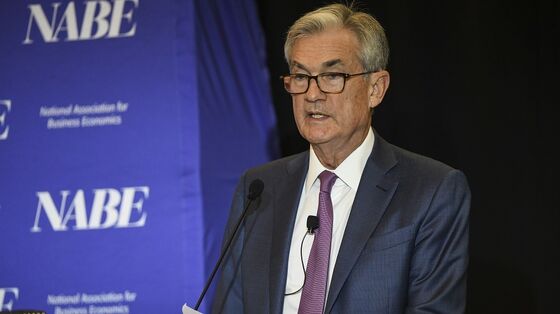

Powell Is Ready to Back Half-Point Hike in May If Necessary

Federal Reserve Chair Jerome Powell said the central bank will take the “necessary steps” to get inflation down.

(Bloomberg) -- Federal Reserve Chair Jerome Powell said the central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed, deploying a more aggressive tone toward curbing inflation than he used just a few days earlier.

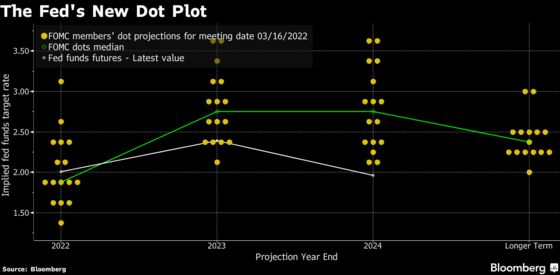

Policy makers raised the benchmark lending rate by a quarter point at their meeting last week -- ending two years of near-zero borrowing costs -- and signaled six more hikes of that magnitude this year, based on the median projection. Powell indicated that half-point hikes may be on the table when policy makers next gather May 3-4 and at subsequent sessions.

“If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so,” Powell said in a speech titled “Restoring Price Stability” to the National Association for Business Economics on Monday.

Following his formal remarks, Powell was asked by the moderator if there was anything stopping policy makers from hiking by a half point in May, which would be the first increase of that magnitude since 2000.

“What would prevent us? Nothing: Executive summary,” he said, drawing laughs from the audience. He added that such a decision had not been made, but acknowledged it was possible if warranted by incoming data.

“My colleagues and I may well reach the conclusion that we’ll need to move more quickly and if so we will do so,” he said.

Powell was more hawkish on Monday than at the press conference following last week’s meeting, indicating that if inflation continues to run hot he would favor a more aggressive pace of tightening. Last week he had to speak for the range of views among the 16 policy makers currently on the Federal Open market Committee.

Markets heard the chair’s message and moved sharply in response, sending Treasury yields spiking higher as investors increased bets that the Fed will raise interest rates by a half point in May to confront the hottest inflation in 40 years.

Goldman Sachs Group Inc.’s economists led by Jan Hatzius saw the comments as a hawkish signal and now expect the Fed to raise interest rates by 50 basis points at both its May and June policy meetings, followed by four 25 basis point increases in the second half of the year.

“He doesn’t want to preside over another episode where they were too slow to act,” said Derek Tang, an economist at L.H. Meyer in Washington. “He is trying to get ahead of things. We were leaning toward a half-point hike in June, but this speech could move it to May.”

The rate is anticipated to reach 2.8% in 2023, beyond the so-called neutral rate of about 2.4% that neither speeds up nor slows down economic activity.

“And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well,” Powell said.

The Fed chief -- who reiterated and elaborated on many of his key comments from last week’s press conference -- said Russia’s invasion of Ukraine is aggravating inflation pressures by boosting prices on food, energy, and other commodities “at a time of already too high inflation.”

He said central banks typically look through event-driven commodity price shocks. But this time won’t necessarily be typical.

“The risk is rising that an extended period of high inflation could push longer-term expectations uncomfortably higher, which underscores the need for the committee to move expeditiously as I have described,” he said.

Inflation Risk

The comments suggest that Powell sees even higher inflation as a greater risk to the economy than any near-term slowdown resulting from consumption due to fuel costs and rising uncertainty.

Powell described the economy as “very strong” and well positioned to handle higher interest rates. Fed officials last week forecast economic growth of 2.8% this year, but Russia’s invasion of Ukraine has thrown new risk into their outlook.

Discussions on when and how quickly to start winding down their $8.9 trillion balance sheet are still ongoing, policy makers say, but a decision is expected soon. On that topic, Powell reiterated a comment from last week’s press conference, saying that action to reduce the balance sheet “could come as soon as our next meeting in May, though that is not a decision that we have made.”

The Fed chair said policy makers are now no longer assuming significant relief on supply-chain issues and will be looking for “actual progress” on inflation to guide interest rate decisions.

Despite the aggressive tone of Powell’s remarks, he said he remained optimistic about soft-landing the economy to some sustainable growth rate.

‘Common’ Occurrence

“Soft, or at least soft-ish, landings have been relatively common in U.S. monetary history,” he said. “I hasten to add that no one expects that bringing about a soft landing will be straightforward in the current context—very little is straightforward in the current context.”

“What he is saying is, ‘I am perfectly willing to take the risk of rolling over the economy to bring inflation down,’” said Roberto Perli, head of global policy research at Piper Sandler & Co. “His job is made easier in that all the political pressure is in favor of raising interest rates.”

©2022 Bloomberg L.P.