BOE Path to Negative Rates Is Lit by the Experiences of Others

BOE Gets Negative Rates Advantage by Watching Others Go First

(Bloomberg) -- The Bank of England has one big advantage when it comes to the contentious topic of negative interest rates: it’s no pioneer.

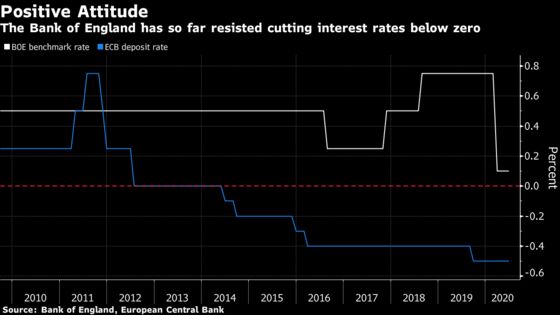

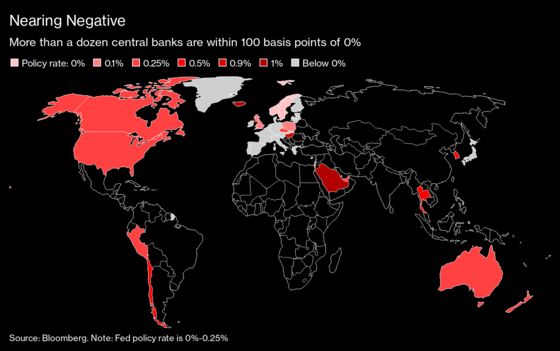

Experiences elsewhere provide the U.K. central bank with options on how to navigate one of the boldest monetary experiments in the 21st century. It’s long been controversial in the euro area, where banks, politicians and savers have criticized it. And while meant to be temporary, the European Central Bank’s record shows that reversing course isn’t easy.

All that makes BOE Governor Andrew Bailey reluctant to cut the key rate -- now at 0.1% -- below zero, and he’s got other policy options that he can pursue first. But he also won’t rule it out. Given the U.K. is facing the worst slump in centuries, plus a potentially hard Brexit hitting the recovery in 2021, Morgan Stanley and Barclays say he may ultimately have to go there.

“You can understand the temptation to look at other tools like negative rates,” said James Smith, an economist at ING in London. “Bank rate at its current level is getting decreasingly stimulative as time goes on.”

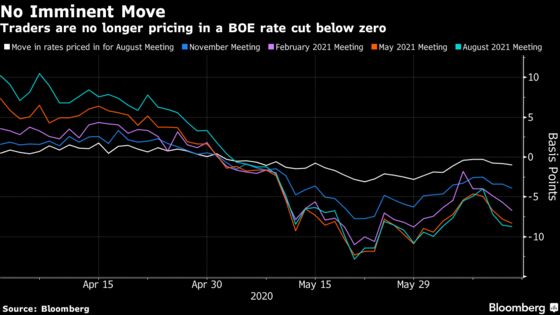

Just one of the 43 economists surveyed by Bloomberg sees a cut below zero by year-end, and investors have pared bets the BOE take that step -- reckoning instead that alternatives such as more bond-buying will be the preferred route. That’s likely to be the case on Thursday, when the bank is expected to add another 100 billion pounds ($125 billion) to its target, taking it to 745 billion pounds in total.

In a television interview on Friday, Bailey said officials stand ready to take more action.

If more drastic moves are required, policy makers have signaled that they won’t be rushing headlong into negative rates. They’re already reviewing a host of complications including the prospect that it’ll damage profits at lenders -- as it has in the euro zone -- because they’ll struggle to pass the cost onto savers.

In any case, policy makers have time to lay the groundwork and give clear signals so markets and banks are prepared.

| BOE’s Likely Order of Action |

|---|

1. More QE 2. More Term Funding Scheme, possibly favoring certain types of loans 3. More macroprudential easing 4. Yield curve control and forward guidance 5. Negative rates Source: Barclays |

Years of subzero borrowing costs in Europe and Japan have already shown that while fears such as cash hoarding are unfounded, the benefits for the economy depend on implementation.

The key lesson is to make sure banks pass on the cheap financing costs to companies and households.

The ECB’s six years of negative rates provide a real-life case study. Although officials claim the policy helped revive the economy and create millions of jobs, they also acknowledge that the adverse impact on banks and financial stability worsens over time. Their most recent stimulus programs have included an enormous new bond-buying program but no further cuts in the deposit rate of minus 0.5%.

They did opt for stealth rate cuts though, reducing the borrowing cost on long-term loans to banks that are expressly used for financing credit to companies and households.

The BOE could follow that model by cutting the rate on its Term Funding Scheme for bank lending.

It’s a “better alternative to negative rates,” according to Deutsche Bank economists including Sanjay Raja. “One, it would have less of an impact on bank profitability; and two, the BOE would avoid any further depreciation to sterling, which would ultimately hurt consumers through import inflation.”

Other measures to come could include buying riskier securities, or a form of yield-curve control -- a strategy of targeting specific yields on bonds that the Bank of Japan has already adopted.

“We are skeptical that another rate cut is high in the MPC’s pecking order,” Goldman Sachs analysts including Sven Jari Stehn wrote in a report, saying increased bond-buying would come first. “We view a reduction in the rate on the Term Funding Scheme as more likely.”

©2020 Bloomberg L.P.