BOE Sees Risk of U.K. Recession With Inflation Above 10%

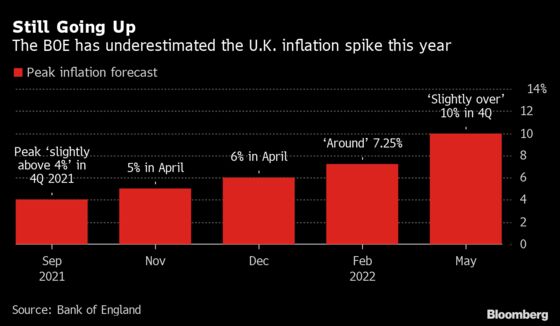

BOE hiked interest rates to highest level since the financial crisis and warned economy is on course to shrink under inflation.

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Bank of England issued the most gloomy outlook of any major central bank this year, warning Britain to brace for double-digit inflation and a prolonged period of stagnation or even recession.

The U.K. central bank’s bleak forecasts along with a boost for interest rates to the highest since 2009 sent the pound to the lowest in almost two years and triggered a drop in government bond yields.

BOE Governor Andrew Bailey underscored the stark trade-offs facing policy makers, who are attempting to contain the worst bout of inflation in three decades and maintain the recovery from the coronavirus pandemic.

“I recognize the hardship this will cause people in the U.K., particularly those on lower incomes,” Bailey told reporters in London on Thursday. “The biggest driver is the real-income shock, which is coming from the change in the terms of trade, coming particularly from energy prices.”

His comments chime with the warning on Wednesday by U.S. Federal Reserve Chair Jerome Powell that bringing inflation under control could cause “some pain.” The BOE lifted its key rate a quarter point to 1%, with three officials voting for an even larger move.

The remarks landed on the same day Prime Minister Boris Johnson’s government is facing the judgment of voters in local elections on its response to the biggest squeeze on living standards in decades.

While the bank predicts the U.K. will avoid a technical recession -- two consecutive quarters of contraction -- it said output will collapse by close to 1% in the final quarter of this year. In 2023, annual GDP is expected to shrink by 0.25%.

“The decision to raise interest rates will cause considerable alarm among households and businesses given the rapidly deteriorating economic outlook,” said Suren Thiru, head of economics at the British Chambers of Commerce.

Minutes of the meeting showed a deepening division on the nine-member Monetary Policy Committee about how to guide rates.

The majority agreed that rates would have to rise again to keep inflation in check. Two members decided to back away from guidance that more hikes will be needed. Three members -- Michael Saunders, Catherine Mann and Jonathan Haskel -- were concerned enough about rising pay growth to vote for a bigger increase.

What Bloomberg Economics Says ...

“The Bank of England delivered another dovish hike Thursday, signaling that rates are unlikely to go much higher as it struggles to balance surging inflation with the risk of recession.”

--Dan Hanson, economist. Click for the REACT.

The BOE’s forecasts also showed:

- Inflation climbing above 10% in October, due to another increase of about 40% in the U.K.’s energy price cap

- Pay growth rising to 5.75% in 2022, sharply higher than the February outlook, before falling in the following two year

- Unemployment dropping this year before climbing to 5.5% by 2025

- Households are facing a 1.75% drop in real disposable income this year, the second-biggest fall since 1964. That’s even after government support measures to ease the cost of living crisis

- The economy continues to stagnate in 2024, when growth is a feeble 0.25%

Policy makers are treading “a very tight line” between tackling inflation and avoiding recession, he said.

The BOE added that the war in Ukraine is the latest in “a succession of very large shocks” that are buffeting the economy.

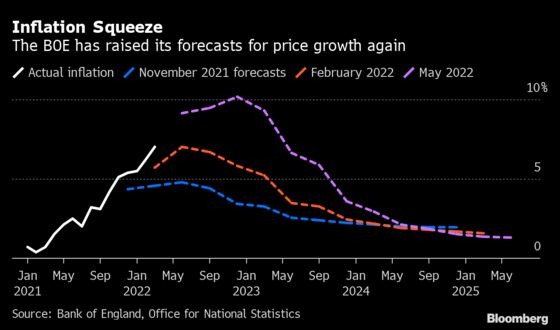

The forecasts, based on a market curve showing interest rates hitting 2.5% by mid-2023, also showed inflation coming down to 1.3% in three years’ time, the biggest downside miss at the forecast horizon since the financial crisis. Excess supply is seen at 2.25% in 2025.

The implication is that current pricing has gone too far. A projection based on rates staying at 1% had inflation at just 2.16% at the same point.

The rate increase, delivered on the eve of the 25th anniversary of independence, marks the BOE’s fourth straight hike and takes the key rate to the highest since early 2009.

Officials also said they would consider beginning the process of actively selling bonds purchased under quantitative easing, a milestone for the policy which began over a decade ago. No major central bank has yet conducted active sales of government bonds.

The MPC have asked bank staff to work on a strategy for sales, and pledged to provide an update in August, allowing them “to make a decision at a subsequent meeting on whether to commence sales.”

Corporate bond sales will begin in September.

The minutes also exposed a growing split among the MPC, with the votes for an outsized hike contrasting with two officials dissenting from the view that more tightening was needed.

That forced the BOE to changed its guidance on further rate moves to say “most members judged that some degree of further tightening in monetary policy might still be appropriate in coming months.”

Some suggested risks were more evenly balanced and even that guidance was too strong. In March, the committee as a whole judged “some further modest tightening in monetary policy might be appropriate.”

For now though, the BOE is far from alone in pursuing an aggressive tightening path.

The Federal Reserve raised interest rates by 50 basis points on Wednesday, the biggest increase since 2000, and signaled it would keep hiking at that pace over the next couple of meetings.

©2022 Bloomberg L.P.