Asia’s Richest Man Seeks to Prove Debt Plan Skeptics Wrong

The oil, telecom and retail conglomerate now expects to reach zero net debt ahead of the March 2021 target.

(Bloomberg) -- Mukesh Ambani, Asia’s richest man, accelerated the timeframe for wiping out $21 billion in net debt at his Reliance Industries Ltd., seeking to quash skepticism that emerged as talks to sell a stake in some assets to Saudi Arabian Oil Co. have dragged on.

The oil, telecom and retail conglomerate now expects to reach zero net debt ahead of the March 2021 target Ambani had set in August, the Mumbai-based company said in a statement Thursday. A $7 billion share sale to existing investors was approved by the board on Thursday, a week after Facebook Inc. agreed to invest $5.7 billion in Reliance Industries’ Jio Platforms business.

The rights issue -- the latest in a series of fund-raising efforts -- may help Ambani, 63, pay down borrowings that piled up as the company spent almost $50 billion to roll out a wireless network. Building investor confidence has become all-the-more crucial after the pandemic caused a crash in oil prices, undermining prospects for Reliance’s proposal to sell an estimated $15 billion stake in its oil and chemicals business to Saudi Arabian Oil.

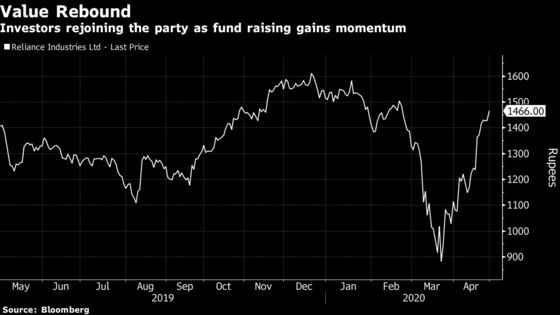

Talks on the investment by the world’s biggest oil producer are on course, Reliance said Thursday in the statement. The company also said it has sought regulatory approvals to carve out the oil and chemicals division. Investors have sought clues to the progress of negotiations with Aramco, as the Saudi company is known, helping drag the stock to a two-year low in March. The shares have rebounded, gaining about 66% since the March 23 close, on renewed confidence in Ambani’s ability to attract investors.

“Reliance Industries has demonstrated excellent timing for fund raising,” said Chakri Lokapriya, chief investment officer at TCG Asset Management. “The Jio Platforms-Facebook deal provides Reliance a huge, scalable business venture with first-mover advantage. The rights issue is a smart way of raising capital.”

Ambani’s focus on paying down debt and attracting investors also comes as Reliance on Thursday reported its biggest profit slump since 2008, missing analyst estimates, on a plunge in oil prices and slumping demand.

Profit plunged by nearly 40% in the March quarter as the coronavirus outbreak slammed fuel demand. To cut costs, Ambani is foregoing his pay and has cut salaries at the oil unit, the company said Thursday.

The billionaire has vowed to shift Reliance away from dependence on profit from its energy-related businesses to faster-growing consumer segments including its digital platform and retail.

Reliance said Thursday that it has received interest from new potential global partners in taking a stake of similar size to Facebook’s agreement to buy a 10% stake in the company’s platform business.

Reliance “has received strong interest from other strategic and financial investors and is in good shape to announce a similar sized investment in the coming months,” it said in a statement. The company “is set to achieve net zero debt status ahead of its own aggressive timeline.”

The Facebook-Jio Platforms transaction is to be closed by end of this quarter, the company said in a presentation to investors on its website.

| For more on Reliance Industries: |

|---|

| Reliance’s $7 Billion Rights Offer to Help Ambani Beat Debt Goal |

| Reliance’s Profit Plunges as Oil Rout Hits Refining Business |

| Reliance to Separate Oil-to-Chemicals Business Amid Aramco Talks |

| Zuckerberg Just Gave Asia’s Richest Man a Sorely Needed Win |

Under the planned rights offering, Reliance will issue shares worth 531.3 billion rupees, it said Thursday. The deal includes one rights share for every 15 held, at 1,257 rupees each, or 14% lower than the closing price on Thursday. Ambani and other members of the founding family who own stakes will subscribe to their entire entitled portion and will buy any stock left over, under the plan.

The offering comes at a tumultuous time for many companies in India.

Even before the pandemic triggered one of the world’s most extensive lockdowns and slammed economic growth, companies were struggling to raise money as banks cut back lending. The atmosphere may make it hard for Ambani to come through on his plans, said Arun Kejriwal, director at KRIS, an investment advisory firm in Mumbai.

“The rights issuance is not attractive,” said Kejriwal. “Hence, the math is not adding up for Reliance in cutting its net debt to zero ahead of the promised deadline. The road map needs to be clearer as the earnings were below expectations.”

In April, Reliance said it would raise as much as 250 billion rupees through non-convertible debentures.

Adjusted debt peaked at 2.7 trillion rupees in fiscal 2020, according to S&P Global Ratings. The ratings company expects that to decline to about 2.2 trillion rupees in the following year and 1.7 trillion rupees by fiscal 2023.

Earnings growth at the company’s digital and retail segments will be about 50% in fiscal 2020, S&P estimates. The businesses will account for about 40% of the company’s earnings before interest, taxes, depreciation and amortization, from just 3% in 2017, S&P said.

“The company’s strategy of transforming its upstream energy focus to domestic consumption-driven businesses has been successful,” S&P said in an April 28 report affirming Reliance’s BBB+ credit rating. “We expect digital and retail growth to continue in fiscals 2021 and 2022.”

©2020 Bloomberg L.P.