U.S. Tags Switzerland Currency Manipulator, Keeps China on Watch

India, Thailand and Taiwan were added to the U.S. Treasury Department's “monitoring list” for even closer monitoring.

(Bloomberg) -- The U.S. Treasury Department designated Switzerland and Vietnam as currency manipulators for the first time, while keeping China on a watch list, in the Trump administration’s final foreign-exchange policy report.

Having removed the manipulator label from China in January, the Treasury urged the world’s second-largest economy to “improve transparency” in its currency management, especially of its central bank’s relationship with state-owned banks -- which market participants say can act in the currency market with official guidance.

The manipulator designation has no specific or immediate consequence, beyond short-term market impacts. But the law requires the administration to engage with the countries to address the perceived exchange-rate imbalance. Penalties, including exclusion from U.S. government contracts, could be applied after a year unless the label were removed.

“The objective of designating some countries manipulators seems to be to gain leverage in trade negotiations,” Steve Englander, head of global G-10 FX research at Standard Chartered Bank, said in a note, adding that the immediate impacts are limited. “Bigger consequences would emerge if the Commerce Department used currency undervaluation findings to initiate countervailing duties against industries benefiting from the undervaluation.”

Thailand, Taiwan and India were added to the agency’s watch list, which also includes Japan, Korea, Germany, Italy, Singapore and Malaysia.

| U.S. Manipulation Criteria |

|---|

|

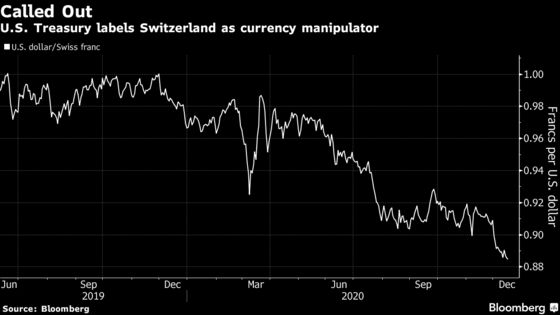

The Swiss National Bank denied the charge while pledging to continue its currency intervention to keep the franc from strengthening too much. Vietnam likewise rejected the tag, reiterating that its exchange-rate management wasn’t creating an unfair competitive advantage.

Switzerland and Vietnam each met all three of the criteria the Treasury uses to make its assessments. Trading partners that meet two criteria are placed on the watch list, although China meets just one. The U.S. has previously put the manipulation designation on China twice, in the 1990s and last year.

“Treasury will follow up on its findings with respect to Vietnam and Switzerland to work toward eliminating practices that create unfair advantages for foreign competitors,” Treasury Secretary Steven Mnuchin said in a statement.

Janet Yellen, who if confirmed will be President-elect Joe Biden’s Treasury secretary, has previously indicated a more understanding view of monetary policy decisions that have consequences for exchange rates. In 2019, she said: “It’s really difficult and treacherous to define when a country is gaming its currency to gain trade advantages.”

A Biden transition spokesperson declined to comment on the Treasury’s report, which scrutinizes the currency practices of 20 major trading partners for potential manipulation over the four quarters through June.

Switzerland

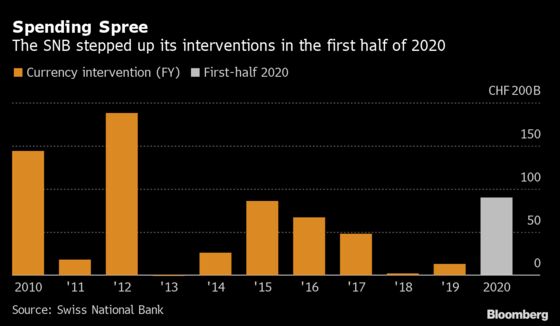

Switzerland was judged to have intervened in the currency market by more than was necessary to address financial-market volatility earlier this year.

