A Lucky Half-Century for This $50 Million Tata Stake Comes to an End

The Tata versus MIstry boardroom coup that turned into a courtroom drama will only be over with a divorce.

(Bloomberg Opinion) -- After several years of legal wrangling, India’s Tata Group has won a decisive victory over its disgruntled minority shareholder. But the boardroom coup that turned into a courtroom drama will only be over with a divorce. That could still get messy.

The Shapoorji Pallonji Group’s claim of being an oppressed junior partner in the storied Indian empire has been set aside by the country’s Supreme Court, which also held SP scion Cyrus Mistry’s 2016 sacking as Tata Group chairman as legal. The next step will be for SP to exit its 18%-plus stake in holding company Tata Sons Ltd. That chunk is worth anywhere between $11 billion to $24 billion, depending on whether you ask the buyer or the seller. The court refused to get drawn into deciding the terms of separation.

Ratan Tata, the 83-year-old chairman emeritus, will no doubt want an early closure. Once free of ownership tussles, the sprawling 153-year-old conglomerate, with tentacles extending from auto and aviation to tea and technology, will be free to dive into e-commerce and other digital businesses. There’s room in India for a Tata super-app to compete with Mukesh Ambani’s Reliance Industries Ltd.

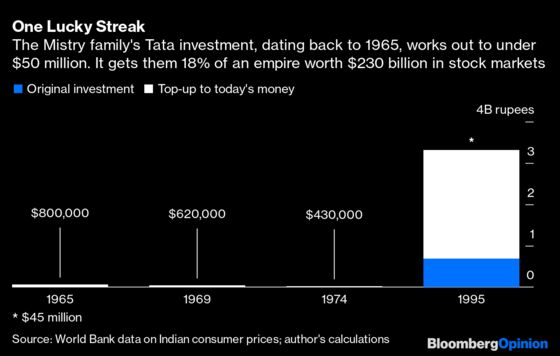

But eagerness to end the rambling saga doesn’t mean having to meet SP Group’s asking price. Now that the court has upheld the change in Tata Sons’ charter to a private company, the Mistry family’s ability to freely monetize its shareholding will be truncated. The majority shareholders of Tata Sons are charitable trusts. They will be loath to overpay for what they might view as a 692 million rupee ($9.5 million) investment between 1965 and 1995. That investment — worth a little less than $50 million in today’s money — had a fantastic run, earning $120 million in dividends alone between 1991 and 2016. But now the compounding party is over.

Even though Ratan Tata had anointed Cyrus Mistry as chairman upon his own retirement in 2012, the notion that the two families were business partners stretched credulity. The Mistry clan entered the Tata group only in 1965 by acquiring a 6% stake from a private individual for 1.1 million rupees, worth $800,000 in today’s money. In 1969, the family bought another 5% block — this time from Tata Trusts, the majority shareholder. A third chunk, purchased in 1974 for 1.3 million rupees, took the Mistry stake to 17.5%. It rose to 18.4% after the family brought in the equivalent of about $45 million today by subscribing to a 1995 rights issue.

Overall, that works out to a total investment of under $50 million in a group whose 29 listed firms were recently valued at $230 billion, with the bulk of the market capitalization coming from just one company, Tata Consultancy Services Ltd., India’s No. 1 exporter of software services.

But within four years of giving Cyrus Mistry the top job, Ratan Tata fell out with him. After his dismissal, Mistry named business units ranging from steel and small cars to mobile services, hotels and power as “legacy hot spots” that could destroy up to $18 billion of the $29 billion capital employed in them. This outburst led the Supreme Court to remark that Mistry acted like “a person who tries to set his own house on fire for not getting what he perceives as legitimately due to him.”

As the spat turned public and ugly, the SP Group’s ability to sell or pledge its shares came under a cloud.

A waiting game may not have mattered to Mistry in 2016, but two years later India had a shadow-banking crisis, its own mini-Lehman Brothers moment, as I then described it. The waves of mistrust triggered by the collapse of IL&FS Group threatened to sink businesses with long-term property assets funded with short-term borrowings. The SP Group, which had its roots in construction, found itself in the unenviable position of being such an overextended player. The group is now asking creditors to restructure half of its $3 billion debt, according to BloombergQuint.

All of SP’s troubles would be over if it could get a nice divorce settlement from the Tata empire. Trouble is, Ratan Tata also knows it. As for the hot spots identified by Mistry, telecom has been sold, and Tata is exploring options to make the U.K. steel business sustain itself without Indian funding. Indian Hotels Co., which owns the Taj brand and operates The Pierre in New York City, has been hit hard by the pandemic. It, too, needs a fresh assessment. After that, it’s time to script a fresh growth chapter in e-commerce.

Now that the court has thrown out his entire case, the 52-year-old Mistry might take longer to bounce back. It seems there’s a limit to how lucky one can get with $50 million.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

©2021 Bloomberg L.P.