Bond Traders Raise Questions Over India's Revenue Forecasts

A note of caution is creeping in among bond traders over India’s latest budget.

(Bloomberg) -- A note of caution is creeping in among bond traders over India’s latest budget.

While the debt market has rallied after the government trimmed its fiscal deficit target and announced plans for a global bond sale, IDFC First Bank Ltd. and Quantum Advisors say the revenue projections in the budget are too optimistic given slowing economic growth.

For instance, gross tax collections will have to increase by more than 18% to meet the current year’s target, compared with a provisional 8.4% expansion achieved in the fiscal year ended March, according to a note from IDFC First Bank. Moody’s Investors Service has also flagged its skepticism after the government trimmed its fiscal gap target to 3.3% of gross domestic product from the 3.4% set in February’s interim plan.

While it’s a relief the government didn’t add to local borrowing plans, “what remains under question is how will they meet the tax and non-tax revenue targets, said Arvind Chari, head of fixed income & alternatives at Quantum Advisors in Mumbai. “The bond markets should thus remain skeptical on this issue.”

Budget Maths in Focus

| Budget Estimates | FY20 (July Estimates) growth% y/y | FY20 (February Estimates) growth% y/y |

| Revenue Receipts | 25.6 | 14.3 |

| Tax Revenue | 25.3 | 14.9 |

| Non-Tax Revenue | 27.2 | 11.2 |

| Total Receipts | 25 | 14.1 |

| Budget Deficit as percentage of GDP | 3.3% | 3.4% |

Note: Expected growth in revenues to meet the budget targets

Source: Nirmal Bang Institutional Equities

Prime Minister Narendra Modi’s government also overestimated revenues for the last fiscal year. His administration has pledged to narrow the deficit by increasing taxes on the wealthy, raising duties on gold and gasoline, extracting higher dividends from the central bank and boosting income from asset sales.

All the numbers in the current budget are realistic and achievable, Finance Minister Nirmala Sitharaman said Saturday.

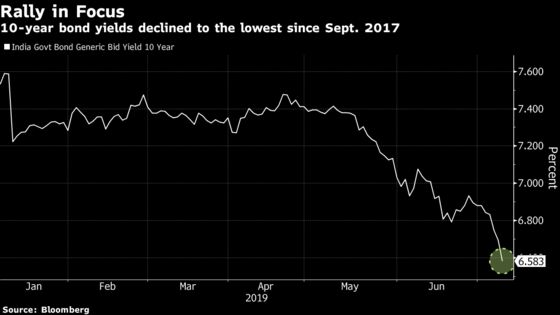

In spite of the skepticism, the yield on the benchmark 10-year bonds declined 15 basis points since Thursday, as traders cheered the government’s plan to raise as much as $10 billion in a global debt sale. Even after a three basis points rise on Tuesday the yields are still down by more than 90 basis points from a high in January after the central bank cut rates and bought debt.

To contact the reporter on this story: Kartik Goyal in Mumbai at kgoyal@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Anto Antony

©2019 Bloomberg L.P.