Putin Is Having Easier Crisis This Time Thanks to Oil, Reserves

Russian policy makers weren’t caught off guard when President Vladimir Putin unleashed his military on Ukraine.

(Bloomberg) -- Russian policy makers weren’t caught off guard when President Vladimir Putin unleashed his military on Ukraine.

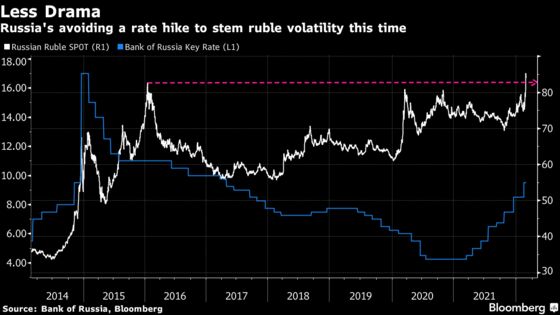

In stark contrast to Putin’s first invasion eight years ago, the central bank took Russia’s pre-dawn attack in stride this week, holding off from an interest-rate increase while extending more liquidity to lenders -- alongside words of assurance that it’s ready to provide more support after western sanctions.

“The central bank and the government have evidently been preparing for tougher sanctions, so that’s why the reaction now was quick and appropriate,” said Olga Belenkaya, an economist at Finam in Moscow.

The Bank of Russia was only the latest to telegraph preparedness in the shadow of what could be Europe’s largest military clash since the Second World War.

When Putin gathered his top officials for a staged event to discuss whether to recognize Ukrainian separatists earlier this week, Prime Minister Mikhail Mishustin said his government had spent months preparing for the decision and the West’s likely response.

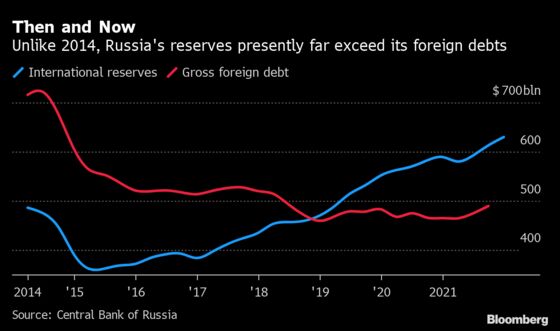

The Economy Ministry chimed in on Friday. It boasted that Russia’s economy is now “more stable” than in 2014 thanks to policies that helped lower sovereign debt while building up international reserves. Having adapted to earlier pressure from sanctions, it said, Russia will look to deepen trade and ties with other countries including in Asia and among its post-Soviet neighbors.

A rate hike is now more of a “last resort” option, according to Anton Tabakh, chief economist at Moscow-based credit assessor Expert RA. By contrast, the central bank delivered one on the first working day after Russia’s parliament approved the use of its military in Ukraine in March 2014.

“Clearly security agencies weren’t the only ones to have immediate plans,” Tabakh said.

Already led by Governor Elvira Nabiullina eight years ago, the central bank had to learn crisis management on the fly the last time geopolitics eclipsed all else.

It spent about $80 billion on defending the ruble before shifting to a free-floating exchange rate ahead of schedule. Speculation was rife that even capital controls were a possibility years after they were dismantled under Putin -- though that never came to pass.

A series of rate hikes that year culminated in the biggest increase since Russia’s 1998 default, a decision -- announced in the middle of the night in Moscow -- that raised the benchmark to 17% from 10.5%.

| Read more about Russia and the conflict in Ukraine: |

|---|

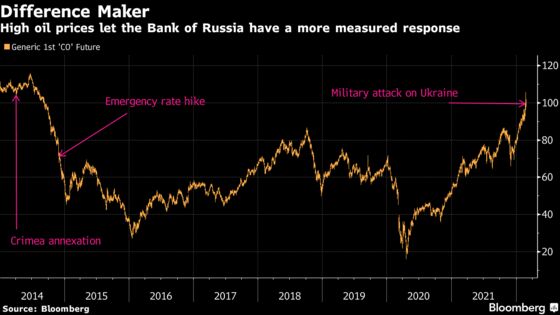

The differences are many between then and now, and they go beyond the sheer planning and execution. While the price of oil stayed above $100 a barrel for much of 2014, it began to plummet from June and ended the year at around half that level.

“It was a new experience for the government and the central bank,” Belenkaya said. “In addition, the sharp drop in oil prices aggravated the situation.”

In the years since then, the central bank has built up its financial reserves to over $600 billion, nearly a third more than it had eight years ago. Russia also developed a domestic payments system and steadily reduced reliance on foreign currency. State lenders now dominate the banking industry to a far greater degree.

Russia’s invasion has also spooked a global oil market that was already perilously tight because of the inability of supply to keep up with the demand recovery from the pandemic. Oil reached a seven-year high on Thursday, rallying above $105, before retreating.

But the calculus for Russia could change, especially if the standoff drags on or escalates. More sanctions may also be in the offing.

The penalties so far included carve-outs for energy payments, a crucial source of revenue for Moscow, and held off from barring Russia from the SWIFT international banking network.

For now, at least, Russia may have enough to wait it out.

“It will be necessary to adapt to much more serious problems that are less monetary in nature and have more to do with the disruption of financial and economic ties as well as logistical and technological chains,” Belenkaya said.

©2022 Bloomberg L.P.