Fears of Yet More Inflation Hound Markets as China Tackles Covid

Fears of Yet More Inflation Hound Markets as China Tackles Covid

(Bloomberg) -- China’s Covid crisis is giving fresh impetus to the worries about inflation that have dogged global markets this year.

The nation’s preference for lockdowns risks worsening already severe supply-chain snarls that have fanned price pressures worldwide, according to Frank Benzimra, head of Asia equity strategy at Societe Generale SA.

There will be “this situation of stress” absent some kind of easing in China’s so-called Covid-zero approach, Benzimra said in an interview on Bloomberg Television. “For the global market, there will be this additional risk of more inflation coming from further disruption” to supplies, he added.

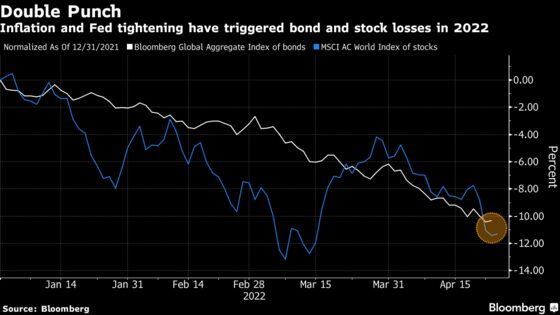

World stocks and bonds are nursing tandem losses of more than 10% this year, hurt by high inflation and the prospect of sharply tighter U.S. monetary policy.

Russia’s invasion of Ukraine has disrupted flows of essential commodities, and the Covid lockdowns in China -- which accounts for about 12% of global trade -- could stoke costs even more as factories and cargo ships lay idle.

A key issue from the Shanghai lockdown “is just the implications on the global supply chain,” Mary Nicola, a global multi-asset portfolio manager at PineBridge Investments, said on Bloomberg Television. That increases economic risks, Nicola said, adding “inflation isn’t going to go away.”

©2022 Bloomberg L.P.