Japan Warns on Yen After BOJ’s Bond Vow Sparks Slide Past 131

BOJ Sparks Sharp Yen Slide After Sticking With Easing

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Japan’s finance ministry issued its most strongly worded warning yet on the yen’s slide, saying it would respond “appropriately” to abrupt moves after the currency plunged on a promise from the nation’s central bank to keep bond yields at rock-bottom levels.

The finance ministry remarks represented a stepping up in language from government officials on the currency, though they don’t yet point to the possibility of imminent market intervention.

The Bank of Japan said earlier Thursday that it would buy an unlimited amount of bonds at a fixed rate every business day to protect a 0.25% ceiling on 10-year government debt yields as part of its stimulus measures.

The yen weakened sharply against the dollar after the policy meeting and breached the 130 mark mid-afternoon in Tokyo, before touching 131 early in the evening. It strengthened to 130.19 after the finance ministry comments.

The BOJ kept its main yield curve control settings and the scale of its asset purchases unchanged, according to a statement Thursday. That decision had been widely expected by economists, although there had been speculation that the BOJ would do or say something to try and halt the slide in the currency. Instead, the policy decision and following press conference only accelerated those losses.

Read More: Japan MOF Official Says Will Act Appropriately on FX If Needed

Stocks in Tokyo finished the day up 2.1%, suggesting that investors still see a weaker yen as good for Japan’s biggest companies. Yields on 10-year government bonds fell to 0.215%.

With the decision, Governor Haruhiko Kuroda and his board pushed back more aggressively than expected against the market chatter that it will have to tweak policy to help stop the yen from weakening more and to ease the upward pressure on yields.

“In some sectors of the financial markets, there were moves to try and gauge the BOJ’s policy stance by testing whether there would be bond-buying operations or not,” Kuroda said during a press briefing later in the afternoon, referring to the switch to daily purchase offers. “We thought we could reduce uncertainty in markets by getting rid of that speculation and clarifying the BOJ’s existing stance.”

Looking ahead, the BOJ also stuck with its view that rates would stay low or go even lower.

Economists see further slides in the yen as inevitable, but say the government is more likely to ramp up its relief measures for soaring energy and food prices before considering intervening in markets to prop up the currency.

“The BOJ wants to make it abundantly clear that it will stick with stimulus and that the yen is not part of its considerations,” said Hiromichi Shirakawa, chief economist at Credit Suisse Securities. “This also sends a clear message that the bank is not joining the Federal Reserve or the European Central Bank on tightening moves.”

With the Fed and others racing to push up borrowing costs to keep a lid on accelerating prices, the divergence in interest rates with the BOJ is growing. That’s helping drive the Japanese currency down against the dollar to a level that is causing pain for some households and businesses.

The currency continued to move as Kuroda reiterated his view that a weak yen was good for the overall economy. Still, he added that he was on the same page with the government on abrupt moves in the currency.

“My stance is basically the same as Finance Minister Suzuki in that recent sudden moves in the currency markets have a negative impact,” Kuroda said. “Today’s decision shouldn’t encourage a weaker yen any more than previous policy has.”

For now the central bank and Prime Minister Fumio Kishida’s administration appear committed to a division of labor that sees the BOJ stimulating a fragile economy while the government tries to offer relief for the effects of soaring energy and food prices amplified by the weaker yen.

“Instead of intervening in the currency markets, Japan is more likely to add to its economic support policies,” said economist Harumi Taguchi at S&P Global Market Intelligence, adding that gaining support for forex intervention would be very difficult. “Kishida has already announced additional measures, but depending on how much more the yen weakens Japan could add to its support measures.”

Thursday’s decision comes just two days after the prime minister unveiled 6.2 trillion yen ($48 billion) of spending to help relieve the burden of soaring fuel and commodity prices on businesses and households.

“The BOJ will stick to its course unless the government puts pressure on it to act,” said economist Yuichi Kodama at Meiji Yasuda Research Institute. “Now the yen has weakened a lot more, I think market speculation about policy changes will cool down” after the BOJ made it’s stance clear.

Whether it would reach 135 from this point depended more on the Fed next week than the BOJ, Kodama added.

Kuroda’s insistence on continuing with stimulus stems from two main factors: continued weakness in the recovery from the pandemic and the weak underlying pulse of inflation outside temporary cost-push factors.

Reflecting the impact of soaring energy prices, the BOJ raised its inflation forecast closer to its 2% goal in the fiscal year that started this month but projected it to weaken the following year. The bank now sees inflation accelerating to 1.9% this year from its 1.1% forecast just three months ago. That means the bank is predicting the highest price growth in three decades outside the tax hike years of 1997, 2014 and 2019.

| New CPI Outlook | Previous Outlook | |

|---|---|---|

| FY2022 | 1.9% | 1.1% |

| FY2023 | 1.1% | 1.1% |

| FY2024 | 1.1% | N/A |

The subsequent cooling of prices fits in with Kuroda’s view that inflation without solid wage gains won’t be sufficient to achieve the positive cycle of growth and prices he seeks. The BOJ’s forecast for the year to March 2025 also showed inflation averaging well below its price goal.

Kuroda said persistent stimulus therefore had to continue. He said the now-daily fixed-rate buying of government debt would help stabilize the bond market, not jolt it.

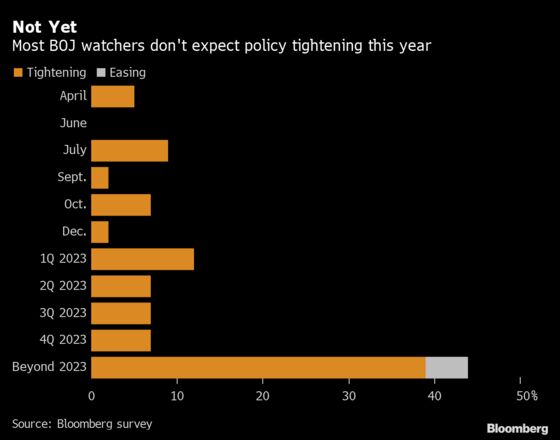

While the BOJ has pushed back strongly for now, it is likely to continue to face speculation that it will have to adjust policy in the coming months. The number of economists who said the bank is likely or very likely to take policy steps in response to a weak yen or inflation this year more than doubled to 45% in a Bloomberg poll this month.

©2022 Bloomberg L.P.