Stock Market Meltdowns Have FAANGs Looking Increasingly Toothless

Stock Market Meltdowns Have FAANGs Looking Increasingly Toothless

(Bloomberg Businessweek) -- Nine years ago, Jim Cramer—the gleefully loudmouthed CNBC pundit—introduced the world to what he called the FANG investment strategy. Facebook, Amazon, Netflix, and Google, his reasoning went, were as close to a sure bet as you could get as commerce, community, and content shifted online. A few years later the acronym was plumped up to FAANG with the addition of Apple Inc. Corporate rebrandings at Facebook and Google would end up messing with the spelling, and some insisted Microsoft Corp. should join the party. But the one constant was a sense of infinite optimism about the companies’ ability to dominate their markets and continue growing at a breakneck pace, making huge sums of money for their shareholders.

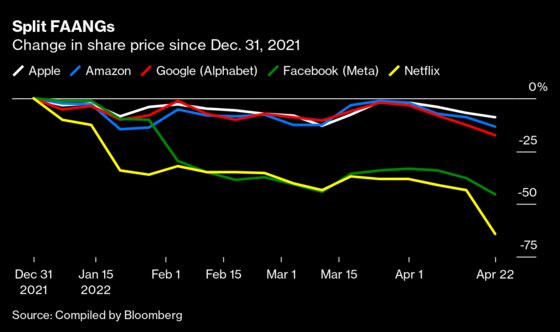

These days the FAANGs—or whatever you might call them—are looking increasingly toothless. On April 19, Netflix Inc. shocked Wall Street when it announced that for the first time in a decade it had lost customers and predicted that even more would bail in coming months. Its shares fell more than a third that day. That followed Facebook’s February meltdown after it revealed user growth had stalled. The company’s stock suffered the biggest one-day loss in value in U.S. market history.

Facebook in October changed its name to Meta Platforms Inc. in an embrace of the so-called metaverse, but its market value has plummeted by more than $500 billion from a peak of almost $1.1 trillion last summer. Netflix, which just two years ago was more valuable than Walt Disney Co., has seen its shares tumble more than 70% since November and is now worth less than half as much as Disney.

Of course, the hard times at Meta and Netflix don’t mean that they won’t bounce back or that the same fate awaits Apple, Amazon, and Google’s parent, Alphabet. Despite Netflix’s woes, it’s still one of the best-performing stocks of the past two decades, up more than 18,000% since its 2002 debut as it delivers average annual returns of about 30%. Over that same span, Apple has returned more than 42,000% including dividends (35% annual average), and Amazon.com Inc. has risen 15,000% (29% on average). “These companies went from micro or startups to behemoths in a record short period of time,” says Michael O’Rourke, chief market strategist at JonesTrading. “The market mistake with these names was the thinking that, oh, this is going to go on forever.”

So what does the prospect of soft-gummed megacaps mean? With the Federal Reserve reversing its easy-money policies and investors fearing an economic slowdown, Alphabet, Amazon, and Microsoft all lag the S&P 500 index. Another problem is soaring U.S. Treasury yields, which diminish the projected value of future corporate profits—a big deal for tech companies, which often enjoy lofty valuations on promises of fatter earnings.

Rather than supercharging market returns as they have for most of the past decade, the companies have become a drag. The FAANGs plus Microsoft account for less than a quarter of the value of the S&P 500 but more than half its decline this year, according to researcher Bespoke Investment Group. That should trouble bulls expecting a quick rebound, says Matt Maley of Miller Tabak + Co. “When a market is being held up by a few stocks, it doesn’t last very long,” he says. “If these stocks go down, the market will go with them.”

Apple is the single member of the group that’s outperforming the S&P 500 in 2022, albeit by a whisker. While investors prize Apple’s devoted customers and the massive cash flows they feed, it’s difficult to argue that the world’s biggest company is a growth stock. Its revenue jumped during the pandemic as customers stuck at home loaded up on iPhones, Macs, and iPads, but sales are projected to expand just 8% in the current fiscal year and continue to slow through at least 2024, according to analyst estimates compiled by Bloomberg.

Amazon and Alphabet Inc. are the only FAANGs that might still be considered growth companies. Amazon’s revenue is predicted to increase 15% in the current fiscal year, fueled by its highly profitable web-services business. And Alphabet is projected to deliver 18% sales growth in its current fiscal year.

As the market seeks out companies hot enough to create the next acronym, there’s little consensus about which—if any—will have the staying power of the FAANGs. Tesla Inc., for instance, has risen to cult status with a market value of almost $1 trillion. Whether it can maintain its first-mover advantage or deliver on Chief Executive Officer Elon Musk’s grand visions of self-driving taxis and humanoid robots remains to be seen.

For now, at least, the FAANGs may not have lost all their bite, says Greg Taylor, chief investment officer at Purpose Investments. The companies are still worth owning, if not for relentless expansion then for strong balance sheets and stock buyback potential, which they can use to boost earnings per share. “It doesn’t mean they’re failures,” he says. “They just need to evolve, and investors need to look at them for what they are—more of a core holding than growth.”

Read next: Elon Musk Stakes a $44 Billion Claim on the Future of Free Speech

©2022 Bloomberg L.P.