Shadow Bank Crisis in India Makes It Hard to Cut Bond Losses

Mutual funds are in a particularly tough spot, given their large holdings of non-bank financing company bonds.

(Bloomberg) -- As India’s shadow banking crisis deepens, it’s getting harder for investors to cut their losses in the sector’s debt.

Mutual funds are in a particularly tough spot, given their large holdings of non-bank financing company bonds. That, in turn, threatens everyone from individual investors to conglomerates with money in the funds, underscoring broader risks to policy makers already grappling with an economic slowdown.

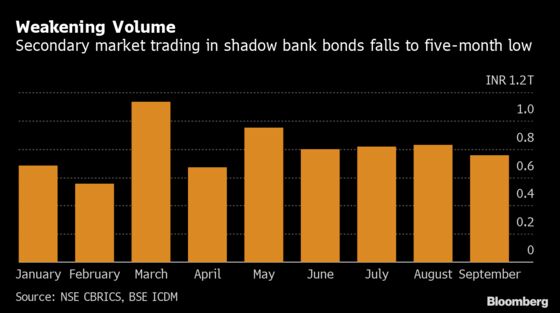

Trading in NBFC bonds slid to a five-month low of about 755.2 billion rupees ($10.6 billion) in the secondary market in September, the lowest since April, according to data compiled by Bloomberg. The slump comes as mutual funds cut investments in the sector to the lowest in nearly two years.

“There are very few takers for NBFC bonds as compared to sellers due to sharp deterioration in credits, risk averseness among investors, and sudden and steep rating downgrades of financiers,” said Ashish Ghiya, managing director at Derivium Genev, one of India’s largest corporate bond brokers. “I expect the slowdown in trading volume of non-bank finance companies to continue for at least a year as the credit crisis is deepening by each passing day.”

Troubles started last year when IL&FS Group suddenly defaulted, rattling investor confidence. Altico Capital India Ltd., a non-bank lender to real estate companies, became the latest to stumble and Punjab & Maharashtra Co-operative Bank Ltd. sent fresh shock waves as it duped regulators and extended outsize loans to an insolvent developer.

Meanwhile, lenders including IndusInd Bank Ltd. -- which saw a fifth of its market value wiped out over the past week on concern about its creditors --, Axis Bank Ltd. and Edelweiss Financial Services Ltd. are predicting that the Indian financial sector’s woes will ease soon.

To cope with rising distress, some asset managers signed pacts with stressed companies to delay margin calls, inviting wrath from the market regulator. Meanwhile, many mutual funds segregated their investments in defaulting companies.

“Buying or selling corporate bonds quickly is difficult, but due to the ongoing shadow bank crisis, it has become even more illiquid,” Derivium Genev’s Ghiya said.

To contact the reporter on this story: Divya Patil in Mumbai at dpatil7@bloomberg.net

To contact the editors responsible for this story: Andrew Monahan at amonahan@bloomberg.net, Anto Antony

©2019 Bloomberg L.P.