Banks Cheer Higher Margins After Years of Rock-Bottom Rates

UBS Group AG on Tuesday said higher interest rates should boost revenue at its wealth management business.

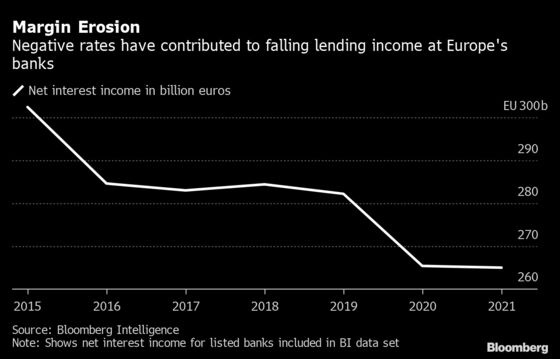

(Bloomberg) -- After years of low or even negative benchmark rates, Europe’s lenders are finally getting a much-anticipated boost as central banks across the world tighten monetary policy to combat surging inflation.

UBS Group AG on Tuesday said higher interest rates should boost revenue at its wealth management business. HSBC Holdings Plc is already benefiting from increases in its home market. And Banco Santander SA, whose loan book topped 1 trillion euros ($1.1 trillion) for the first time, is poised to boost margins as borrowing costs rise in markets including the U.K., the U.S. and Poland and potentially also the euro area this year.

Higher rates “will absolutely help our net interest income,” Ralph Hamers, UBS’s chief executive officer, said in an interview on Bloomberg TV. “We expect a tailwind on the revenue side of more than a billion materializing in the second half of this year in the wealth management business.”

Results at the three firms -- the first large banks in the region to report first-quarter earnings -- all beat analysts’ estimates, even as a slowdown in their key Asian markets hit HSBC and UBS and the war in Ukraine rattled stock investors.

But with the benefit of higher rates come added costs. At Santander, which is contending with surging expenses in key markets such as Spain and Brazil, operating costs rose 8%, even as the lender flags its track record in keeping cost growth below inflation. UBS’s Hamers highlighted “cost pressures around salaries” in the U.S. and Asia.

At HSBC, where net interest income rose 7.4% from a year ago, rising rates helped cause a surprise drop in a key measure of capital strength, which fell in part because of a $3.1 billion hit from securities the firm held as an interest rate hedge. That means additional share buybacks are unlikely this year.

Chief Financial Officer Ewen Stevenson, who struck a bullish tone in a call with analysts Tuesday, called the drop a “timing mismatch on capital” and said that next year should see the reverse result. That means “much higher net interest income, much higher returns, much higher distribution capacity in 2023 and beyond.”

©2022 Bloomberg L.P.