Didi Leads Slump in U.S.-Listed Chinese Shares Amid SEC Probe

Didi Leads Slump in U.S.-Listed Chinese Shares Amid SEC Probe

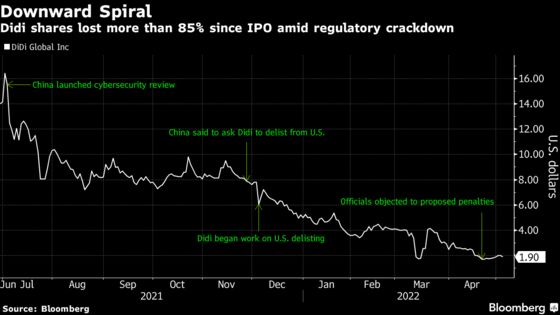

(Bloomberg) -- Didi Global Inc. led a drop in U.S.-listed Chinese internet stocks after news of a U.S. Securities and Exchange Commission investigation into the ride-hailing company’s 2021 debut in New York added to investor concerns around the sector.

Didi shares dropped as much as 6% on Wednesday, extending a decline of more than 60% this year with $59 billion market value wiped out since its initial public offering last summer. Among other large-cap Chinese tech stocks, Alibaba Group Holding Ltd. fell 2.2% and JD.com slid 3.2%. The Nasdaq Golden Dragon China index is down as much as 3.1%, ending a recent rally fueled by Beijing’s pledge to boost economic growth and support tech firms.

A May 2 filing showed that Didi is facing a SEC probe into its controversial IPO, which has already been under scrutiny by Beijing regulators. Didi’s future is in limbo, as senior Chinese officials are said to regard a proposed cybersecurity penalty as too lenient, leading the company to suspend its plan for a Hong Kong listing when it prepares to depart New York bourses.

The news dealt a fresh blow to Chinese tech, a sector that investors are increasingly avoiding amid delisting risks and concern over an economic slowdown.

©2022 Bloomberg L.P.