Philippines Watching U.S. on Rate Move, Finance Chief Says

Philippines Must Grow Over 6% to Cut Debt, Finance Chief Says

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Philippines is watching the pace of the Federal Reserve’s monetary policy normalization as it weighs the timing of its own interest-rate move, according to the nation’s finance chief and a central bank rate-setter.

“We don’t want to be behind the eight ball here,” Finance Secretary Carlos Dominguez said in an interview with Bloomberg Television’s Kathleen Hays. “If the U.S. raises their interest rates, people in the Philippines will of course want to follow those rates,” while balancing the needs of growth, inflation and capital preservation.

The Philippines is among a clutch of Asian nations that have stood pat on rates to support the recovery of their economies from the pandemic, even as global peers led by the Fed have moved to tightening to combat surging inflation. Dominguez, also a government nominee on Bangko Sentral ng Pilipinas’ monetary board, is set to vote on two more policy decisions before leaving office on June 30 when President Rodrigo Duterte’s six-year term ends.

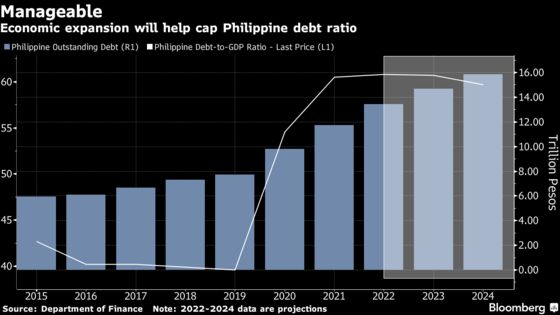

Dominguez also underlined the need for fostering annual growth rates of more than 6% in the next five to six years to help the nation pare debt taken on to fight the pandemic’s fallout.

The country’s debt-to-gross domestic product ratio rose to 60.5% in 2021 from 54.6% in the previous year and 39.6% in 2019. Fitch Ratings earlier this year affirmed the sovereign’s rating at the second-lowest investment grade, while putting it on watch for a downgrade citing uncertain growth prospects and challenges to reducing government debt.

“The next administration would have to design policies and stick to very strict fiscal discipline to grow out of these debt problems,” Dominguez said.

The pandemic disrupted consumption and business activity, which in turn crimped tax revenue and pushed the Southeast Asian nation to rely more on debt to fund spending plans. While Dominguez recently said he’s readying a fiscal consolidation plan for the new government, analysts at Barclays Plc to Fitch see the presidential election in May leading to policy continuity.

The Philippines targets a growth rate of 7%-9% this year as consumption starts returning to pre-pandemic levels. The government extended the least stringent movement curbs through end-April in metropolitan Manila, which accounts for a third of the nation’s economic output.

Here are some more excerpts from the interview:

- The Philippine economy might expand less than target in a year’s time, Dominguez said, citing the impact of Russia’s war in Ukraine

- The peso’s depreciation is within “manageable limits,” he said

- Dominguez said the government is studying what more can be done and “definitely pushing harder” to collect the estate tax owed by the family of late dictator Ferdinand Marcos whose son, Bongbong, is running for president

©2022 Bloomberg L.P.