Czechs Raise Rates to Highest Since 1999 as Price Risks Escalate

Czechs Surprise With Bigger Rate Hike as Inflation Risks Mount

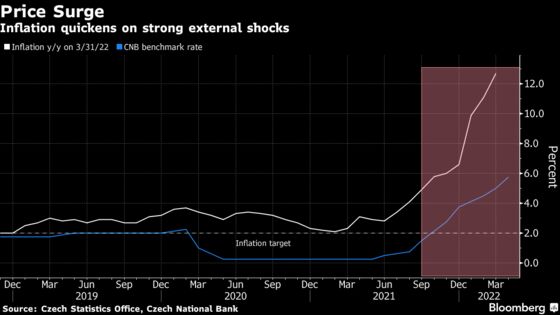

(Bloomberg) -- The Czech central bank lifted borrowing costs more than expected to the highest level since 1999 and signaled further monetary policy tightening to come as intensifying inflation pressure eclipses risks to economic growth.

Policy makers on Thursday raised the benchmark rate by 75 basis points to 5.75% -- exceeding the forecasts of all analysts in a Bloomberg survey for a half-point move. The hike brings cumulative increases since June to 550 basis points.

The central bank also significantly raised this year’s inflation projection, while trimming its outlook for gross domestic product to include a slight contraction in the second half of the year.

While baseline forecasts suggested an even bigger rate increase, the board opted for a moderate move because of strong external cost pressures and the exceptionally high uncertainties and risks in the outlook. Governor Jiri Rusnok said more tightening is possible at future meetings.

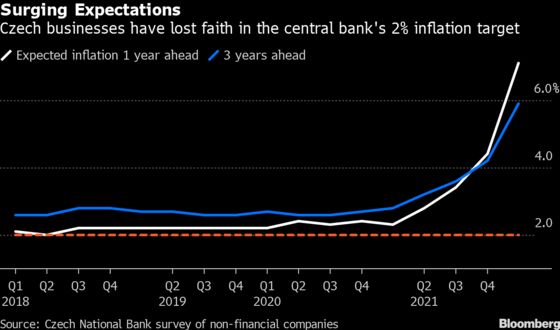

The Czechs are experiencing the fastest inflation in nearly a quarter century as Russia’s invasion of Ukraine drives up energy and raw-materials prices. While the key manufacturing industry grapples with component shortages and the economy may stall this year as a result, central bankers are concerned about signs that high prices are becoming entrenched.

“Unfortunately the situation, as we see it, is escalating,” Rusnok told reporters.

While inflation pressures are now mostly imported from abroad, they quickly translate into domestic trends as consumers, emboldened by the European Union’s lowest unemployment rate, accept higher prices.

“We’re observing a fairly fast spill-over of these external price pressures into domestic relations,” Rusnok said. “Our monetary policy can’t ignore that.”

The board also approved an increase in the amount of regular sales of the returns on the vast foreign-currency reserves, but the governor said policy makers don’t want to target a specific koruna exchange rate.

The currency appreciated as much as 0.5% against the euro, before paring the gains to trade 0.1% stronger at 24.57 as of 4:40 p.m. in Prague. The yield on the government’s five-year domestic bond jumped 27 basis points to the highest since 2008.

The rate decision reflected segments of an alternative set of economic projections, which implied less tightening but a delay in meeting the inflation goal until 2024.

“The baseline is quite hawkish,” said Jakub Seidler, chief economist at the Czech Banking Association. “The fact that the bank board used a combination of two different scenarios makes it harder to predict its future moves, although rates are likely to rise further above 6%.”

©2022 Bloomberg L.P.