(Bloomberg Opinion) -- Shanghai is flying again. The first company to sell shares on its Nasdaq-style technology board priced its stock at a huge premium to the broader market, little more than a week after a successful debut for the city’s cross-border listing program with the U.K. The dual initiatives may help the Shanghai stock exchange regain some of the fundraising allure it’s lost to Shenzhen and Hong Kong – if it can keep up the momentum.

On Tuesday, Suzhou HYC Technology Co. became the first candidate on the SSE STAR Market to price its stock. The maker of industrial testing equipment will raise 973 million yuan ($141 million) selling shares at 24.26 yuan apiece. The price implies a multiple of 41 times earnings, adjusted for non-recurring items, compared with 14.5 times for the Shanghai Composite Index, after regulators relaxed an unofficial price-earnings cap of 23 times on initial public offerings. The retail portion of the offer was 1,670 times oversubscribed, Bloomberg News reported Friday.

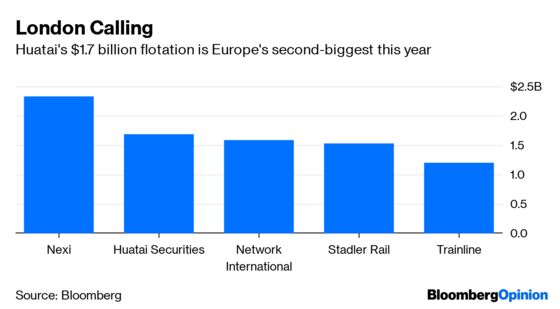

Huatai Securities Co., meanwhile, became the first company to list under the Shanghai-London Stock Connect program this month, raising $1.7 billion in Europe’s second-largest IPO of 2019. As of Wednesday’s close, its global depositary receipts had climbed 17% from the offer price.

The STAR market will help Shanghai compete with Shenzhen, whose ChiNext board has become the go-to venue for new economy companies in China over the past few years. It will also offer an alternative to listing in offshore markets such as Hong Kong and the U.S. Besides relaxing the P/E ceiling, regulators will allow dual-class share structures and admit companies that have no revenue, in line with overseas markets that target technology startups. The London trading link may also burnish Shanghai’s appeal for potential listing candidates, offering them the chance to tap overseas capital while remaining listed at home.

There are multiple headwinds facing both initiatives, though. If history is any guide, liquidity on the tech board is likely to slip after an initial spurt. That’s what happened with ChiNext, which started operations amid much fanfare in 2010.

For all the enthusiasm, the STAR board has yet to land a big fish. There were 131 applicants as of Thursday morning, of which more than 20 have already received approval from the Shanghai exchange, according to data compiled by Bloomberg. Yet there’s no sign of China’s biggest and most exciting private tech firms – such as Bytedance Ltd., the company behind the globally popular TikTok video app; or Ant Financial, the payments affiliate of Alibaba Group Holding Ltd. Indeed, New York-traded Alibaba is itself planning a secondary listing in Hong Kong.

That reflects the fact that raising money in dollars is still a powerful hook for Chinese technology companies, both as a springboard for expansion and as a hard-currency exit for Western venture capital firms that have invested in them. In 2018, Chinese tech firms sold $15.75 billion of shares in Hong Kong, where the local currency is pegged to the dollar, versus $7.87 billion in the mainland.

In theory, this should be an ideal time for Shanghai to introduce its technology board. China-U.S. trade tensions have flared, potentially causing companies to rethink the wisdom of listing in America. Meanwhile, Republican Senator Marco Rubio is among politicians sponsoring a bill that proposes to delist mainland firms that don’t open their audit books to U.S. regulators. Chinese companies are desperate for money, but the Chinese Securities Regulatory Commission, which vets all other listings outside the STAR market, has at least 400 companies waiting for approval in a line that could take years to clear.

The response to HYC Technology and other candidates such as UCloud Technology Co., which has a dual-class structure, and Suzhou Zelgen Biopharmaceutical Co., which has no revenue, will tell whether that promise is fulfilled. For bankers, the market may prove a mixed blessing. While IPO arrangers are freed from the P/E cap, they are required to buy between 2% and 5% of each company they bring to market. That ensures the underwriting banks have skin in the game and gives them a disincentive to price sales too high.

As for the London connect, there’s no guarantee that the buzz surrounding Huatai’s debut will be sustained. Chinese firms previously listed in the U.K. are barely traded: Shares of Air China Ltd., for example, changed hands only four times in May. It’s also a one-sided arrangement: London-listed companies can’t raise money on the STAR market, which may limit their interest in having shares traded there. So far, HSBC Holdings Plc – which has roots in Shanghai – may be the only firm to have indicated interest.

The STAR market will certainly give Shanghai a leg-up in its competition with the southern city of Shenzhen. The effects are unlikely to be felt much further afield, though. Offshore centers from Hong Kong to New York can rest easy.

--With assistance from Irene Huang.

That includes the exercise of a greenshoe option that raised the initial amount from $1.5 billion.

To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nisha Gopalan is a Bloomberg Opinion columnist covering deals and banking. She previously worked for the Wall Street Journal and Dow Jones as an editor and a reporter.

©2019 Bloomberg L.P.