Is Inflation Targeting Due for a Makeover?

(Bloomberg Opinion) -- “Did inflation targeting kill India’s growth story?” asks the headline of a recent article in the Mint newspaper.

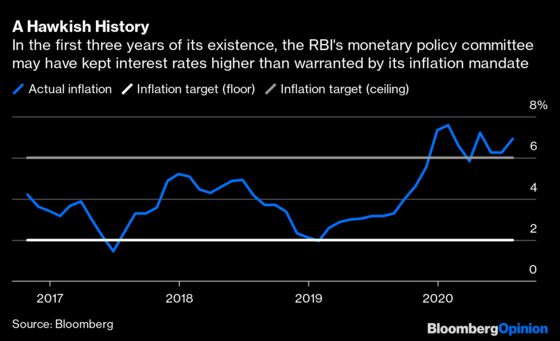

The idea of making an explicit numerical inflation goal the central bank’s primary objective came late to India. It was only in 2016 that the Reserve Bank formally took responsibility for keeping the rate of price change between 2% and 6% for five years. The clock runs out next March, but already some analysts are attacking the mechanism as anti-growth and in need of an overhaul.

Similar questions have been asked in advanced nations since the 2008 financial crisis. Back then, interest rates were quickly cut to zero. The job market improved, but inflation refused to accelerate toward the central banks’ 2% mandate, leading to unconventional policies such as quantitative easing and negative interest rates.

The former inflates asset prices and the latter hurts banks, which find it hard to pay less than zero to depositors. Given that experience, should the inflation goal be set higher at, say, 4%, so that there’s more room to cut rates when the economic skies darken? Does it make sense to aim for average inflation over a longer period, rather than trying to control year-on-year changes? Perhaps the objective should be recast as something entirely different, such as nominal gross domestic product, or wage growth?

In the post-pandemic global economy, the craft of central banking may come under greater scrutiny, especially now that the Federal Reserve, which carries a dual mandate of maximum sustainable employment and price stability, has signaled that it’s going to be patient before raising interest rates. In India, where the Covid lockdown has taken a bigger toll than in any major economy, there’s a growing sense that the government and the RBI ought to do more.

India’s potential rate of growth was sliding well before the pandemic, partly because interest rates were too high. The central bank targeted inflation, but consistently overestimated. It didn’t help that just as the monetary policy committee was settling into the job, Prime Minister Narendra Modi outlawed 86% of the country’s cash overnight in November 2016. Not being able to meet a distraught people’s liquidity requirements bruised the RBI’s authority. Perhaps to reassert its independence, the bank kept interest rates higher than they should have been.

The coronavirus has come as an even bigger shock. Lifting the rate of economic expansion will be a daunting task if some of nearly 19 million salaried jobs lost to Covid as of July don’t return. India could get stuck with a sub-5% increase in GDP, some critics say, just when it was dreaming of mimicking China’s decades-long streaks of double-digit expansion. That explains the unhappiness with inflation targeting.

What’s to be done? One idea, proposed by Sabyasachi Kar, a professor at the New Delhi-based National Institute of Public Finance and Policy, is to embed a device for raising the potential rate of growth — the economy’s speed limit — within inflation targeting. In his “augmented” framework, the RBI would monetize a part of the government’s deficit for capital expenditure.

Most of India’s private-sector infrastructure operators have neither the financial nor the political capital to take more risks. Public investments that supplement budgeted spending should help boost overall productive capacity. However, the central bank will only provide this unusual support when inflation is well-behaved and the economy isn’t overheating.

It’s still a risky gambit. Giving a cheap borrowing option to an undisciplined spender like India’s government could see it channel meager tax revenue to yet more populist programs, dragging the central bank into the inevitable politics that surrounds large infrastructure assets. If the currency market reckons the central bank is being made to prop up wasteful projects, it may worry about erosion of the RBI’s capital. One-time deficit monetization such as Indonesia’s may be easier to communicate to investors than a standing facility that’s more open to abuse.

Still, business-as-usual isn’t working. As Kar says, the choice is between “adopting unconventional policies, or remaining stuck in low-growth traps.” India’s public debt will surge to 85% of GDP by March 2022, from 70% before the virus outbreak, Fitch Ratings estimates. Without the RBI coming to the rescue, economic growth and tax collections may stay depressed for longer. The fiscal burden may become unbearable.

Rather than butting heads with the fiscal authority, or meekly toeing its line, the central bank should insist on pragmatic, rules-based cooperation. Kar wants the RBI to control the purse strings by monitoring the use of funds directly borrowed by the government.

Is augmented inflation targeting suitable only for emerging markets?

Rich countries have vast insurance and pension savings. They don’t need to tap central banks to finance infrastructure, whereas societies with shrinking populations — like Japan — may not be able to sustain higher growth even with ultra-loose policies.

But in South Korea, potential growth could get a helping hand from fiscal support for women to participate in the economy. In the U.S., warehouse and factory wages are rising even with millions out of work. The Trump administration’s now-expired $600-a-week-stipend for jobless workers is a sore spot for for staffing executives looking to fill roles, according to Bloomberg News. Does that mean that a universal basic income — topped up by the Fed whenever inflation is low — may be more effective in reviving demand than yet another dose of quantitative easing? It’s a debate worth having. India is a good place to start.

Full disclosure: I had a chance to discuss the note with the author before publication.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

©2020 Bloomberg L.P.