Taiwan Surprises With Biggest Interest Rate Hike Since 2007

Taiwan Surprises With Biggest Interest Rate Hike Since 2007

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

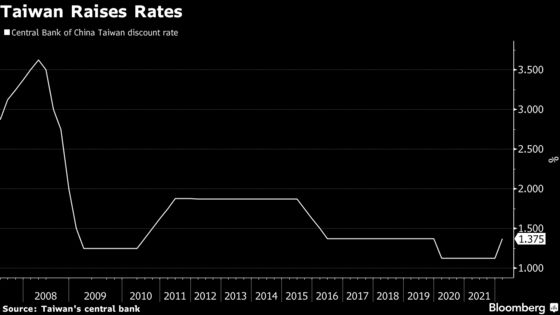

Taiwan’s central bank surprised markets by raising its benchmark interest rate by the most since 2007 on Thursday, saying the move is needed to contain rising inflation.

The decision to raise borrowing costs 25 basis points to 1.375% was Taiwan’s first rate hike since 2011 and the first time the central bank has changed rates since early 2020, when it cut just as the full impact of the global Covid-19 pandemic was becoming clear.

The bank also raised its forecast for gross domestic product growth for 2022 to 4.05% from its previous forecast of 4.03%, with Governor Yang Chin-long noting that would have been even higher without the war in Ukraine. Inflation is likely to be stronger than initially predicted, rising 2.37% this year.

Economists had mostly expected the bank to wait until June to raise rates. A majority of the 29 polled by Bloomberg before the announcement had forecast policy makers would keep rates unchanged at a record-low 1.125% for an eighth-straight quarter.

But inflation pressures are tough to ignore. The U.S. Federal Reserve just raised interest rates Wednesday and signaled six more increases this year as it tackles the worst inflation in four decades. The Bank of England is also expected to increase its benchmark rate on Thursday.

“The fundamentals are supporting the decision to normalize policy rates,” said Michelle Lam, economist at Societe Generale SA in Hong Kong. She noted the increase in consumer inflation, and said there are “signs of price pressure broadening across more products.”

The housing market has also remained buoyant even as the central bank takes steps to control credit, and that all “probably emboldened” the bank to be more “proactive,” she said. The central bank “probably” won’t stop with this increase, she said, adding that raising the policy rate to at least 1.875% “would be appropriate.”

The more aggressive-than-expected rate hike prompted a 1.25% surge in one month Taiwanese dollar non-deliverable forwards, the biggest jump since last April.

Containing Inflation

The economy had met the criteria policy makers needed to consider before raising rates, according to Governor Yang. He has previously laid out inflation, borrowing costs in the world’s major economies, and the pace of the recovery from Covid-19 as essential factors.

The rate increase will be helpful for containing inflation, according to the central bank. Asked by reporters Thursday about the possibility for more rate increases, Yang instead pointed to the variety of options available to the central bank should it want to keep tightening monetary policy, including removing liquidity from markets.

Surging demand for Taiwan’s technology products has propelled the economy to its strongest growth in more than a decade, even as the virus has ravaged economies around the world.

That robust growth and a worldwide shortage of key raw goods such as semiconductors have pushed inflation to be consistently above 2%, the upper limit of the central bank’s target range. On Thursday, the bank said raw material prices will continue to affect inflation this year.

While the magnitude of Taiwan’s hike was “unconventional,” it makes sense given how much the central bank expects CPI to rise, according to Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd.

©2022 Bloomberg L.P.