More Joy for Emerging Markets Now Hinges on Fed, Survey Shows

The outlook for emerging markets is looking just a little brighter through the rest of the year.

(Bloomberg) -- The outlook for emerging markets is looking just a little brighter through the rest of the year, but it’s largely because central banks are sucking the allure out of the biggest economies.

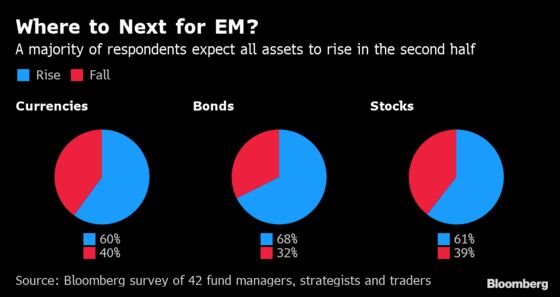

That’s the main finding of Bloomberg’s quarterly survey of 42 global fund managers, strategists and traders on their outlook for developing markets. Currencies, bonds and stocks will advance amid a hunt for yield thanks to easier monetary policy, the poll showed. Indonesian and Russian currencies and bonds were among top picks alongside Chinese and Brazilian equities, while Turkish and Argentinian securities were least favored.

“Things have improved slightly for emerging markets as we now have the support of a dovish Fed along with other major central banks,” said Hironori Sannami, an emerging-market currency trader at Mizuho Bank Ltd. in Tokyo. “With the worst being avoided in the U.S.-China trade war for now, higher-yielding assets are probably going to see demand.”

Stimulus efforts by the biggest central banks are so key for the coming quarter that what the Federal Reserve does next has surpassed the growth outlook as the main obsession for investors, the survey showed. That’s not to say the trade war isn’t still a major driver, despite the truce reached between Presidents Donald Trump and Xi Jinping at the G-20 summit in June.

The MSCI Emerging Markets Index of stocks has extended gains after posting a 9.2% increase in the first half of this year, while a gauge of developing-market currencies has made little headway after rising 2.2% during the same period.

Below are the results of the June 18-26 survey. Click here for the previous survey.

Survey Results

As the search for yield continues, emerging markets are expected to outperform their developed counterparts.

Asia remained the most favored region for currencies and stocks, while EMEA slipped to last position across all asset classes.

Russian currency and bonds moved up from the previous survey, while China kept its top position for stocks.

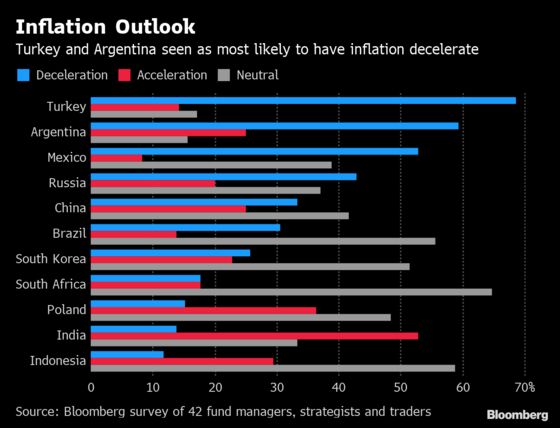

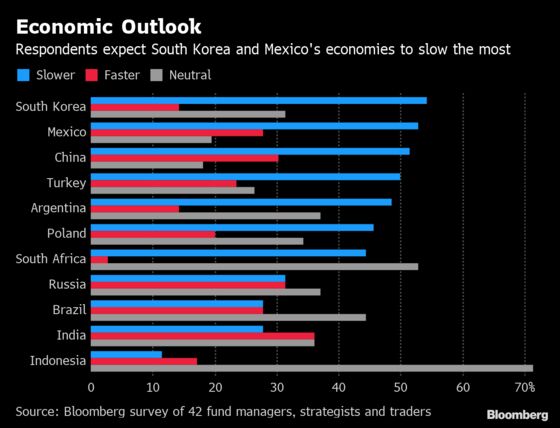

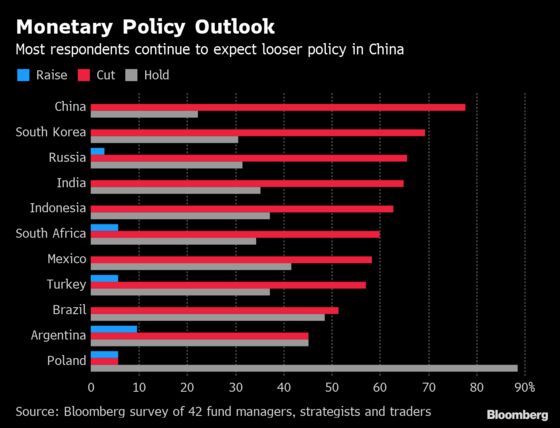

Finally, here is the outlook for inflation, growth and monetary policy across 11 emerging markets:

The survey participants:

- AllianceBernstein LP

- Amundi Asset Management

- Asset Management One Co.

- Banco Bilbao Vizcaya Argentaria SA

- Blackfriars Asset Management

- BNP Paribas Asset Management

- CIMB Group Holdings Bhd.

- Commerzbank AG

- DBS Group Holdings Ltd.

- Deltec Asset Management LLC

- DuPont Capital Management

- Eastspring Investments Ltd.

- Federated Investors Inc.

- Fujitomi Co.

- GW&K Investment Management

- Informa Global Markets

- J O Hambro Capital Management Ltd.

- Krung Thai Bank Pcl

- Lazard Asset Management

- Legal & General Investment Management

- Manulife Asset Management

- Mirabaud Asset Management Ltd.

- Mizuho Bank Ltd.

- Mizuho Research Institute Ltd.

- Neuberger Berman Group LLC

- Nissay Asset Management Corp.

- Nordea Bank ABP

- Oanda Corp.

- Office Fukaya, Research & Consulting

- Rabobank

- SBI Securities Co.

- Sempione SIM SPA

- Skandinaviska Enskilda Banken AB

- Societe Generale SA

- Standard Chartered Plc

- Sumitomo Mitsui DS Asset Management Co.

- Union Bancaire Privee UBP SA

- UOB Asset Management

- Vanguard Markets Pte

- Wells Fargo & Co.

- William Blair International

--With assistance from Tomoko Yamazaki, Justin Villamil, Aline Oyamada, Lilian Karunungan, Netty Ismail, Karl Lester M. Yap and Adrian Krajewski.

To contact the reporters on this story: Yumi Teso in Bangkok at yteso1@bloomberg.net;Matt Turner in Hong Kong at mturner107@bloomberg.net;Selcuk Gokoluk in London at sgokoluk@bloomberg.net

To contact the editors responsible for this story: Tomoko Yamazaki at tyamazaki@bloomberg.net, ;Sophie Caronello at scaronello@bloomberg.net, ;Dana El Baltaji at delbaltaji@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.