Oil Posts Weekly Loss as Jobs Surge Can’t Banish Economic Worry

Oil set for biggest weekly decline since May as global demand concerns outweighed an OPEC+ pact to extend supply curbs into 2020.

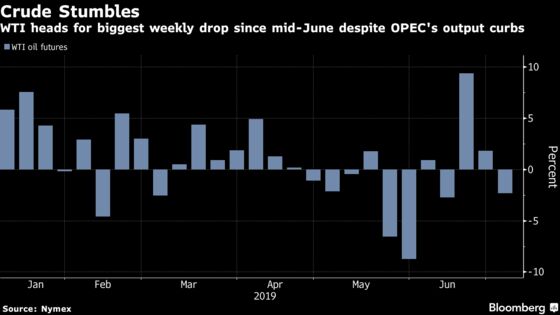

(Bloomberg) -- Oil posted its first weekly loss since mid-June, as a forecast-topping U.S. employment report wasn’t enough to offset the economic worries dogging the market.

Futures in New York closed down 1.6% for the week, despite eking out an increase Friday after the government said payrolls climbed by 224,000 in June. The ultimate fallout from the report was unclear as investors fretted that labor-market strength would decrease the odds of a Federal Reserve rate cut. The dollar surged, adding to pressure on commodities sold in the U.S. currency.

German factory orders on Friday added to a spate of sluggish manufacturing data from around the globe. That overshadowed this week’s decision by OPEC and its allies to extend supply curbs and the seizure of a tanker carrying Iranian crude by British special forces on Thursday.

“From a demand standpoint, the question is will the Fed save the day” or “are we too far gone?” said Tyler Richey, co-editor at Sevens Report Research in Florida. “What economic data begins to show in the next few weeks and months is going to be the most important thing to watch.”

Oil slumped on Tuesday in its worst decline following a meeting by the Organization of Petroleum Exporting Countries in four years. While the cartel is struggling to boost prices, its voluntary production limits are also leaving the door open for U.S. shale producers to grab more market share, according to Goldman Sachs Group Inc. American crude output resumed gains last week.

West Texas Intermediate oil for August delivery gained 17 cents, or 0.3%, on the day, closing at $57.51 a barrel on the New York Mercantile Exchange. There was no settlement Thursday due to a holiday in the U.S., so all transactions were booked on Friday.

Brent for September rose 1.5% to $64.23 a barrel on the ICE Futures Europe Exchange. It was down 3.5% for the week.

Prices have also lost support from a tight physical crude market, which has pushed up global refining margins in the last few days after a lackluster May and June.

“If the state of the economy does not improve, demand alone is not likely to be able to slice potentially growing inventories,” Michael Poulsen, an analyst at Global Risk Management Ltd A/S, wrote in a report. “The Middle East tensions are also potentially bullish for oil prices and any new development in the area could spur fears of oil disruptions.”

| Other oil-market news: |

|---|

|

--With assistance from James Thornhill and Heesu Lee.

To contact the reporters on this story: Alex Nussbaum in New York at anussbaum1@bloomberg.net;Alex Longley in London at alongley@bloomberg.net

To contact the editors responsible for this story: David Marino at dmarino4@bloomberg.net, Carlos Caminada

©2019 Bloomberg L.P.