(Bloomberg Opinion) -- Companies are under increasing pressure to improve their performance on environmental, social and governance issues. Now, two studies suggest that investors punish the valuations of those that either breach their corporate responsibilities or overpromise on their greenness. Firms that haven’t yet assigned a senior executive to oversee ESG accountability would do well to get a wiggle on.

Analysts from the Swiss Finance Institute used data from a company called RepRisk, which collates ESG transgressions by firms. The study covered more than 76,000 ESG incidents at 8,000 companies from 45 countries or regions. The analysts paired companies with ESG alerts against peers in the same country and industry but without notifications to draw comparisons.

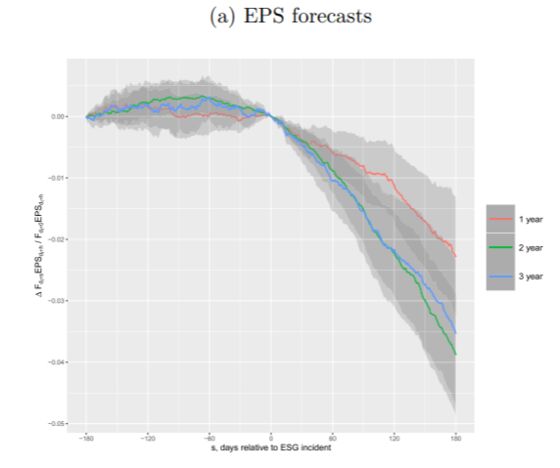

The researchers found that companies with negative ESG news events were punished by analysts, who reduced their earnings per share forecasts for transgressors in both the subsequent quarter and on one- to three-year horizons. The more incidents a company had, the bigger the cuts to the earnings estimates. Social and governance issues were bigger drivers of downgrades than environmental malpractice.

The study found that analysts were anticipating lower future revenue for companies with bad ESG records, rather than either an increase in their cost of capital or a rise in expenditure to address the issues.

Companies struggled to shake off the aftershocks of bad ESG news. The downgrade to earnings forecasts in the subsequent three years was 1.36 times larger than in the following 12 months; by contrast, a credit-rating downgrade had about half of the effect on longer-term expectations compared with over a one-year horizon.

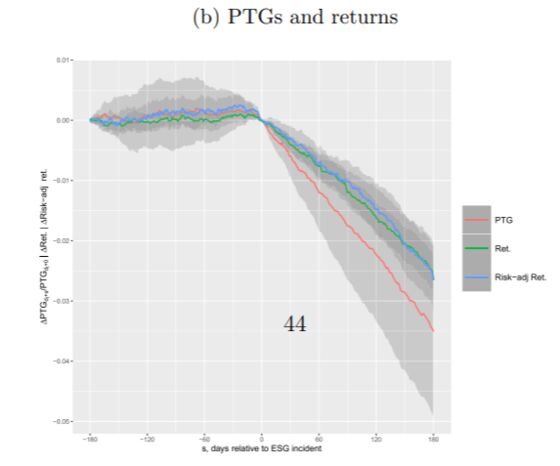

There was a parallel impact on both predicted and actual share prices. Analysts chopped their price target guidance for ESG offenders, and were right to do so: Matched with non-offenders, the returns to investors of miscreants were an average of 2 percentage points lower a year after the event. In Europe, where investors are more receptive to ESG issues than in the U.S., the study found that “analysts who exhibit more sensitivity to ESG news provided significantly more precise forecasts than their peers.”

The impact on market values is echoed in the second study, by the EDHEC Business School’s Risk Institute, albeit related to greenwashing rather than actual ESG violations. EDHEC analyzed the performance of the 500 largest U.S. companies between 2012 and 2017, comparing Newsweek Sustainability Rankings with ESG scores produced by London Stock Exchange Group Plc’s Refinitiv unit. The researchers proposed that the former scores are “more reliable and accurate” than the latter, arguing that any widening of the gap in favor of the ESG valuation compared with the NWS count was evidence of greenwashing.

The study found that companies it deemed to have overstated their green credentials saw a long-lasting deterioration in their worth, as measured by excess market capitalization over their book values. The report found that larger firms are less likely to indulge in greenwashing, as are those with larger executive boards.

More than reputation is at stake in ESG. With investors demanding that the capital they allocate doesn’t go to companies that harm either society or the planet, offenders are likely see increased financial repercussions from perceived misbehavior.

More from Bloomberg Opinion:

-

BNP’s $3 Million Gender Pay Gap Hit Was a Watershed: Chris Hughes

-

If Your Wife Makes More Than You Do, Read This: Kara Alaimo

-

Do You Really Need to Drive an Electric Tank?: Chris Bryant

Bloomberg LP competes in the market for selling ESG data and analytics.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Mark Gilbert is a Bloomberg Opinion columnist covering asset management. He previously was the London bureau chief for Bloomberg News. He is also the author of "Complicit: How Greed and Collusion Made the Credit Crisis Unstoppable."

©2022 Bloomberg L.P.