstanding a survey question.

“The jobs report was extremely weak, sending an ominous signal of what is to come,” said Michelle Meyer, head of U.S. economics at Bank of America Corp. “Not only were the numbers terrible but the BLS noted that they could have been worse.”

In addition, the figures may be less reliable than usual because survey response rates were significantly below typical levels from both households and businesses.

The Labor Department said in a special note that “It is important to keep in mind that the March survey reference periods for both surveys predated many coronavirus-related business and school closures in the second half of the month.”

A separate report Friday from the Institute for Supply Management showed measures of business activity and employment at U.S. services firms contracted in March, an abrupt reversal from solid growth the previous month.

Other Details

- The average work week fell to 34.2 hours, the lowest since 2011, in a sign companies began pulling back before laying off workers. Temporary workers fell by 49,500, the largest decline since 2009; retail jobs fell by 46,200.

- The initial wave of layoffs hit Hispanic and Asian Americans harder, with their unemployment rates each jumping 1.6 percentage points to 6% and 4.1%, respectively. The white jobless rate rose 0.9 point to 4%, and it was up 0.9 point to 6.7% for black Americans.

- Government jobs rose by 12,000, with a 17,000 rise in temporary jobs tied to the decennial census count.

- The number of people classified as unemployed on temporary layoff totaled 1.85 million, up from 801,000 in February, for the biggest one-month increase in records going back to the 1960s.

©2020 Bloomberg L.P.