Banner Year of Share Buybacks in India Runs Into Tax Roadblock

The proposed tax may affect share purchases worth 100 billion rupees that are in progress.

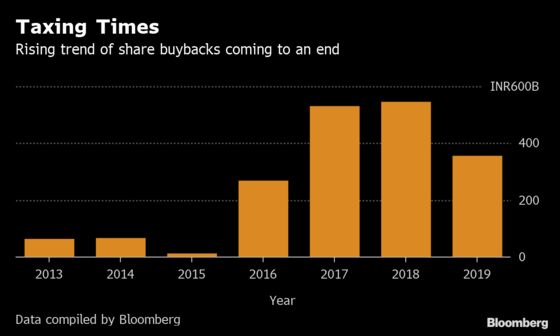

(Bloomberg) -- The decision by India’s government to impose a tax on stock buybacks puts the brakes on what could have been another great year for share repurchases.

More than 70 companies, including software exporter Wipro Ltd., announced or completed 354.6 billion rupees ($5.2 billion) of share buybacks in the first half of 2019, data compiled by Bloomberg show. That’s about two thirds of the 546 billion rupees of such transactions for all of 2018, which was the most in at least six years, the data show.

“In the last three years, buybacks had supported the rally in stocks and helped improve the earnings per share for companies,” said Umesh Mehta, head of research at Samco Securities Ltd. in Mumbai. “That opportunity is now closed. Companies would now have to move back to distributing dividends, where the tax liability is lower.”

The proposed tax may affect share purchases worth 100 billion rupees that are in progress. Infosys Ltd., India’s second-largest provider of IT services, has until Sept. 19 to complete buying back 82.6 billion rupees of its own stock, while Adani SEZ & Ports Ltd. is looking to repurchase shares worth 19.6 billion rupees, according to exchange filings.

Shares of Infosys extended two weeks of losses on Monday, while those of Adani SEZ closed at the lowest price since May 22.

Companies have been using buybacks as a more tax-efficient way to return excess cash to shareholders in addition to dividends, which attract a levy of 15%. India’s top five software exporters have returned a combined 867 billion rupees over the past three years via this route, according to Jefferies.

Finance Minister Nirmala Sitharaman closed the window Friday by announcing a 20% tax on stock repurchases. The trigger for the levy to kick in depends on when the company actually pays the money for the shares tendered, said Mehul Bheda, a partner and tax consultant at Dhruva Advisors in Mumbai.

“The tax saving on the buyback has been substantially reduced,” he said.

--With assistance from Nirav Tanna.

To contact the reporter on this story: Nupur Acharya in Mumbai at nacharya7@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Ravil Shirodkar, Margo Towie

©2019 Bloomberg L.P.