“Switzerland does not engage in any form of currency manipulation,” the Swiss National Bank said as it sought to assure markets that it would continue to fight a strong franc to combat deflationary risks. The release came a day before the SNB’s next monetary policy decision, due Thursday at 9:30 a.m. Zurich time.

Some investors agreed with the Treasury’s assessment of Swiss policy.

“Switzerland deserves it as they are printing massive amounts of money and then buying U.S. stocks, among others,” Peter Boockvar, chief investment officer for Bleakley Advisory Group, wrote in a note.

While the Swiss franc rose -- by more than 3% against the dollar over the 12 months through June -- the Treasury said that authorities “conducted large-scale one-sided intervention, significantly larger than in previous periods, to resist appreciation.”

The Treasury concluded that at least some of the Swiss intervention “was for purposes of preventing effective balance of payments adjustments.” The agency suggested the Swiss National Bank look at “domestic quantitative easing” to help balance its monetary policy mix.

The SNB turned to intervention years ago because the local bond market is too small for quantitative easing. Officials have also said that in a small, trade-reliant economy money spent on fiscal stimulus will likely just flow abroad rather than boost domestic consumption.

A senior Treasury official acknowledged that explanation, while indicating that the magnitude of Swiss intervention remains a key problem for the U.S. The official briefed reporters early Wednesday on the condition of anonymity.

The International Monetary Fund last year approved Switzerland’s policy of negative interest rates and interventions.

Vietnam

Vietnam also ran afoul for restraining currency appreciation at a time of rising trade surpluses with the U.S.

Noting the rapid rise of Vietnam’s trade surplus with the U.S., the Treasury called for the Southeast Asian country to allow its managed currency to appreciate more rapidly to help address external imbalances.

Vietnam’s central bank responded Thursday that it doesn’t use its exchange rate “to create an unfair competitive advantage in international trade.”

The nation’s “exchange rate management in recent years is within its general framework of monetary policy and aims to achieve the consistent goal of controlling inflation, stabilizing macro-economy” and does not create an unfair competitive advantage for the nation, the State Bank of Vietnam said.

The trade surplus with the U.S. and its current account surplus are the result of a range of factors related to the peculiarities of the Vietnamese economy, it said.

The VanEck Vectors Vietnam ETF climbed 0.4% on Wednesday, signaling investors so far are unruffled by the Treasury’s move.

The Treasury said Vietnamese authorities reported to the U.S. that they had made net purchases of foreign exchange of $16.8 billion over the four quarters through June, equivalent to 5.1% of gross domestic product. The agency called for greater transparency in managing the dong, and the modernization of monetary tools so the country can rely less on currency intervention.

Vietnam should also reduce trade barriers to allow a level playing field for American firms and workers, the Treasury said.

China

For China, the Trump administration’s swift removal of its manipulator label just months after its August 2019 designation -- in a move days before signing a bilateral trade deal in January -- suggested a political element to the labeling. That could mean a different evaluation next year for Switzerland and Vietnam.

“I don’t think Yellen will be too vocal about the monetary policy side of things,” said Bilal Hafeez, CEO of Macro Hive and former head of G10 foreign-exchange and rates strategy at Nomura Holdings Inc.

Taiwan’s central bank said Thursday that the U.S. has never pressured it too much on its currency and blamed the trade war with the China for expanding its trade surplus.

Bank of Thailand said it has no policy to intervene in the currency market to gain a trade benefit. The nation, however, has said it’s been seeking to tame an excessive rally in the baht to protect exports, including intervening regularly in the FX market.

The Reserve Bank of India didn’t immediately respond to a request for comment.

A series of penalties may apply to a trading partner that continues to be labeled as a manipulator after a year of talks, including reconsideration of any ongoing trade negotiations. Along with potential exclusion from U.S. government procurement contracts, the administration of the day could cut off new financing from the Overseas Private Investment Corp. -- a U.S. government agency that helps development projects -- and press the International Monetary Fund to strengthen its surveillance of the country’s exchange-rate policies.

©2020 Bloomberg L.P.