Top Indian Funds Differ on Whether India RBI Is Behind the Curve

SBI Funds warn the global rout may hurt Indian bonds as the central bank downplays inflation risks.

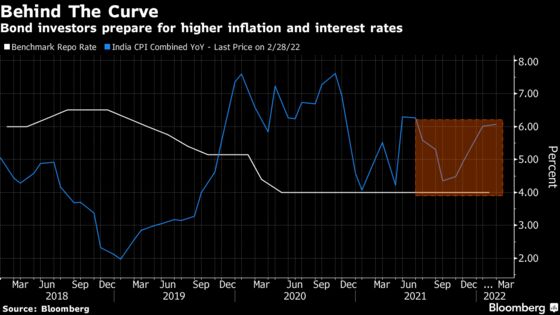

(Bloomberg) -- Two of India’s top asset managers have diverging views on whether the central bank is falling behind in normalizing policy, highlighting the divide in the market’s outlook on inflation.

India’s central bank maybe underplaying inflationary risks and might have to tighten interest rates much more aggressively later, like the Federal Reserve, according to the nation’s largest asset manager SBI Funds Management Pvt. Kotak Mahindra Asset Management Ltd., however, says there aren’t demand-side pressures on inflation and the Reserve Bank of India is right in its policy approach.

“If you don’t normalize gradually and preemptively, you may be in a situation down the line where you have to slam on the brakes,” said Rajeev Radhakrishnan, chief investment officer for fixed income at SBI Funds, which manages 4.6 trillion rupees ($60 billion).

The RBI has confounded market expectations with its accommodative policy even as inflation breached its 6% limit for two months. SBI Funds warn the global rout may hurt Indian bonds even as Governor Shaktikanta Das has said that the central bank wasn’t lagging behind in normalizing policy.

The Fed could have proceeded more gradually, said Radhakrishnan, as the market is now pricing in about seven hikes this year. “The risk of something similar is there in India, though not to that magnitude.” He favors bonds with maturities of up to one year.

This view however is not a consensus in market. “The so-called observation that they (RBI) are behind the curve seems to be a bit far-fetched,” Lakshmi Iyer, chief investment officer for debt at Kotak Mahindra Asset Management, said in an interview with Bloomberg TV on Wednesday.

“There is no necessity to give a shock treatment to the system given that demand-side constraints hitting on inflation are still not really visible,” Iyer said.

Bonds in India have been supported by a dovish RBI and lack of auctions since the end of February, though yields are set to rise as the government starts its planned record 15 trillion rupees of borrowing in April. Benchmark 10-year yields have climbed just three basis points this month, compared with more than 50 points rise for U.S. Treasuries of that maturity.

The central bank’s next policy review is due on April 8.

©2022 Bloomberg L.P.