Economists See India Raising Rates Sooner to Counter Inflation

RBI is expected to raise the repo rate by 25 basis points in the quarter ending June, compared to the previous estimate for a hold

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

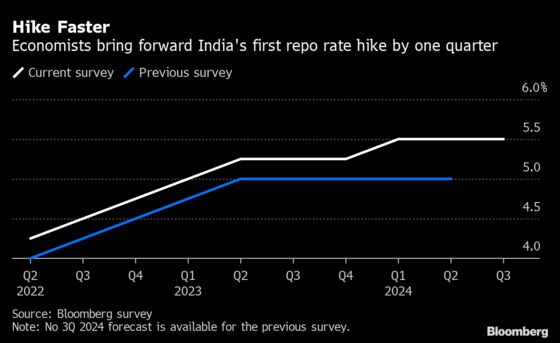

Economists have brought forward their calls for India to increase its main interest rate in the current quarter ending June to fight inflationary pressures made worse by war-induced supply-chain disruptions.

The repurchase rate is expected to be raised by 25 basis points to 4.25% during the period, compared to the previous estimate for a hold, according to the median in a Bloomberg survey of economists. They see the rate rising to 5.5% through five more quarter-point hikes across the survey period ending September 2024, or two additional 25 basis-point moves than previously seen.

India reported faster-than-expected retail inflation in March on the back of rising fuel and food costs, adding pressure on the Reserve Bank of India to tame price-growth that’s already breached its 6% upper tolerance limit this year. Although the central bank’s rate-setting panel held borrowing costs unchanged this month, it resolved to withdraw accommodation going forward to fight price pressures.

“With inflation rising sharply in recent months, RBI’s tone has become more hawkish,” said Arjen van Dijkhuizen, a senior economist at ABN Amro NV. “We expect the RBI to start hiking the repurchase rate earlier, and have now penciled a cumulative three 25 basis-point hikes in 2Q, 3Q and 4Q of 2022.”

Economists see headline inflation reaching 6% in the financial year ending March 2023, almost 50 basis points higher than previously forecast. That will be faster than the RBI’s own forecast, which pegs full-year price-growth at 5.7%. The wholesale price index is expected to edge higher to 8.39% from 7.26%, according to the Bloomberg poll. Average April-June quarter WPI has the highest jump in forecast by 3% to 13%.

Gross domestic product will likely slow to 7.5% from 8.8% in the year beginning April. Forecast for gross value-added is seen slowing to 6.9% from 8.1% in the next fiscal year, the survey showed.

©2022 Bloomberg L.P.