Ares-Led Group Snaps Up $2 Billion Chunk of Nielsen Buyout Debt

Ares-Led Group Snaps Up $2 Billion Chunk of Nielsen Buyout Debt

(Bloomberg) -- A group of lenders led by Ares Management Corp. has scooped up the unsecured portion of the $11.15 billion debt financing supporting Elliott Investment Management and Brookfield Asset Management’s acquisition of U.S. TV ratings business Nielsen Holdings.

Activist fund Elliott first teamed up with Brookfield in March to orchestrate the take-private of the business, lining up debt commitments from banks and other lenders to finance the multibillion-dollar deal, according to a regulatory filing.

An Ares-led consortium is now providing a $2.15 billion second-lien loan, which will replace an unsecured bridge facility previously in place, according to people with knowledge of the matter, who asked not to be identified discussing a private transaction. Typically, bridge loans are replaced with more permanent financing, such as bonds, and sold to investors.

This leaves a $6.35 billion secured term loan and $2 billion of secured bonds for general syndication, which could launch in the coming months. The financing also includes a $650 million secured revolving facility, according to the filing.

Representatives for Ares, Elliott, Brookfield and Nielsen declined to comment. Representatives at the banks providing debt financing alongside Ares, namely Bank of America Corp., Credit Suisse Group AG, KKR & Co., Citigroup Inc., Nomura Holdings Inc. and Mizuho Financial Group Inc., declined to comment, while Barclays Plc and HSBC Holdings Plc did not immediately respond to requests for comment.

Private Credit Panacea

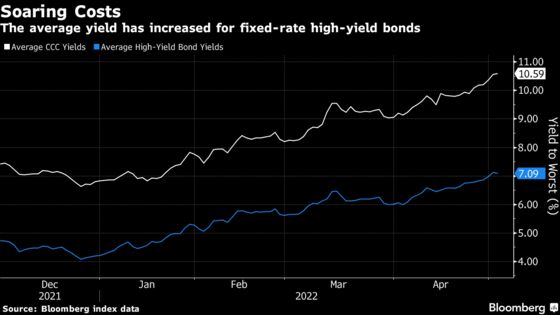

The Nielsen buyout was announced on March 29 and the deal is expected to close within the second half of this year. It marks another win for the private credit asset class which has been competing increasingly with more traditional debt market players, namely banks. Private credit has become more attractive in some cases than the unsecured bond market, where the cost to borrow has rapidly risen due to increasing rates, inflation and geopolitical risk.

Private equity firms have a window of opportunity to replace underwritten debt from banks with other sources of funding in the weeks immediately following the signing of commitment letters. Brookfield recently sidestepped volatility in the junk-bond market on a separate leveraged-buyout deal for auto-dealership software company CDK Global Inc., by placing an unsecured bridge loan with a private credit firm, and changing the structure to a second-lien loan.

Read more: Brookfield Shifts Unsecured Bond to Private Credit in CDK Buyout

Shedding unsecured bonds in the run up-to a broader debt sale is a strategy that could ultimately help bring the less risky secured loan and bond portions of a deal over the finish line, as unsecured debt typically draws the most resistance from investors and can be the hardest to sell.

Unsecured bonds typically have higher yields and lower ratings as they are not backed by collateral, making them especially expensive for borrowers. The average yield -- a proxy for the cost of borrowing -- for bonds with the lowest speculative-grade rating recently hit 10.59%, according to Bloomberg index data.

The junk-bond market is also seeing the lowest supply of new deals in more than a decade. Borrowers that tapped the market for such deals, including Carvana Co. and Lone Star Funds, have recently struggled to sell down their notes to fund acquisitions amid rising interest rates.

©2022 Bloomberg L.P.